USD and Risk Currencies Will Depend on How Good the Data Is for the FED

The data has shown a decent economic bounce in the US but is it enough for the FED to pick up the pace of hikes this meeting?

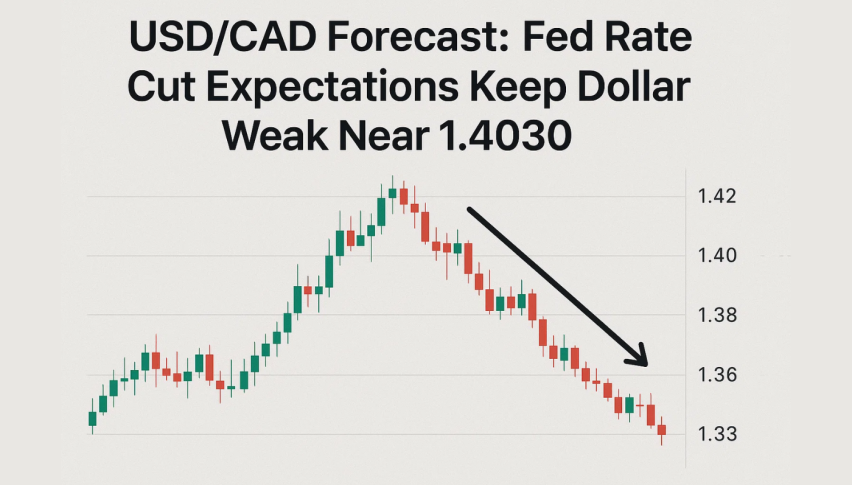

The USD has been showing strong sign of resuming the bullish trend of 2022. The reason for that massive upward move was the FED raising interest rates at an extraordinary pace, but the Buck retreated as the FED slowed down with rate hikes, on softer exonomix data. But the data has started to show a rebound in the US economy, although is it good enoug h for the FED to pick up the pace of rate hikes of rate hikes again?

FED Chairman Jerome Powell emphasized that the decision on interest rates later this month is dependent on incoming data and that they are not planning a 50 bps increase at the moment, which was what sent the USD 30 pips lower after the surge on the previus day from Powell. He cited yesterday’s JOLTS jobs report, which was quite good but with some weaker details, as well as non-farm payrolls, CPIinflation, a well as PPI inflation as critical data points.

The consensus for non-farm payrolls is for a +205K increase, with estimates ranging from 80K to 330K. If the data comes in line with consensus, the market is expected to swing back towards a 25 basis point increase. The upcoming CPI reading is considered more important than NFP due to its lagged effects on jobs, with a consensus of +0.4% MoM for both core and headline inflation.

The details of the data will be critical, but an in-line reading is expected to swing the market back towards a 25 basis point increase. However, the FED may be stuck following the market or leaking, and a surprise 25 basis point cut would not be desirable as it would show weakness in the fight against inflation.

Overall, it is a data traders’ market, and traders should keep a close eye on incoming data and news updates. Risk currencies such as NZD/USD and AUD/USD are most at risk in case of strong data, so we will try to sell retraces higher on these two pairs.

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account