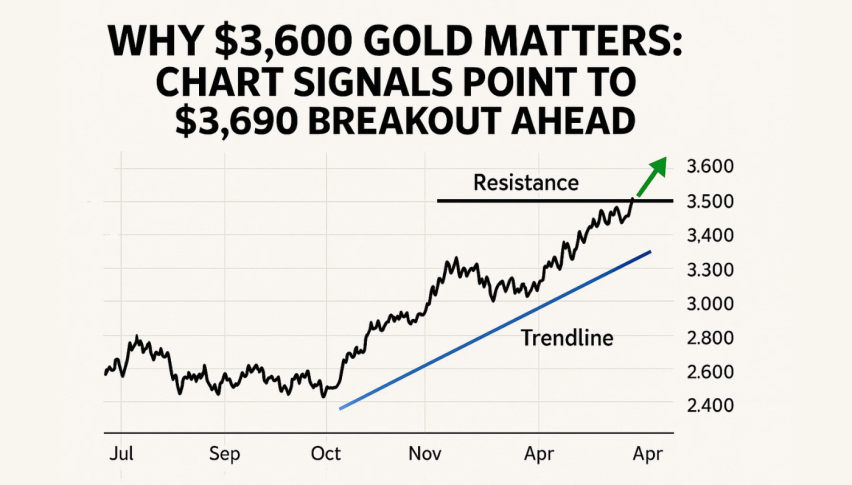

Why $3,600 Gold Matters: Chart Signals Point to $3,690 Breakout Ahead

Gold is steady at $3,645 after bouncing off $3,626 support. The metal is underpinned by expectations of a US rate cut this month...

Quick overview

- Gold is currently steady at $3,645, supported by expectations of a US rate cut and safe-haven buying ahead of inflation data.

- Technical indicators show a bullish momentum, with the RSI rising from 50 to 60 and a bullish engulfing candle confirming demand.

- Key support levels are at $3,626 and $3,615, while resistance levels are at $3,673 and $3,690.

- Traders are advised to enter long positions at $3,645-$3,650, with a stop below $3,615 for a favorable risk-reward setup.

Gold is steady at $3,645 after bouncing off $3,626 support. The metal is underpinned by expectations of a US rate cut this month and safe-haven buying ahead of inflation data. Technically, gold is in an uptrend channel defined by a clear trendline from September. This means buyers are in control despite short term pullbacks.

Technical Indicators Point to Upside

Momentum is bullish. RSI has bounced from 50 to 60 without being overbought. A bullish engulfing candle at the trendline confirms demand is intact. These patterns at Fibonacci levels (0.5 here at $3,626) often precede another leg up.

- 50-SMA support: $3,599

- 200-SMA support: $3,432

- Key resistance: $3,673, $3,690

- Key support: $3,626, $3,615

Moving averages are strong. 50-SMA above 200-SMA, a bullish crossover. As long as the channel holds, $3,673 and $3,690 are targets.

Trade Setup: Risk-Reward at $3,645

For traders, it’s simple. A long entry at $3,645-$3,650 is in line with the trendline and Fibonacci support. A stop below $3,615 under the trendline and 0.618. On the upside, first resistance is $3,673, then $3,690. Risk-reward is good especially with engulfing candles on the bullish side.

In short, gold’s structure is bullish. Buyers are stepping in on dips and the combination of higher lows, strong SMAs and momentum is pointing up.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account