Forex Signals Oct 31: Exxon, Chevron, AbbVie, Colgate Earnings as Investors Watch Margins

Exxon Mobile, Chevron, and consumer health firms AbbVie and Colgate may all report ahead of the bell, which might lead to an uptick in...

Quick overview

- Major corporations in the energy and healthcare sectors, including Exxon Mobil and AbbVie, are set to report earnings, potentially increasing market volatility.

- The European Central Bank maintained its interest rates while highlighting an uneven growth outlook, with inflation nearing the target but external risks persisting.

- U.S. markets ended lower despite strong earnings from tech giants like Apple and Amazon, while trade tensions eased following a meeting between Trump and Xi.

- Gold prices fluctuated around $4,000, and Bitcoin experienced volatility, dropping below $110K before recovering slightly.

Live BTC/USD Chart

Exxon Mobile, Chevron, and consumer health firms AbbVie and Colgate may all report ahead of the bell, which might lead to an uptick in market volatility. Strong energy profits could help the Dow.

ECB Holds Rates Steady as Lagarde Warns on Uncertain Outlook

The European Central Bank left the deposit rate at 2.0% and the refinance rate at 2.15%, with President Christine Lagarde noting that growth remains uneven — services are expanding, while manufacturing stays weak due to tariffs and global slowdown. She said inflation is near the 2% target, but risks remain from defense spending and currency strength. The ECB will stay data-dependent and made no firm rate commitment.

Growth Outlook and Market Moves

Lagarde said the eurozone economy is “in a good place” but faces external headwinds. The EUR/USD slipped to 1.1546 before closing near 1.1568, showing sellers still dominate below 1.1592.

The U.S. dollar gained, led by USD/JPY up 0.9% after the BOJ also kept rates unchanged, with Governor Ueda reaffirming no set path for hikes.

Trade and Market Reaction

A Trump–Xi meeting eased tariff tensions, cutting average rates to 47% and reviving hopes for U.S.–China trade stability. U.S. markets, however, ended lower — Nasdaq down 1.57%, S&P 500 off 1% — though Apple (+5%) and Amazon (+13%) rallied after hours on strong earnings.

Key Market Events to Watch Today: Energy and Healthcare Giants Report Before Market Open

A busy morning of earnings lies ahead, with several major corporations from the energy and healthcare sectors releasing results that could set the tone for Friday’s trading session.

Exxon Mobil (XOM)

- Q3 EPS Estimate: $1.83

- Exxon Mobil’s report will be closely watched as crude prices remain volatile.

- Investors will focus on upstream margins, refining output, and cash flow strength, especially after a softer Q2 performance.

- Attention will also be on management commentary regarding capital spending and progress on carbon-capture initiatives.

Chevron (CVX)

- Q3 EPS Estimate: $1.71

- Chevron’s results come amid scrutiny over its recent Hess acquisition delays and production guidance revisions.

- Analysts expect a rebound in refining profits but caution that lower natural gas prices may pressure total earnings.

- Investors will look for clues on the company’s share buyback plans and dividend outlook.

AbbVie (ABBV)

- Q3 EPS Estimate: $1.78

- The pharma giant’s update will spotlight the Humira revenue decline and performance of its replacements, Skyrizi and Rinvoq.

- The market will also weigh management’s tone on R&D spending and progress in the immunology and oncology pipelines.

- Stronger-than-expected results could reaffirm AbbVie’s transition strength post-Humira.

Colgate-Palmolive (CL)

- Q3 EPS Estimate: $0.89

- Colgate’s results will highlight how pricing actions are offsetting sluggish volume growth amid consumer caution.

- Analysts expect modest organic growth supported by emerging market demand and cost-control initiatives.

- Margins will be a key focus given higher input costs and currency headwinds.

Last week, markets were quite volatile again, with gold finding support at $4,000. EUR/USD stayed above 1.16 while main indices closed the week higher at new records. The moves weren’t too big though, and we opened 35 trading signals in total, finishing the week with 23 winning signals and 12 losing ones.

