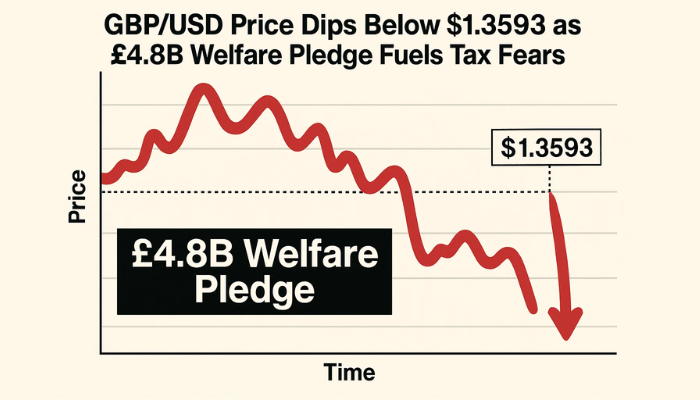

GBP/USD Price Dips Below $1.3593 as £4.8B Welfare Pledge Fuels Tax Fears

The Pound fell further on Tuesday to $1.3567 against the Dollar as concerns over the UK’s fiscal path grew. Selling intensified...

Quick overview

- The Pound fell to $1.3567 against the Dollar amid concerns over the UK's fiscal path and a £4.8 billion increase to Universal Credit.

- Chancellor Rachel Reeves' announcement has raised fears of tax increases, leaving investors uncertain about government funding.

- The Dollar is gaining strength due to safe-haven demand and optimism over upcoming trade deals, while GBP/USD shows bearish technical signals.

- Traders are focused on the upcoming BOE Financial Stability Report and FOMC Meeting Minutes, which could further impact currency movements.

The Pound fell further on Tuesday to $1.3567 against the Dollar as concerns over the UK’s fiscal path grew. Selling intensified after Chancellor Rachel Reeves announced a £4.8 billion increase to Universal Credit, sparking talk of tax rises in the Autumn Budget. The move breaches Labour’s own fiscal rules and has left investors worried about how the government will fund this.

Barclays say tax rises are likely as Reeves hasn’t said whether spending will be cut or new revenue found to offset the welfare increase. That lack of clarity has spooked markets already sensitive to signs of fiscal slippage. With the Bank of England expected to start cutting rates by August the macro backdrop is bearish for GBP.

Catalysts this week include the BOE Financial Stability Report and 10-year bond auction on Wednesday. But traders are focused on the budget math and how it impacts UK growth and inflation targets.

Dollar Gains Momentum Ahead of Trade Deals

Across the Atlantic the Dollar is firm on safe-haven demand and optimism over trade deals. Treasury Secretary Scott Bessent said the US is finalising multiple deals with announcements expected “in the next 72 hours”. So far the US has done deals with the UK, Vietnam and a limited deal with China but talks with India are stalled.

Further boosting the greenback former President Trump said the US will issue formal notices on new tariffs on 12 countries that haven’t signed bilateral trade deals. The combination of trade clarity and dollar sentiment has kept pressure on GBP/USD.

Traders are also looking at Wednesday’s FOMC Meeting Minutes and US 10-year bond auction with yields rising ahead of both. If the Fed is hawkish the dollar could strengthen further and hit the Pound.

GBP/USD Technical Setup: Bearish Continuation Confirmed

On the 2-hour chart GBP/USD has broken below $1.3593 a key support level and is testing the lower boundary of a descending triangle—a bearish continuation pattern. The 50-period SMA at $1.3633 is resistance while each failed rally reinforces bearish control.

- RSI: 35.76

- Support: $1.3540 → $1.3502 → $1.3456

- Resistance: $1.3593 → $1.3633 → $1.3643

Trade:

- Entry: Short below $1.3540 on close

- Stop: $1.3595

- Targets: $1.3502 and $1.3456

As long as price is below the SMA and trendline the path of least resistance is down. A break could accelerate selling to June’s support zones.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account