Gold (XAU/USD) Price Forecast: Retreats to $2157 Amid Fed Cut Speculation

Gold prices saw a retreat from the $2,157 mark despite a weaker US dollar, as optimistic market sentiment and a tech rally dampened demand

Gold prices saw a retreat from the $2,157 mark despite a weaker US dollar, as optimistic market sentiment and a tech rally dampened demand for the safe-haven asset. Expectations of interest rate cuts by major central banks this year have further solidified this confidence.

Fed Rate Cut Rumors Weigh on Dollar, Offering Fleeting Support to Gold

The US dollar is struggling more as a result of speculation about a Federal Reserve rate cut, particularly after Fed Chair Jerome Powell hinted at potential adjustments should inflation stabilize in his congressional testimony.

This speculation, alongside steady job claims and productivity data, softens the dollar but provides only a limited uplift to gold prices amidst broader market optimism.

Market Optimism Challenges Gold’s Ascent Amidst Rate-Cut Conversations

While the prospect of a Fed rate cut has induced a risk-on sentiment, driving record highs in indices like the S&P/ASX 200, it concurrently caps potential gains for gold.

The anticipation of monetary easing, juxtaposed with market rallies, underscores the complex dynamics influencing gold’s price trajectory in the face of fluctuating economic indicators and central bank policies.

