Behind the Fermi Stock Sudden Surge to $30: Hype, Hope, and Empty Books

Despite soaring share prices, Fermi Inc.’s lack of revenue and questionable valuation cast a long shadow over its early market success.

Quick overview

- Fermi Inc.'s stock surged 24% to $30, but its lack of revenue and questionable valuation raise concerns about its market success.

- The company's market capitalization has ballooned to $17.6 billion, despite having no clear business model or demand.

- Recent partnerships for nuclear reactor projects aim to legitimize Fermi's expansion plans, but the absence of disclosed costs raises skepticism.

- Investors are drawn to Fermi's ambitious narrative, yet the lack of tangible earnings and operational depth suggests its rise may be unsustainable.

Despite soaring share prices, Fermi Inc.’s lack of revenue and questionable valuation cast a long shadow over its early market success.

A Rally Built on Speculation

Fermi Inc. (NASDAQ: FRMI) may have staged an impressive rebound this week, but the foundations of its rally appear fragile. The stock jumped 24% to $30 on Friday, breaking a five-day losing streak and tracking broader market enthusiasm. Yet, beneath the surface, investors are struggling to find clarity — particularly when the company has no meaningful revenue stream and limited public awareness.

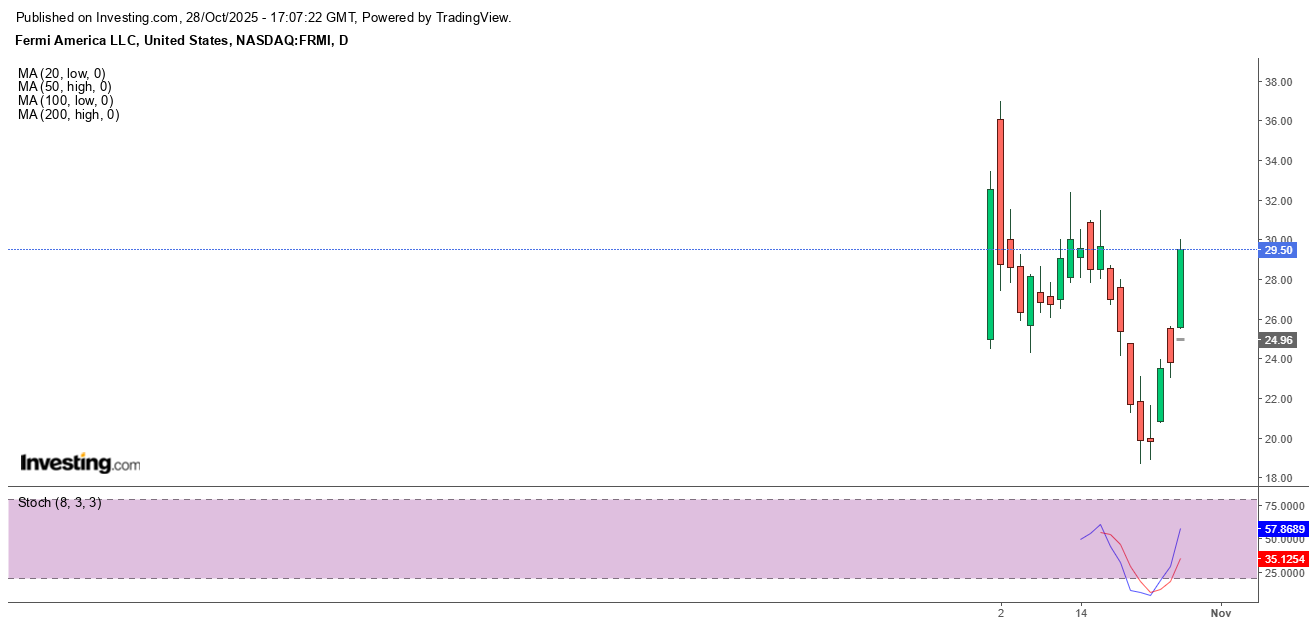

FRMI Chart Daily – Returning to $30 Fast

Since early October, FRMI has swung wildly, plunging 50% from $36 to $18 before recovering in recent sessions. The volatility underscores how heavily sentiment — rather than substance — is driving the stock’s movement.

Lofty Valuation, Murky Fundamentals

Following its market debut on October 1, Fermi’s valuation has ballooned to an eye-popping $17.6 billion — a figure that even seasoned analysts find difficult to justify. With no clear business model or evident demand, the company’s market capitalization seems detached from operational reality.

During its IPO, Fermi raised $682 million by selling 32.5 million shares at $21 each, promising to channel funds into growth, staffing, and general corporate needs. However, skeptics question whether this capital raise is enough to sustain a firm without tangible earnings or cash flow visibility.

The Nuclear Ambition Play

In an attempt to legitimize its expansion plans, Fermi recently announced agreements with Hyundai Engineering & Construction and Doosan Enerbility. These partnerships focus on initiating engineering work and component production for AP1000 nuclear reactors intended to power a massive data campus in Texas.

While these deals appear promising on paper, the lack of disclosed costs for the ambitious “Project Matador” raises eyebrows. Fermi’s goal to merge nuclear power generation with artificial intelligence infrastructure may sound visionary, but it also underscores the immense risk of building an empire on unproven technology and speculative energy projects.

Investor Optimism Meets Harsh Reality

Fermi’s stock performance mirrors a broader pattern seen in speculative AI-linked startups — where valuations skyrocket on narrative rather than numbers. Despite its partnerships and bold energy vision, there remains little evidence that Fermi can generate meaningful returns in the near term. The recent surge appears more like a momentum-driven rebound than a reflection of business fundamentals.

Conclusion: Big Vision, Bigger Questions

Fermi’s narrative combines the hottest buzzwords in today’s market — artificial intelligence, nuclear energy, and innovation — but so far, it lacks the operational depth to back its valuation. While investors are clearly intrigued by its long-term potential, the absence of revenue, transparency, and profitability metrics suggests that Fermi’s rise may be more mirage than milestone.

Unless the company can convert its bold ambitions into measurable results, Fermi Inc. risks becoming another cautionary tale in the AI-fueled investment frenzy.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM