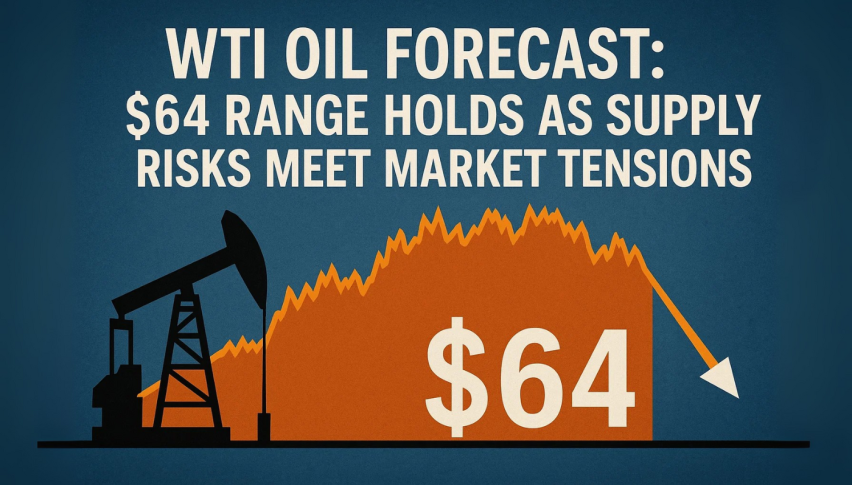

WTI Crude Dips to $67.50 as OPEC+ Hikes Output, Traders Eye $70.54 Break

WTI crude oil futures fell to $67.50 on Tuesday, pulling back from recent two week highs as traders digested a mix of bearish and bullish...

Quick overview

- WTI crude oil futures dropped to $67.50 as OPEC+ announced a production increase of 548,000 barrels per day for August.

- Concerns over oversupply are rising due to the restoration of 80% of earlier production cuts amid weak global demand.

- Geopolitical tensions in the Red Sea and U.S. tariff threats are adding uncertainty to the market and affecting trader sentiment.

- Technically, WTI remains in a rising channel, with key resistance at $70.54 and support at $66.84.

WTI crude oil futures fell to $67.50 on Tuesday, pulling back from recent two week highs as traders digested a mix of bearish and bullish news. The price drop comes after OPEC+ announced on Sunday they would increase production by 548,000 barrels per day in August – their 4th consecutive monthly increase.

This upcoming increase brings OPEC+ closer to restoring the 2.2 million barrels per day in voluntary cuts made earlier this year. With 80% of those cuts coming back to market, fears of oversupply are resurfacing as global demand remains weak due to trade uncertainty and macro slowdown.

Meanwhile, Red Sea geopolitical tensions provided some support to prices. Yemen’s Houthi rebels launched another attack over the weekend, increasing risks to oil transport routes and adding uncertainty to short term supply logistics.

U.S. Tariff Threats Cloud Market Sentiment

In the U.S., President Trump’s latest trade announcement kept energy markets on edge. On Monday, his administration sent formal letters to major trading partners, including Japan and South Korea, outlining 25% tariffs on select imports. Although enforcement is delayed until August 1, it ramps up tensions with BRICS nations and signals a more protectionist stance that could slow global growth.

The dual threat of rising supply and weak demand – especially from developing nations targeted by tariffs – has kept traders cautious. These macro forces are preventing oil from breaking out despite short term supply disruptions.

Key points:

- OPEC+ to increase supply by 548,000 bpd in August

- U.S. tariffs on Japan, South Korea imports to begin August 1

- Red Sea attacks renew shipping disruption fears

- Market eyes Fed comments and global demand signals

WTI Technicals: Channel Intact, $70.54 in Focus

From a technical perspective, WTI crude is still in a rising channel on the 2 hour chart. Price is above the 50 period SMA at $66.84 after rebounding sharply from $64.01 low.

The 23.6% Fibonacci retracement at $67.09 acted as short term support and the RSI is at 57 – not overbought.If bulls can get above $69.00 (38.2% Fib) the next resistance is $70.54. Below $66.84 and it’s weakness and a pullback to $65.50.

Technical:

- Support: $66.84 (50-SMA), $65.50 (channel base)

- Resistance: $69.00 (Fib), $70.54 (swing high)

- RSI: 57, not overbought

Outlook:

As long as WTI is in its rising channel and above key MAs, the path of least resistance is up – but macro will slow momentum. Watch OPEC+ and U.S. trade for clues if $70.54 is in sight or if bears will take over.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account