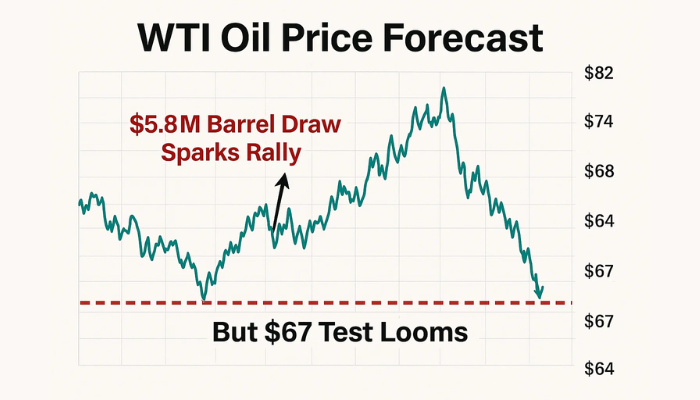

WTI Oil Price Forecast: $5.8M Barrel Draw Sparks Rally, But $67 Test Looms

Oil prices climbed modestly Thursday, holding gains sparked by a stronger-than-expected U.S. inventory draw and tentative geopolitical...

Quick overview

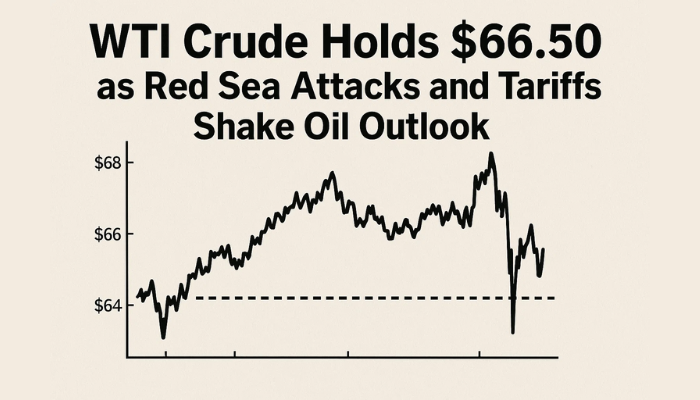

- Oil prices rose modestly, with West Texas Intermediate (WTI) crude nearing $65.20 after a significant drop from June's high.

- The U.S. Energy Information Administration reported a larger-than-expected crude inventory draw of 5.8 million barrels, indicating strong demand.

- Investors are closely monitoring geopolitical developments, particularly the Iran-Israel ceasefire and potential changes in OPEC+ supply policy.

- WTI crude remains rangebound, with key resistance at $67.10 and support at $64.00, as traders await clearer market signals.

Oil prices climbed modestly Thursday, holding gains sparked by a stronger-than-expected U.S. inventory draw and tentative geopolitical relief. West Texas Intermediate (WTI) crude edged near $65.20, rebounding after a steep $12 drop from the June high of $77.11.

According to the U.S. Energy Information Administration (EIA), crude inventories fell by 5.8 million barrels in the week ending June 20—well above analyst forecasts of a 797,000-barrel draw. Gasoline stocks also posted an unexpected 2.1 million-barrel decline, as demand surged to levels not seen since late 2021. Analysts interpret this as confirmation that the U.S. driving season is finally gaining traction.

Nomura economist Yuki Takashima noted the market’s optimism, stating, “Buyers are responding to resilient U.S. demand, but geopolitical nerves remain. Traders want clarity on the Iran-Israel ceasefire and OPEC+ supply policy.”

Middle East Ceasefire and OPEC+ in Focus

Investors continue to weigh headlines from the Middle East, where the recent ceasefire between Iran and Israel has steadied markets. U.S. President Donald Trump confirmed Washington would seek a formal nuclear agreement with Iran in upcoming talks, though existing sanctions—particularly on Iranian oil—remain in place for now.

Meanwhile, Russia’s Rosneft CEO Igor Sechin suggested that OPEC+ could bring forward its planned output increases by as much as a year. If confirmed, this could ease supply constraints and temper prices in the second half of 2025.

- Crude Draw: 5.8M barrels (vs. 797K forecast)

- Gasoline Drop: 2.1M barrels (vs. +381K expected)

- Resistance Level: $67.10–$67.62

- Support Zone: $64.00

WTI Crude Oil (USOIL) Technical Outlook: Key Levels Ahead

WTI crude oil (USOIL) remains rangebound, trading within a narrow range, caught between a rising trendline and overhead Fibonacci resistance. The recent bounce off $64.00 shows signs of a short-term bottom, yet traders remain cautious.

The 2-hour chart reveals a developing bear flag pattern. Momentum, however, is shifting. The MACD has flipped positive, and histogram bars are trending higher, an early sign of bullish divergence.

Trade Setup

- Bullish Reversal: Long above $67.10 on strong candle close

- Target: $69.01 and $70.54

- Stop: Below $64.00

- Bearish Breakdown: Short below $64.00 with volume

- Target: $62.88 and $61.47

- Stop: Above $65.30

Until WTI escapes this compression zone, the market remains on pause—awaiting either renewed bullish conviction or another leg down.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account