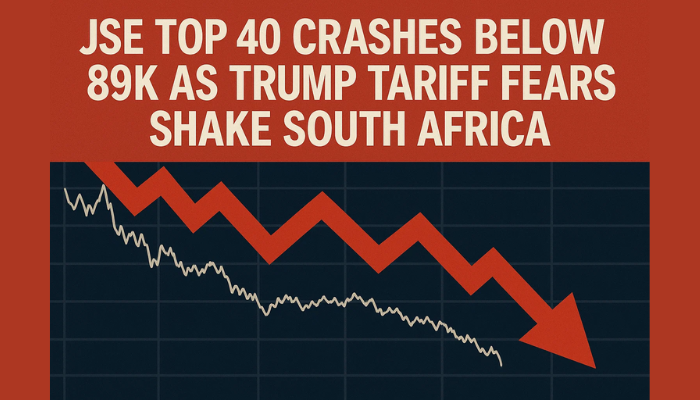

JSE Top 40 Crashes Below 89K as Trump Tariff Fears Shake South Africa

SA markets are under pressure. The JSE Top 40 Index just broke below a key rising channel and the rand is down 0.7% to 17.80 against the USD

Quick overview

- The JSE Top 40 Index has broken below a key rising channel, indicating a weakening trend.

- The rand has declined 0.7% against the USD, influenced by Trump's trade threats and a risk-off sentiment among global investors.

- Potential tariffs on South African exports, including a 30% tariff and a 50% copper import tariff, could significantly impact the country's commodity sectors.

- Despite rising gold and platinum prices, increased bond yields reflect growing political and economic uncertainty in South Africa.

SA markets are under pressure. The JSE Top 40 Index just broke below a key rising channel and the rand is down 0.7% to 17.80 against the USD. This as global investors get cautious, driven by Trump’s renewed trade threats, which has sparked a risk-off sentiment across emerging markets.

Trump has threatened a 30% tariff on SA exports from August 1 unless a trade deal is reached. And to add fuel to the fire, his administration is floating a 10% BRICS-related penalty, citing geopolitical misalignment. SA’s major commodity sectors – gold, platinum and copper – are now in the crosshairs. A 50% copper tariff could directly hit one of the country’s key export streams.

What’s Pressuring SA Markets?

- Rand at 17.8550, down 0.7% vs. USD

- 30% US tariff deadline: August 1

- 10% BRICS penalty linked to geopolitical tensions

- 50% copper import tariff may hit commodity revenues

- Dollar index up 0.2%, adding pressure on EM currencies

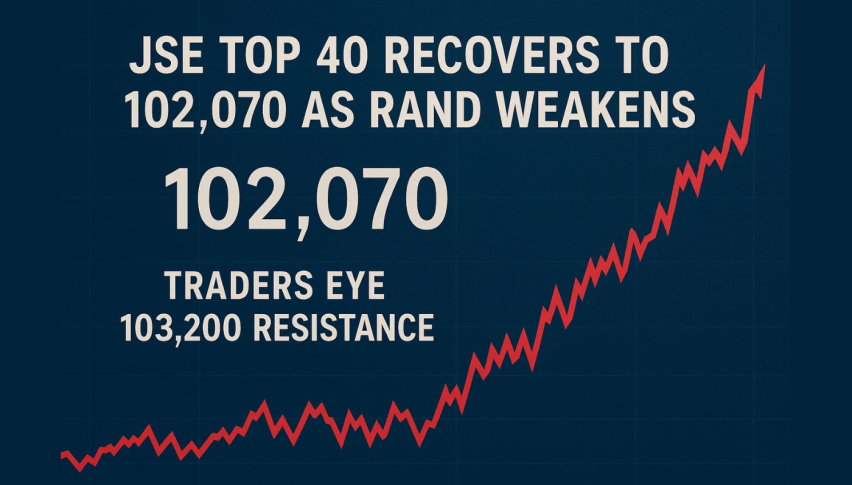

Technical Breakdown: JSE Top 40 Cracks

The JSE Top 40 Index (J200) broke below its upward-sloping channel and the 50-period SMA at 89,270 ZAR, confirming the trend is weakening. After weeks of steady gains, the move means bulls are losing control – at least in the short term. This support-turned-resistance level is now the battleground.

The RSI is at 43.37, deep in bearish territory, and momentum indicators suggest unless buyers step in soon, we could see a deeper correction. Near-term support is at 88,526, with a bigger breakdown exposing 87,347. Above 89,270 and we shift sentiment back in favour of bulls.

JSE Top 40 Technical Takeaways:

- Channel break and SMA breach confirms trend reversal

- RSI at 43.37 suggests growing bearish momentum

- Support: 88,526, 87,941 and 87,347

- Resistance: 89,270 and 90,246

Bonds, Commodities and the Way ForwardIt’s not just equities. SA’s 2035 bond yield is up 4.5 bps to 9.83% as risk premiums increase due to political and economic uncertainty. But there’s a silver lining. Gold and platinum prices are rising and copper is holding up for now.

According to ETM Analytics, if global commodity demand holds and the dollar weakens, these could support the rand and market sentiment. But until tariff clarity comes, be cautious.

Looking Ahead:

Watch out for mining output and retail sales data this week. That will tell us if this is a pullback or a sign of bigger trouble ahead.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account