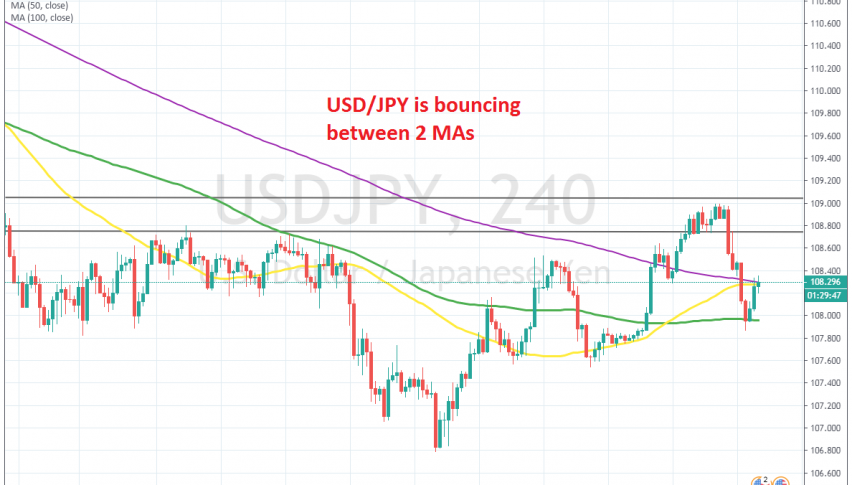

USD/JPY Stuck Between 2 MAs after Bouncing off the 100 SMA

USD/JPY bounced off the 100 SMA today, but it has been stuck now between that MA and the 200 SMA at the top

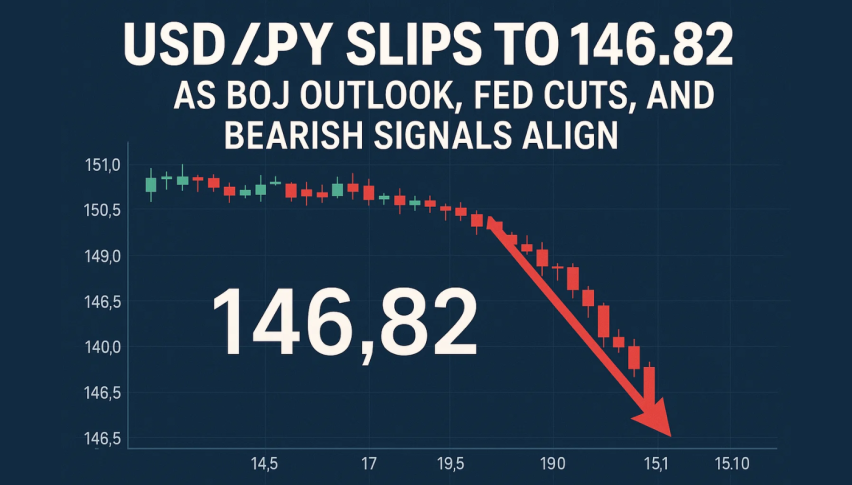

[[USD/JPY]] has been on a strong bearish trend in the last two months. While the rest of major currencies rallied against the buck as the soft economic reports from the US accumulated, the JPY had tow reasons to gain against the USD. Besides the economic slowdown in the US, the JPY also received strong bids as a safe haven asset, which accelerated the downtrend further.

Although, the sentiment improved as the G20 summit approached and this pair reversed higher. The economic slowdown has stalled in the US, as economic reports of the few weeks have shown and this pair made a bullish reversal, climbing more than 200 pips since late June.

But the global economic slowdown continues, which means that the economic slump is not over. The safe havens will continue to be in demand until the situation improves, which lead to another decline for this pair, falling from 109 to 107.80s. Although, the decline stopped at the 100 SMA (green) on the H4 chart which provided decent support at around 108 and USD/JPY bounced off of it.

Although, the price is finding resistance at the 200 SMA (purple) and the 50 SMA (yellow). If the price moves above the 50 and 200 MSAs, then the buyers will remain in control, otherwise, this might be a good chance to sell this pair, so we have to follow the price action to see how it behaves around here.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account