Gold Price Forecast: Technical Outlook

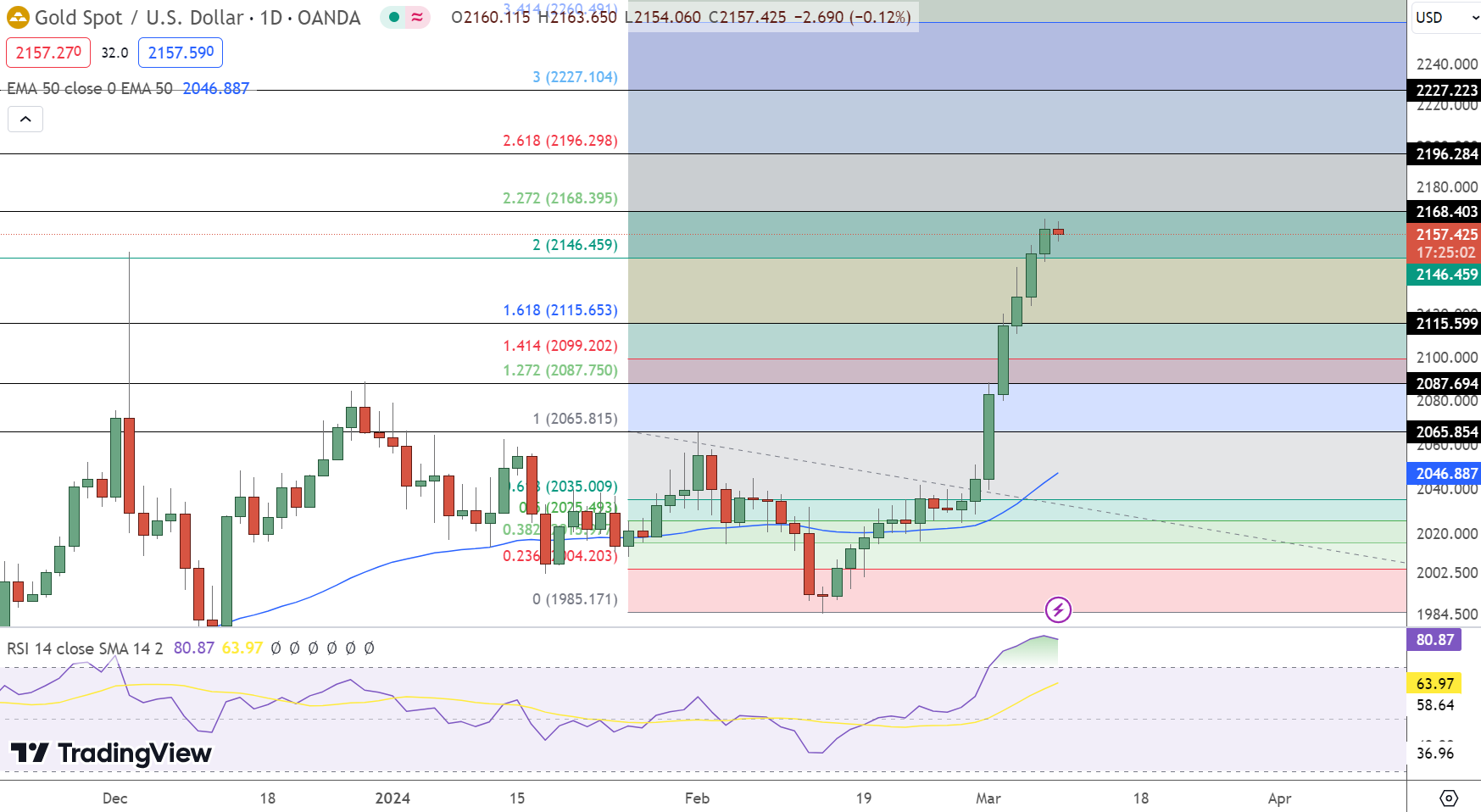

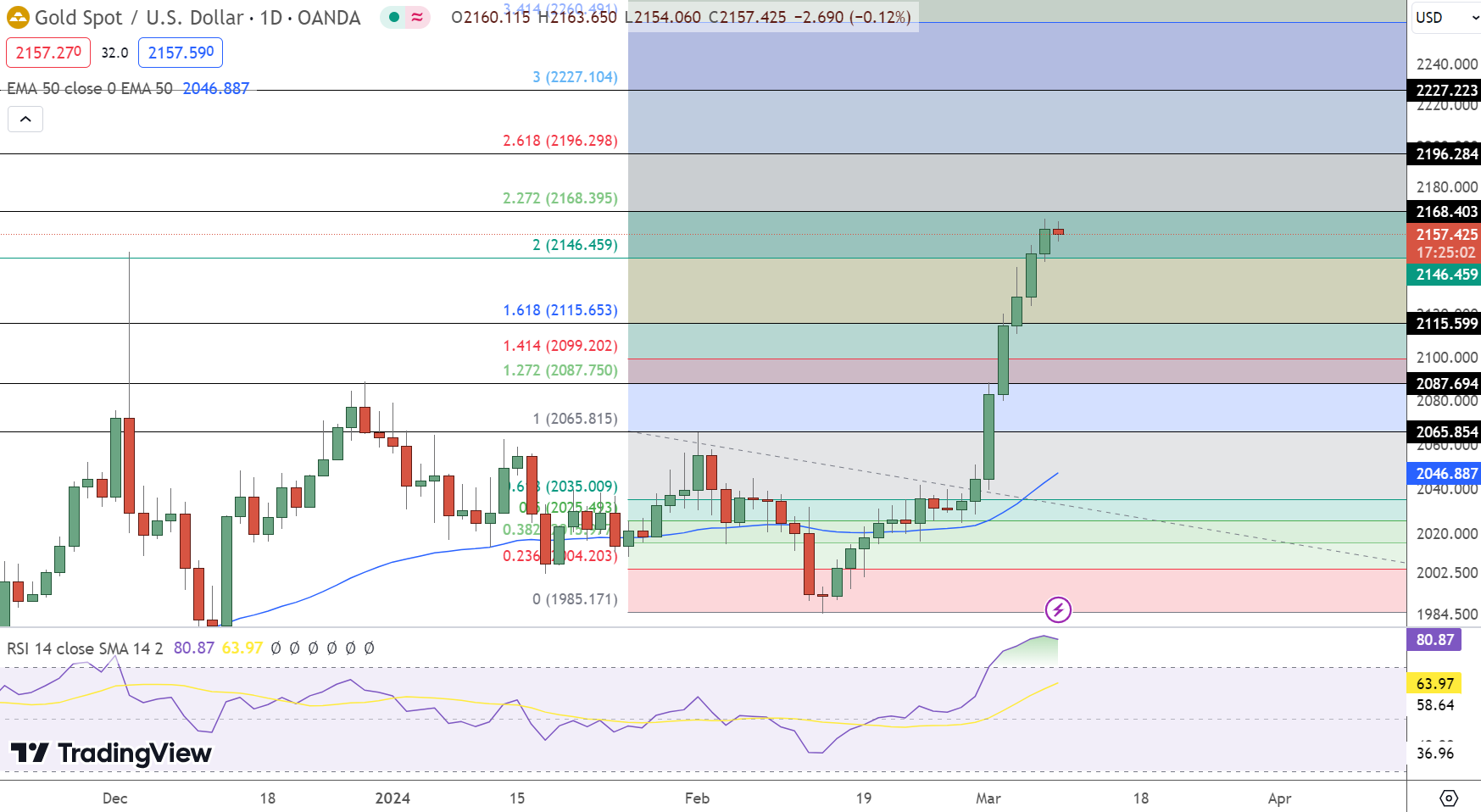

On March 8, GOLD (XAU/USD) slightly declined by 0.13%, settling at $2157.425. Despite this minor dip, technical indicators point to a predominantly bullish outlook.

The pivotal level for the day is established at $2146.46. Surpassing this pivot, immediate resistances line up at $2168.40, $2196.28, and $2227.22, suggesting potential upward trajectories.

Conversely, support levels are discerned at $2115.60, followed by $2087.69 and $2065.85, which could provide a buffer against further declines.

With an RSI of 80 indicating overbought conditions and a 50-day EMA at $2046.89, the overall sentiment remains bullish above $2146.46, although a descent below this threshold might trigger a notable selling trend.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account