How to trade crypto signals using Gemini

Crypto signals are defined as a set of instructions packaged as trading tips that help traders to invest wisely. The signals allow traders to avoid apparent pitfalls that could easily cost them money. Signals can be created by software or through the knowledge and opinions of experienced traders.

Experienced traders and analysts with long track records are the ones tasked with building crypto signals. Note that the trading signals provided by experienced analysts are not products of guesswork. Hence you can easily rely on them and overcome the entry barriers to trading crypto.

Market analysts undertake thorough technical and fundamental analyses of particular cryptocurrencies to come up with detailed crypto trading signals. The format entails details of the entry-level price, stop loss and profit take target.

Why use Crypto Signals with Gemini?

- Low trading fees – Gemini aims to keep its fee threshold as low as possible. Employing reliable, consistent and frequent crypto signals with an exchange that charges low fees will make you lots of profit.

- Simplicity – Gemini has an easy registration process and the interface is user-friendly to accommodate traders of any level.

- Both Margin and Futures accounts – Gemini has both futures and margin accounts that allow you to reap returns from leveraging your capital investment.

- Security and data privacy – you need not worry about the safety of your funds when trading with Gemini. The platform follows a strict data privacy protocol to ensure its user data is safe and can never fall into the hands of unscrupulous individuals.

A crypto signal in its most basic form would look like this:

Trade Bitcoin (BTC)- Sell – $16,000 – TP $15,000 – SL $17,000

- Trade Bitcoin (BTC) on any exchange

- The action for the trade whether it’s buying or selling. In this case, it’s a sell.

- The entry price level to sell is $16,000

- A take profit target price at $15,000

- And finally, a stop-loss target at $17,000

In most cases, crypto signal platforms will provide a short-term signal with all targets mapped.

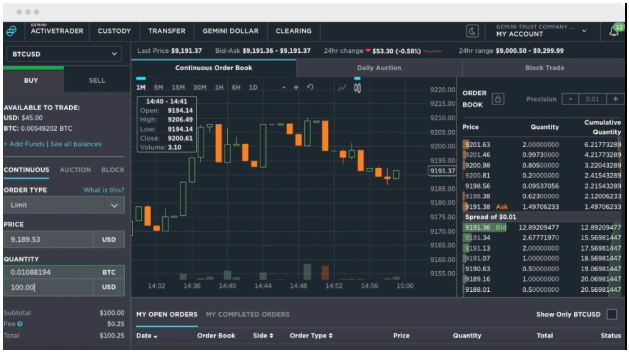

How to use Gemini with crypto trading signals

You need a Gemini account to continue. Once done with registering your profile on the official exchange account, come back here and learn the exact way of trading Gemini using trading signals. We will make the assumption that we have received Futures trading signals.

Prerequisites include:

- A Gemini account. Registering on the platform will require you to pass all Know-your-Customer (KYC) in place.

- Load funds into your account. Deposit at least $50 to get started. There is no maximum or minimum amount of capital. You have the freedom to start anywhere.

- Finally, a Gemini trading signal from your preferred crypto signal provider. In this example, we will use a signal from FXLeaders analysts for buying Ethereum (ETH) at $1350 using a 2X leverage, a profit takes target at $1600 and the stop loss at $1100.

Step 1: Go to derivatives

Locate USD-M Futures on the Gemini homepage. Navigate to the Derivatives Button at the top of the homepage. If you do not intend to use leverage, click Spot located under Trade. Depending on your preferred base stablecoin, you can choose between USDC and USDT. in our case, we are going with USDT Perpetual.

At this point, I am already assuming you have already loaded your Gemini wallet with funds. As well as transfer the funds from your funding/spot wallet to the Futures wallet.

The next step is to now set up the leverage. We have two options when customizing leverage, Cross or Isolated margin. Cross means the leverage will affect your entire capital regardless of whether it’s in an open position or not. Isolated means the leverage will not affect your balance in the Futures wallet. We recommend using Isolated. Isolated leverage ensures you reduce the overall risk spread just in case you have several Futures positions you want to open simultaneously.

After picking Isolated, set your leverage to 2X through the steps shown in the image below and confirm. Since our signal is a buy action, we will set the Long Leverage to 2.

The next step is implementing the signal you received. On the right sidebar, is an open and close bar. Choose the Open Position Bar and click on Limit. You will then need to tick a box written :

- Buy long with TP/SL

Checking the box will display two text boxes where you can now customize your take profit target and stop loss target depending on the signal you received. In our case, we have a buy signal for the ETH/USDT pair at $1350, a take profit target at $1600 and a stop loss target at $1100.

After the above steps, it’s time to open our long position. We intend to use $25 to open a buy position at $1350. The other parameters include setting up a TP and an SL at $1600 and $1100 respectively.

This is the final step and at this point, you only need to patiently wait for your order to fill. Something else you need to look at is how to take a profit without closing your position. Nonetheless, we are not going to cover that topic in this article. But generally, this is all about how to use crypto signals with Gemini.

