Silver Prices Eye $39: Will Powell’s Jackson Hole Speech Spark a Rally?

Silver fell as traders digested the July Fed minutes which showed inflation as a risk. Nearly all Fed members...

Quick overview

- Silver prices fell as traders reacted to the July Fed minutes indicating inflation concerns and a steady rate stance.

- A stronger US Dollar Index has made silver more expensive for foreign buyers, impacting demand.

- Geopolitical tensions and political risks in the US are adding volatility to silver prices, with calls for Fed Governor Cook's resignation raising concerns about central bank independence.

- Silver's technical outlook shows a coiling pattern, suggesting a potential breakout, with key levels to watch for both upside and downside movements.

Silver fell as traders digested the July Fed minutes which showed inflation as a risk. Nearly all Fed members want to keep rates steady but are concerned about price pressures outweighing labor market weakness. This is bearish for a September rate cut and put pressure on precious metals.

A stronger US Dollar Index (DXY) near multi-week highs also weighed on silver by making the metal more expensive for foreign buyers. Futures now price in a 75% chance of a quarter point rate cut in September, down from near certainty earlier this month according to CME’s FedWatch tool. Traders are also pricing in 54 basis points of easing by year end.

“The Fed is clearly keeping its tightening bias alive which makes it hard for non-yielding assets like silver to sustain rallies,” said a commodities strategist in Singapore.

Geopolitical and Political Risks Add to Volatility

While silver often benefits from geopolitical stress as a safe-haven asset, optimism on Russia-Ukraine peace talks has cooled investor demand. Russian officials said any durable security arrangement must include Moscow’s role, which makes the negotiations complex and reduces the chances of a quick breakthrough.

In the US, political risks are also seeping into the markets. Calls for Fed Governor Lisa Cook to resign over financial issues have sparked debate on central bank independence. Analysts warn that this could undermine policy credibility and create pockets of volatility that will affect silver prices.

Key risk drivers to watch:

- US inflation above 2% Fed target

- Geopolitical negotiations in Eastern Europe

- Political pressure on central bank independence

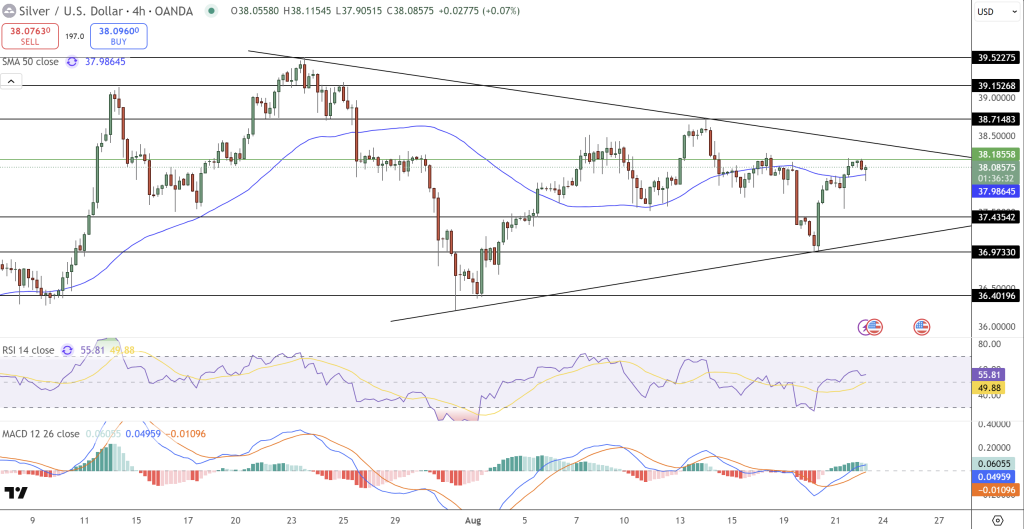

Silver Technical Outlook: Coiling for a Breakout

Beyond fundamentals, silver’s chart is coiling in a symmetrical triangle, which means a breakout after weeks of consolidation. Higher lows near $37.43 shows buying interest, while repeated rejections below $38.71 caps upside.

Momentum is mixed. RSI is at 55, which is mildly bullish but not conviction. MACD has turned positive which suggests a potential recovery in momentum. 50-period simple moving average ($37.98) is the near term pivot.

Key levels to watch:

- Upside: Break above $38.71 and then $39.15 and $39.52* Downside: Break below $37.43 and then $36.97 and $36.40

For now, traders are on the sidelines ahead of Fed Chair Jerome Powell’s speech at Jackson Hole. Any dovish comments could weaken the dollar and spark silver buying, while inflation comments could keep silver range bound or lower.

Conclusion

Silver is caught between hawkish Fed and global uncertainties. With the chart coiling for a breakout, the next few days of economic data and Powell’s comments will be key. Until then, expect choppy trade and silver to be dollar and sentiment sensitive.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM