VT Markets Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a VT Markets Account

- Trading Platforms and Tools

- Copy Trading

- Markets available for Trade

- Bonus Offers and Promotions

- Introducing Broker Program

- Customer Reviews and Trust Scores

- Discussions and Forums about VT Markets

- Employee Overview of Working for VT Markets

- Pros and Cons

- In Conclusion

VT Markets is a global forex and CFD broker recognized for its competitive spreads, lightning-fast trade execution, and wide selection of tradable assets. The broker caters to both beginner and experienced traders, providing access to popular platforms, robust trading tools, and a seamless trading experience across multiple markets.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

| Broker | VT Markets |

| Minimum Deposit | 50 USD |

| Leverage (up to) | 500:1 |

| Crypto Deposits | Yes |

| Commission Fee | ECN Accounts |

| Withdrawal Fee | Yes |

| Inactivity Fee | Yes |

| Regulations | 🇦🇺 ASIC 🇿🇦 FSCA 🇲🇺 FSC |

| Open an Account |

Overview

VT Markets has grown rapidly since 2015, offering a trusted and innovative trading environment. With more than 600,000 active clients and over 720 billion in monthly trading volume, it empowers traders worldwide by focusing on accessibility, ambition, and rewarding success across all levels.

Frequently Asked Questions

What makes VT Markets different from other brokers?

VT Markets stands out by simplifying trading for everyone, not just experts. It provides advanced tools, trusted conditions, and strong educational resources. Additionally, its culture emphasizes rewards, ambition, and ESG initiatives, which makes it a forward-thinking broker in a highly competitive industry.

How large is the VT Markets client base?

VT Markets has established a strong global presence since 2015. It currently serves over 600,000 active clients who execute more than 60 million trades monthly, representing a trading volume that surpasses 720 billion per month, which highlights both trust and consistent growth.

Our Insights

VT Markets continues to make trading accessible, trusted, and rewarding for traders worldwide. Its philosophy of ambition, innovation, and responsibility creates more than a trading platform—it builds a global community where every client is supported, rewarded, and empowered to reach new opportunities.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Fees, Spreads, and Commissions

VT Markets delivers competitive trading costs with ultra-low spreads and transparent commissions. Standard STP accounts offer 1.2 pip spreads with zero commission, while RAW ECN accounts provide 0.0 pip spreads and low $6 per round-turn fees. Swap-free accounts eliminate overnight fees, supporting diverse trading strategies.

| Account Type | Spread | Commission | Swap/Interest Fees |

| Standard STP | 1.2 pips | None | None |

| RAW ECN | 0.0 pips | 6 USD | None |

| Pro ECN | 0.0 pips | 6 USD | None |

| Swap-Free | 1.2 pips | None | None |

| Cent | 1.1 pips | None | None |

Frequently Asked Questions

What are the typical spreads on VT Markets accounts?

Standard STP accounts start at 1.2 pips, RAW ECN accounts offer razor-thin 0.0 pip spreads, and Cent accounts begin at 1.1 pips. Swap-free accounts maintain competitive spreads without overnight fees, making VT Markets suitable for traders prioritizing cost efficiency.

How does VT Markets charge commissions?

Standard STP and Cent accounts have no commissions per round turn, while RAW ECN accounts charge $6 per round turn. Swap-free accounts maintain no swap fees, allowing traders to focus on strategy without hidden costs, particularly for long-term positions.

Our Insights

VT Markets balances transparency and affordability. Traders can choose accounts with zero to low commissions and highly competitive spreads. Swap-free and professional options ensure both beginners and high-volume traders benefit from cost-effective, precise trading conditions.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