Frequently Asked Questions on trading Gemini with signals

- What other features does the signal provider offer apart from crypto signals? : A good signal provider provides more than just signals. This could be news coverage, events, live updates and detailed description of the methodology they use for a particular trade. Choose a provider that offers passive learning besides earning.

- Does the signal provider offer a free trial or money-back guarantee?: A service provider with either a free trial or money-back guarantee indicates the team is not just out for money. They have the urge to grow their customer relations and are invested in the long-term growth and advancement of their subscribers.

- Should I follow my gut instincts when trading with crypto signals? Your gut instincts will always warn you if something is not right. The right service provider will not relay any red flags or cause any doubts. Therefore, try as much as possible to rely on our gut feelings when choosing the right trading signal provider. Just in case you identify any red flags, the provider is not worth the risk. Hence, flag it down.

- Should I consider the track record and experience of the team behind the signals?: Identify a service provider that has been around for a while. Newcomers have a high chance of getting things wrong. A seasoned team of analysts and signal providers with years of experience are the most preferred choice. Also, take note of the platform’s reputation and its historic perfomance. Consistent positive testimonials and ratings are signs of a credible provider.

- How can I gauge the credibility of a crypto signal provider? : A quality provider is transparent when communicating their wins and losses. It is not possible to have a long streak of wins only if there is no backup proof. Genuine providers will back up their wins and admit losses on the way.

- What are the risks of using crypto signals when trading?: There are several limitations and risks of using crypto signals when trading on the Gemini Exchange. These risks include:

- Price Movement – The volatile nature of cryptocurrency will always lead to dramatic price changes. Volatility could either hurt or profit your investment. Therefore treat those unexpected market changes as a double-edged sword. It is easy to lose with crypto when trading in a highly volatile market. You either make quick profits or quick losses. We however recommend using crypto signals when trading the big coins, which even if they are not at the entry-level; will still regain their position.

- Fees – There is a cost associated with trading any cryptocurrencies. These costs could be trading, withdrawal and deposit fees. Such fees result in tight profit margins and we recommend factoring them in when calculating your investments. Imagine if you bought a coin from one exchange and expect it to sell on another exchange at 1% profit. You have to pay 0.3% in fees for each exchange. The total profit will be minus 60%. Some exchanges also charge deposit and withdrawal fees. Factoring all these costs could easily see you out of interest.

- Slippage – Slippage is the extent of a price change between the time you started your trade to the time you successfully concluded the transaction. In arbitrage, it means the price could change to your disadvantage after you have just bought the coin. Slippage could be a small amount of money but it really counts in the cryptocurrency market. Crypto trading requires you to trade within tight margins and you, therefore, require to put much thought into all these costs, including the costs of a reliable crypto signals provider.

- What are some benefits of trading with crypto signals? : Trading on the Gemini exchange with crypto signals has the following benefits:

- A reliable extra pair of eyes – It is difficult to monitor multiple markets taking place across different timeframes. You also cannot watch these markets 24/7. In such cases, reliable trading signals become your personal trading assistant enabling you to trade a couple of markets altogether.

- Generating profit – A decent crypto trading signal platform will generate you money. It does not matter whether you are parting with some dollars to get a premium signal, the provider will make you money at the end of the day.

- Fresh perspective – If your provider has more experience than you do and they end up providing a contrary signal; the signal ends up clearing your doubts about the market’s direction. A fresh perspective will also help you horn your trading skills and your ability to conduct accurate technical analysis.

- A tool for passive learning – Crypto signals allow you to learn everything about trading and the thought process of expert traders. Following the trades of professional traders and analyzing their process of working out the signals, you incorporate new knowledge into your way of trading and thinking.

- Reducing risk – Sometimes you cannot make the right decision on where the price of an asset is heading. And jumping into a trade with a biased mindset is setting yourself up for risk and loss. Crypto signals alleviate this kind of risk and you could end up making a profit where you would have made a loss.

- What are the cons of trading with crypto signals?: Here are some limitations of trading the crypto market using signals:

- Placing trust in someone’s opinion on how to invest your trading capital comes with a high level of understanding. Imagine if you end up trusting a dubious signal provider and then you lose your money. There are many illegitimate platforms out there and you could easily fall for what seems like credible positive reviews. Wrong trading signals could easily wipe out your entire capital investment.

- No upward learning curve – Crypto signals will not help you take the traditional trading learning curve as it is with live trading. Yes, you will easily find new opportunities and exploit them but you will be using someone else’s opinions. To get better at trading, you need to learn it through the experience of live trading.

- Pay is upfront – Some providers might charge lots of money to offer signals even to a small account. This would not be recommendable if you believe the profits are not worth the signal. Also, remember there is a risk attached to paying money to a provider you have never used before.

You can easily lose money – If you lack a good risk management strategy, crypto signals could result in a loss of money.