Will the USD Turn Bearish or Keep the Bullish Run After Today’s FED Meeting?

The USD has been bullish for more than a year, but the situation might change after today's FED meeting, if they announce a slowdown

The US Dollar has been on a bullish trend since last year, as inflation started getting out of control. The FED acknowledged the surging inflation earlier than the ECB, which helped keep the sentiment bullish for the USD. other central banks started raising interest rates as well, but the FED has been at the forefront, delivering several 75 bps hikes in the last three meetings and they are expected to do so again in today’s meeting.

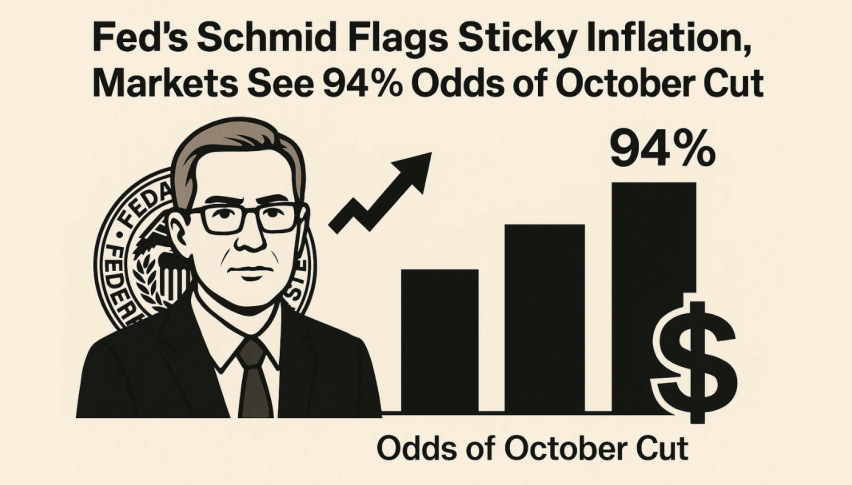

But, markets are interested to see/hear what plans they have after this rate hike. Expectations are for a slowdown, that’s the reason that the USD has been showing bearish signals recently. Although, it’s not certain that the USD will turn bearish even if the FED announces a slowdown.

GBP/USD H1 Chart – Sellers Pushing Below the 200 SMA

Will we see a crash or a surge after the FED rate decision later this evening?

Bank of America Global Research discusses the USD outlook around tomorrow’s FOMC policy decision.

“We expect the Fed to raise its target range for the federal funds rate by 75bp in November to 3.75-4.0%. In our view, the November FOC meeting is not about the November policy rate decision. Instead, the meeting is about future policy rate guidance and what to expect in December and beyond. We expect Chair Powell to open the door to a downshift in December by mentioning the debate took place in his press conference. However, he will likely maintain optionality by emphasizing that the Fed will remain data dependent and that no decision was made,”BofA notes.

“We look for the Federal Reserve‘s announcement to continue to be supportive for the USD in the near term. With the USD at around 40-year highs, we expect EUR-USD to end the year at 0.95 and linger around such levels into the start of next year,” BofA adds.

GBP/USD Live Chart

GBP/USD- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account