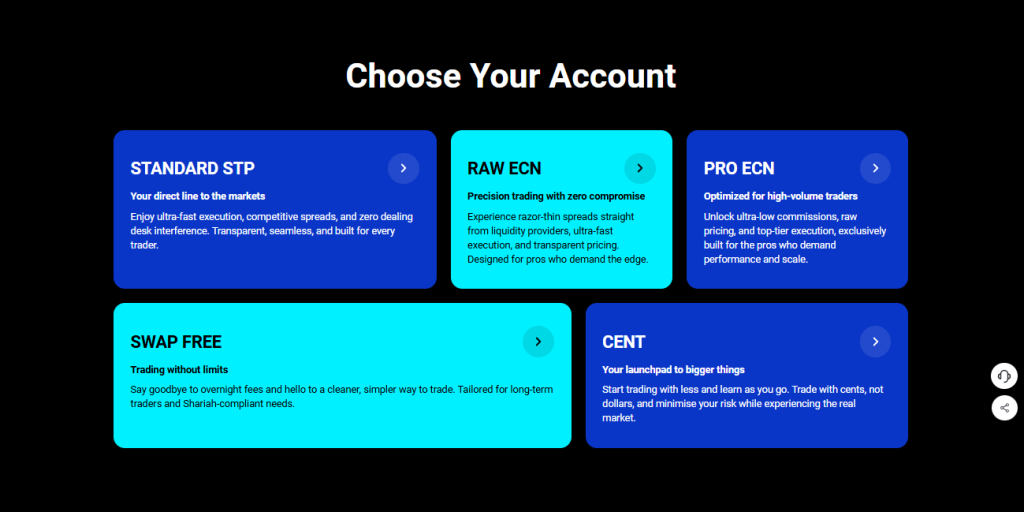

Minimum Deposit and Account Types

VT Markets offers account types for every trading goal. Standard STP, RAW ECN, Pro ECN, Swap-Free, and Cent accounts cater to beginners and professionals. Minimum deposits range from $50 for Cent accounts to $100 for others, providing flexibility while supporting diverse trading styles.

| Account Type | Open an Account | Minimum Deposit | Minimum Trading Size |

| Standard STP | 100 USD | 0.01 lot | |

| RAW ECN | 100 USD | 0.01 lot | |

| Pro ECN | 100 USD | 0.01 lot | |

| Swap-Free | 100 USD | 0.01 lot | |

| Cent | 50 USD | 0.01 lot |

Frequently Asked Questions

What is the minimum deposit for VT Markets accounts?

Cent accounts allow traders to start with just $50, while Standard STP, RAW ECN, Pro ECN, and Swap-Free accounts require $100. This makes VT Markets accessible for both new traders and professionals seeking larger-scale trading.

Which VT Markets account suits beginners versus professionals?

Beginners can use Cent or Standard STP accounts for low-risk learning, while RAW ECN and Pro ECN accounts are designed for experienced traders needing precision, ultra-low spreads, and scalable performance. Swap-Free accounts support long-term or Shariah-compliant strategies.

Our Insights

VT Markets accommodates all trader levels with flexible account options and low minimum deposits. Beginners can start small, while professionals benefit from advanced execution and low spreads. Overall, account diversity ensures a suitable fit for every trading objective.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

How to Open a VT Markets Account

Opening a VT Markets account is fast and mostly online. You can register for a demo or upgrade to a live account, verify identity, then fund your account to trade on MT4, MT5, or the web and mobile platforms.

1. Step 1: Visit the VT Markets registration page

Go to VT Markets and click Open a Live Account or Open Demo to begin your application.

2. Step 2: Complete the online form

Enter personal details, country of residence, email, and create a secure password; additionally, complete the short trading experience questionnaire.

3. Step 3: Confirm your email

Open the verification email from VT Markets and click the activation link to access your client portal.

4. Step 4: Submit KYC documents

Upgrade to a live account and upload a valid government ID and proof of address for verification; review times can vary.

5. Step 5: Fund your account and choose a platform

From Money Management, choose a deposit method such as bank transfer, credit or debit card, or e-wallets, fund the account (minimums vary by account and region), then download MT4 or MT5 or trade via web or mobile.