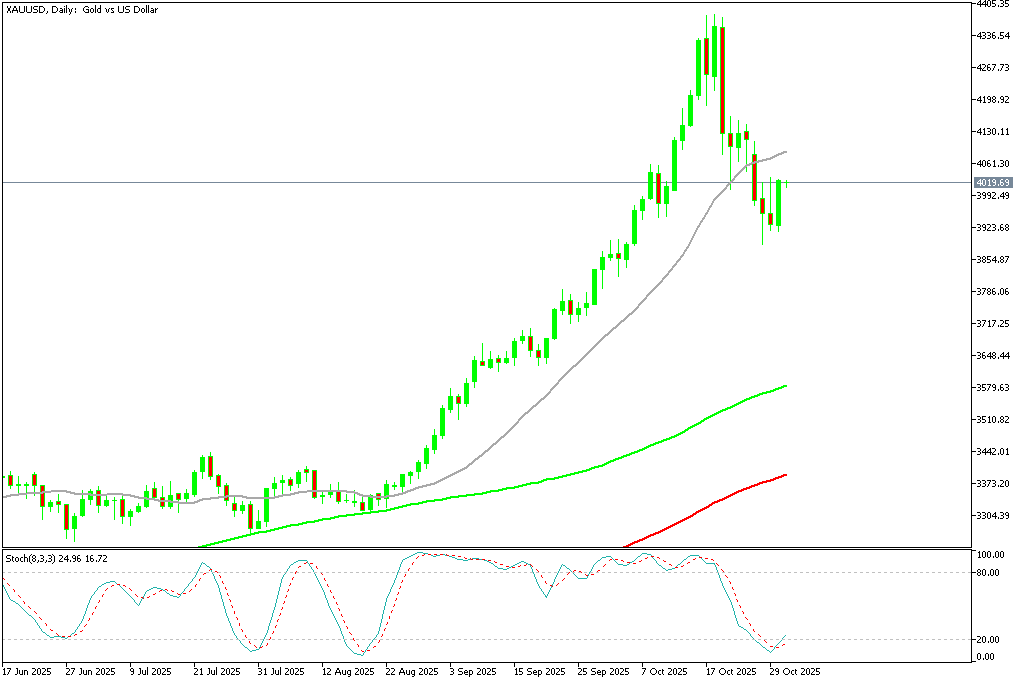

Gold Returns Above $4,000

Although demand for safe haven assets is still high, gold fell precipitously from record highs following the Fed’s most recent rate cut comments, as profit-taking was prompted by Powell’s cautious tone. Earlier this month, gold jumped above $4.3800 following the Federal Reserve’s announcement of a 25 basis point rate decrease. But the impetus soon waned, and prices dropped back to $4,004. The 20 daily SMA (gray) held as support last week, but it gave way yesterday as sellers pushed Gold below $3,900 but buyers returned yesterday and pushed XAU above $4K.

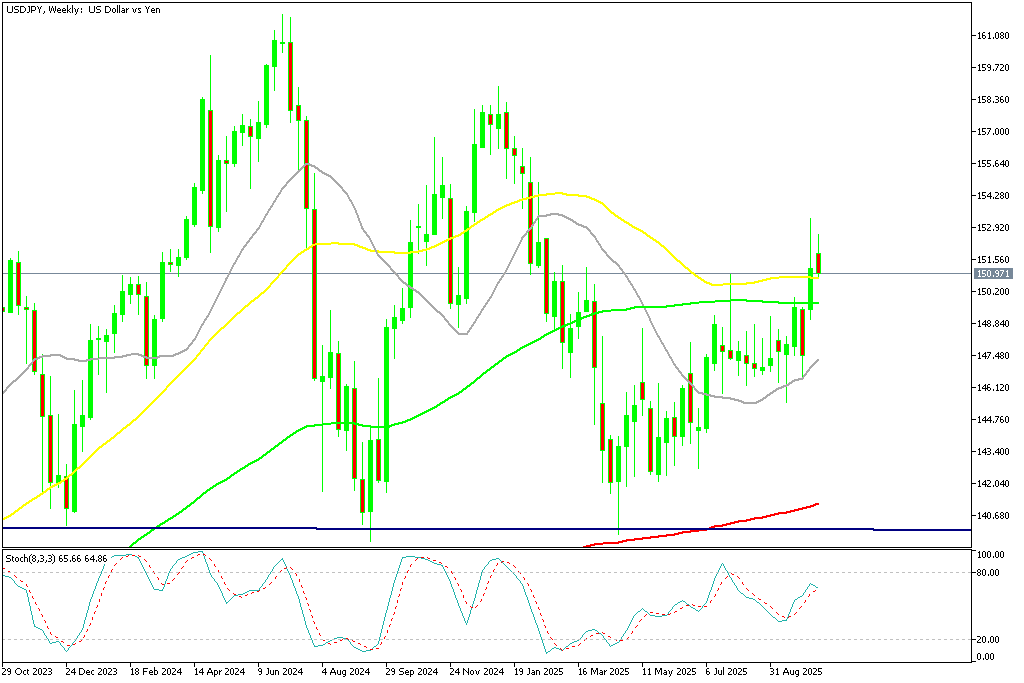

USD/JPY Returns to 150

Foreign exchange markets saw sharp swings. Early in the week, U.S. yield differentials and Japanese capital outflows pushed the dollar above ¥150, but disappointing U.S. jobs data triggered profit-taking, causing the USD/JPY to slide by four yen from its peak. However, the new BOJ governor the JPY has weakened and USD/JPY soared to 153 but returned below 152 yesterday.

USD/JPY – Weekly Chart

Cryptocurrency Update

Bitcoin Returns Below $110K

Cryptocurrencies remained highly active over the summer. Bitcoin (BTC) climbed to fresh highs of $123,000 and $124,000 in July and August, supported by institutional inflows and technical strength. However, remarks from Treasury Secretary Scott Bessent ruling out U.S. increases to BTC reserves triggered a steep pullback, sending the coin down below $105,000 before finding support at the 200 daily SMA (purple) and recovering above $115,000 but then fell toward $100K again. However last week BTC has turned higher again, climbing above $114K over the weekend.

BTC/USD – Daily chart

Ethereum Stays close to $4,000

Ethereum (ETH) has been similarly strong, surging toward $4,800, its highest since 2021 and near its all-time peak of $4,860. Despite a dip last week, ETH found support at the 20-day SMA, with retail enthusiasm and renewed institutional participation driving fresh upside momentum. ON Friday we saw a dive below $3.500 however buying resumed on Sunday and ETH/USD climbed above $4,500 but returned back down below $4,000 again this week.

ETH/USD – Daily Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM