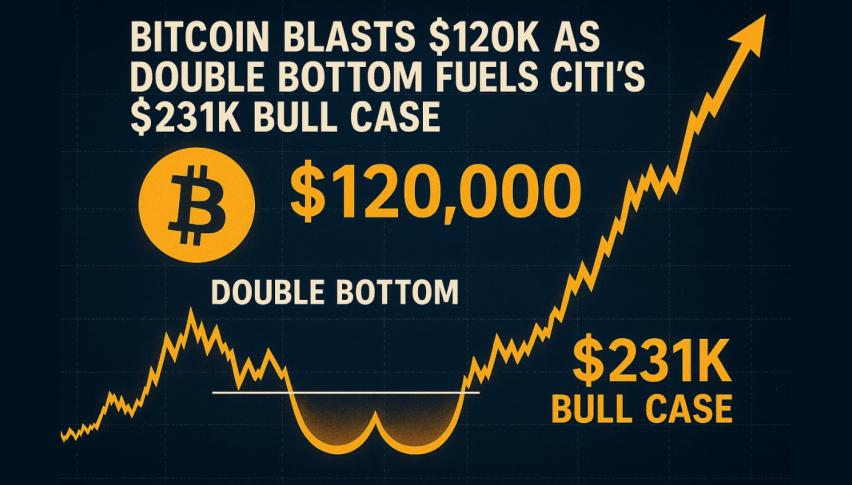

Bitcoin Blasts $120K as Double Bottom Fuels Citi’s $231K Bull Case

Bitcoin (BTC) recently reclaimed momentum, hitting $120,000 and breaking out of a descending channel that capped...

Quick overview

- Bitcoin recently hit $120,000, breaking out of a descending channel and reflecting renewed bullish sentiment.

- A confirmed double bottom pattern suggests immediate support around $119,328, with potential targets at $125,895 and $136,520.

- Citigroup projects Bitcoin could reach $231,000 within 12 months, driven by structural growth and increasing institutional adoption.

- Growing institutional interest and broader adoption of digital assets are reinforcing market momentum and confidence in Bitcoin's long-term prospects.

Bitcoin (BTC) recently reclaimed momentum, hitting $120,000 and breaking out of a descending channel that capped its price since mid-July. The cryptocurrency now trades around $119,917, reflecting renewed bullish sentiment.

Technical indicators show a confirmed double bottom pattern: the first trough appeared near $97,800 in late August, followed by a second around $98,200 in late September. The breakout above the $111,000 neckline reversed the consolidation phase, with $119,328—previous resistance—now acting as immediate support.

Fibonacci extensions suggest the next potential targets at $125,895 and $136,520, where selling pressure may emerge. Short-term consolidation is expected near $119,000, a crucial pivot for trend continuation.

Key Takeaways:

- Double bottom confirmed near $98K

- Broke descending channel since July

- Immediate support around $119,328

- Next potential targets: $125,895 & $136,520

Citigroup Projects $231K Bull Scenario

Citigroup recently issued a bullish forecast placing Bitcoin at $231,000 within 12 months. Their base case sits at $181,000, while the bear case rests near $82,000. The projections are underpinned by structural growth and increasing institutional adoption.

Analysts highlighted ongoing demand from institutional investors and financial advisors seeking digital asset exposure. Citigroup also suggested BTC could reach $132,000 by year-end, potentially marking a new all-time high. Investor sentiment is further bolstered by endorsements from figures like Ray Dalio, who called Bitcoin an “alternative money,” even as profit-taking exceeded $3.7 billion during the recent $120K rally.

Institutional Appetite and Adoption Trends

Market momentum is reinforced by growing institutional interest and broader adoption of digital assets. The recent breakout not only validates technical patterns but also strengthens confidence in Bitcoin’s long-term bullish case.

Liquid inflows from ETFs, financial advisors, and hedge funds continue to support price appreciation. Meanwhile, adoption-driven narratives—including corporations holding BTC as treasury assets—highlight the potential for sustained upward pressure.

Investor Insights:

- Institutional inflows support further gains

- Broader adoption drives long-term BTC demand

- Technical breakout reinforces bullish case

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account