This process can be completed in minutes for registration, although KYC and deposit processing times depend on your region and payment method.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Trading Platforms and Tools

VT Markets offers a robust lineup of platforms designed to fit different trading styles. From the award-winning VT Markets App to MetaTrader 4 and 5, and TradingView, each platform delivers speed, precision, and flexibility for traders seeking performance and control.

| Platform | Best For | Key Strength | Accessibility |

| VT Markets App | On-the-go users | Mobile range | iOS and Android |

| MetaTrader 5 | Beginners | Multi-asset | Desktop and Mobile |

| MetaTrader 4 | Experienced | Advanced tools | Desktop and Mobile |

| TradingView | Strategy-focused | Precision charting | Web-based |

Frequently Asked Questions

Which VT Markets platform is best for beginners?

MetaTrader 5 is often the preferred option for new traders. It provides a user-friendly interface, multi-asset capabilities, and built-in tools to help beginners learn the basics of trading, while still offering enough power to grow alongside their trading journey.

Do VT Markets platforms support advanced strategies?

Yes, traders can choose platforms like MetaTrader 4 or TradingView for advanced strategies. MetaTrader 4 delivers powerful tools and custom indicators, while TradingView supports precision-driven charting and strategy testing. Together, they give professional traders strong control over execution and analysis.

Our Insights

VT Markets ensures every trader finds a platform that matches their goals. Beginners benefit from MetaTrader 5, while advanced users thrive with TradingView and MetaTrader 4. With the VT Markets App for mobile flexibility, the broker combines innovation, speed, and accessibility in one ecosystem.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Copy Trading

VT Markets introduces VTrade, a powerful copy trading platform that allows investors to follow seasoned professionals and replicate their strategies in real time. With transparent performance tracking and user-friendly features, traders can save time, reduce complexity, and grow portfolios with confidence.

| Feature | Benefit | Transparency | Access |

| Follow Top Traders | Replicate strategies | Real-time stats | Global |

| Track Performance | Risk and returns | Equity data | 24/7 |

| Flexible Choices | Copy multiple pros | User control | Mobile |

Frequently Asked Questions

How does copy trading with VT Markets work?

Copy trading through VTrade allows users to select experienced traders, review their performance statistics, and automatically mirror their trades in real time. This approach empowers beginners and busy investors to participate in the markets without needing deep trading knowledge.

Is copy trading safe with VT Markets?

VT Markets ensures a secure environment for copy trading. While risks remain due to market volatility and trader performance, the platform provides transparency through performance tracking, risk metrics, and equity data, giving investors tools to make informed decisions before following any trader.

Our Insights

VT Markets copy trading through VTrade bridges the gap between beginners and professionals. By offering transparency, flexibility, and security, it empowers traders to save time and leverage expert strategies. Although risks remain, the platform simplifies access to trading opportunities with a balanced approach.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Markets available for Trade

VT Markets offers a wide range of markets, from forex and indices to precious metals, energies, commodities, ETFs, CFD shares, and CFD bonds. With such diversity, traders can diversify portfolios, manage risk effectively, and capture opportunities across global financial instruments.

| Category | Examples | Opportunities | Trader Benefit |

| Forex | Major/Minor Pairs | Global currency trading | High liquidity |

| Indices | Global Benchmarks | Stock market access | Portfolio balance |

| Commodities | Energies Metals | Inflation hedging | Diversification |

| CFDs | Shares Bonds | Broader exposure | Flexible trading |

Frequently Asked Questions

What markets can I trade with VT Markets?

VT Markets provides access to forex, indices, energies, precious metals, soft commodities, ETFs, CFD shares, and CFD bonds. This extensive range enables traders to diversify their strategies and tap into global opportunities across various asset classes.

Why is market variety important for traders?

Market variety helps traders balance risk and opportunity. When one market is volatile, another may remain stable. With VT Markets offering instruments across multiple asset classes, traders gain the flexibility to adapt to changing conditions while pursuing consistent growth.

Our Insights

VT Markets positions itself as a multi-market broker that caters to different trading styles. By providing a wide selection of instruments, it allows traders to diversify, hedge, and seek opportunities worldwide, all from one platform.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Bonus Offers and Promotions

VT Markets offers a variety of promotions designed to add value to every trade. From generous welcome and deposit bonuses to ClubBleu rewards, referral incentives, and VPS refunds, traders can maximize their potential while enjoying perks that enhance long-term trading success.

| Promotion | Reward Type | Value Offered | Key Benefit |

| Welcome Bonus | Deposit bonus | 50% | Boost starting capital |

| Deposit Bonus | Reload bonus | 20% | Extra value on deposits |

| Refer a Friend | Referral incentive | Up to $20,000 | Grow network, earn rewards |

| ClubBleu | Loyalty program | Vouchers, tiers | Ongoing rewards |

| VPS Refund | Cost-saving perk | Full refund | Free trading setup |

Frequently Asked Questions

What promotions does VT Markets currently offer?

VT Markets provides several promotions, including a 50% welcome bonus, a 20% deposit bonus, a ClubBleu rewards program, referral bonuses of up to $20,000, and an active trader program with balance rewards. Traders may also claim VPS refunds when meeting trading requirements.

How do VT Markets promotions benefit traders?

Promotions at VT Markets help traders increase trading capital, reduce costs, and enjoy added rewards. Bonuses provide a head start, referral incentives create extra income, and ClubBleu ensures consistent rewards. Together, these benefits amplify value across both beginner and experienced traders.

Our Insights

VT Markets promotions deliver meaningful rewards that go beyond trading. By combining bonuses, loyalty programs, and cost-saving incentives, the broker ensures traders can enjoy more value, stronger capital, and exclusive perks on their trading journey.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Introducing Broker Program

VT Markets offers a flexible and rewarding Introducing Broker (IB) program tailored for both individuals and businesses. With instant payouts, transparent tracking, marketing tools, and professional support, partners can scale their network, boost earnings, and deliver value-added solutions worldwide.

| Feature | Benefit | Support Provided | Payouts |

| Flexible Rebates | Customised earnings | Multilingual 24/7 help | Instant |

| Transparent Tracking | Monitor referrals easily | Marketing materials | Reliable |

| Tools Provided | Copy, MAM, PAMM | Expert guidance | Flexible |

Frequently Asked Questions

How does the VT Markets Introducing Broker program work?

The IB program rewards partners for referring new clients to VT Markets. Commissions are earned through flexible rebate structures, with instant payouts and transparent tracking. Partners also receive tools such as copy trading, MAM, and PAMM to expand their offerings.

What support do Introducing Brokers receive from VT Markets?

Introducing Brokers benefit from professional marketing materials, a multilingual support team available 24/7, and an intuitive portal for managing their network. This infrastructure allows IBs to focus on growing their business while providing clients with tailored investment solutions.

Our Insights

The VT Markets IB program creates a mutually beneficial partnership. With scalable solutions, flexible rewards, and world-class support, both individual and business partners can confidently grow their network while delivering strong value to clients globally.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Customer Reviews and Trust Scores

VT Markets gets a mix of praise and criticism from customers and reviewers. Many appreciate its competitive fees, responsive support, and range of assets, while others raise concerns around withdrawals, verification delays, or transparency in some aspects. Review and rating platforms offer useful insight into what traders like and what they find frustrating.

| Review Source | Trust/Rating (5) | What People Praise | What People Criticize |

| Trustpilot | 4.3 | Good customer service, fast responses, smooth deposits/withdrawals in many cases | Some reports of being unable to withdraw, long verification, issues with promises vs actual spreads |

| ForexBrokers.com | 4.0 | Low fees in certain account types, wide range of CFDs, solid platform tools | Education tools are average, risk score moderate; not in all jurisdictions |

| Investing.com Other review sites | High ratings in many categories like assets, support | Many customers say the broker balances features and trust/safety well | Some users complain about differences in advertised vs real spreads; delays in support in some cases |

VT Markets’ overall trust scores suggest a moderately high level of customer satisfaction, though not without recurring complaints about withdrawals and transparency.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Discussions and Forums about VT Markets

In public forums and trading communities, VT Markets is often discussed in contexts of trade execution, platform experiences, regulatory trust, and comparison with other brokers. Some conversations are positive, others are warnings stemming from specific negative experiences.

| Platform / Forum | Nature of Discussion | Common Praise | Common Complaints |

| Trustpilot comments | Mostly user reviews of customer service and transactions | Positive feedback on fast support, helpful agents, ease of deposits | Complaints about withdrawal delays, verification requests, discrepancies in spread or trading conditions |

| Reddit (Forex-Trading threads) | Peer-to-peer sharing of trading platform experiences, changes or updates, complaints or tips | Some users note improvements (e.g. updated MT5 software, better tech when busy), others share tips to avoid problems | Allegations of “stall tactics” around withdrawals, higher than expected spreads, poor transparency |

| Review aggregation sites / blogs | More structured comparisons with other brokers | Feature-rich tools, decent range of assets, acceptable fees in many cases | Education or learning materials less strong, some brokers offer better spreads or regulatory cover |

Discussions suggest that while VT Markets is well respected by many, it is not without risk or controversy — particularly around withdrawals, verification, and expectation vs reality.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Employee Overview of Working for VT Markets

Looking at employee feedback (Glassdoor & similar), the picture is mixed. Some like the colleagues, opportunities to learn, and the salary; others feel the company suffers from management, culture, and structure issues.

| Factor | What Employees Like | What Employees Dislike |

| Work environment/ Team | Collaborative teams, supportive colleagues, freedom to try things out | High turnover, sometimes unclear management roles or shifting priorities |

| Compensation/ Rewards | “Above market salary” in some cases; pay is at least on time | Benefits below what some expect; instability in what is promised vs delivered |

| Management/ Structure | Opportunities to learn, exposure to different areas of fintech / forex industry | Employees report poor communication, unclear reporting lines, and overly demanding or erratic workloads |

Employee feedback implies that VT Markets can be a good place to gain experience, but there are some serious concerns about retention, clarity, and consistent leadership.

★★★ | Minimum Deposit: $50 Regulated by: ASIC, FSCA, FSC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Competitive spreads (in some account types) | Withdrawal delays reported by some users |

| Friendly/Responsive customer service often mentioned | Verification/KYC can be slow burdensome |

| Wide range of assets (1000+ CFDs etc.) | Some complaint about higher spreads than advertised |

| Regulators in multiple jurisdictions (ASIC etc.) | Mixed reviews on educational tools/ resources |

| Good platforms/tools (MT4, MT5 etc.) | Employee turnover is high; management issues reported |

References:

In Conclusion

VT Markets has established local and regional offices to better serve customers in several jurisdictions, especially in the Asia-Pacific region. They also have regulated entities in places where they don’t necessarily have full stand-alone offices, but do provide support and services.

- 🇲🇾 Malaysia

- 🇿🇦 South Africa

- 🇲🇺 Mauritius

- 🇦🇪 United Arab Emirates (Dubai)

- 🇨🇾 Cyprus

VT Markets’ presence through these offices helps with customer support, regulatory compliance, marketing, and local client servicing.

Faq

Yes, VT Markets is overseen by top-tier financial regulators such as the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Financial Services Commission (FSC) in Mauritius.

From $5. The minimum deposit for a VT Markets account varies by account type but starts from $5 for a Cent account.

Yes, VT Markets provides a VPS refund program to qualifying clients who satisfy certain trading volume requirements.

You can contact VT Markets via live chat and email. They also offer a FAQ area in the Help Centre on their website.

Yes, VT Markets’ VTrade platform supports copy trading, allowing traders to mimic the trades of successful traders.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a VT Markets Account

- Trading Platforms and Tools

- Copy Trading

- Markets available for Trade

- Bonus Offers and Promotions

- Introducing Broker Program

- Customer Reviews and Trust Scores

- Discussions and Forums about VT Markets

- Employee Overview of Working for VT Markets

- Pros and Cons

- In Conclusion