Ethereum (ETH) – Forecast Summary

| Ethereum Forecast: End 2021 Price: $4,400 – $5,000 Price drivers: Market sentiment, COVID-19, War on cryptos, London Hard fork |

Ethereum Forecast: 1 Year Price: $6,000 – $8,000 Price drivers: Ethereum 2.0 success, Safe haven status, Post COVID-19, Hawkish central banks? |

Ethereum Forecast: 3 Years Price: $10,000-20,000 Price drivers: Global politics, Crypto market sentiment, Ethereum upgrades |

Ethereum has seen some bullish momentum since the bearish period in the crypto market ended in late July. It made gains that were considerably larger than Bitcoin and moved above $4,000 by early September. The release of Ethereum 2.0 London hard fork in September added further to the positive sentiment in the crypto market, which benefited Ethereum considerably until the flash crash in the market. Ethereum lost 25% of the value, which is still less than most of the crypto market. The bearish sentiment in the crypto market kept dragging the price down, as it fell below $3,000 again, but buyers are back in control now and the price seems to be heading for $4,000 and the all-time highs at $4,380s.

Like most other cryptos early in 2021, Ethereum continued to make new highs until the middle of May this year, as it broke above $ 4,000, reaching $ 4,380 on May 11. But, the crash in the cryptocurrency market came and Ethereum lost around $2,500. The bearish move unfolded in two phases all over the market, one bearish leg in May and another one by the middle of June. Ethereum transactions declined from 1.716 million at their peak in May, to 1.189 million by the middle of June 2021, although the situation has changed again since late July. The sentiment has improved in the crypto market which has turned bullish again, while ETH/USD has resumed the bullish trend of the first several months, but is yet to reach May highs. It has nearly doubled in value since the bottom at $1,700 lows, breaking above all obstacles, which shows great buying pressure. It is once again leading the market higher, helped also by the London Hard Fork released this month, since Bitcoin has only gained around 70% of the value in this latest bullish run in cryptocurrencies.

ETH/USD was quite bullish for the first several months of 2021. It was the first to resume the bullish trend in February after the retreat during most of January and again in March after the retreat in the last week of February. The price broke above the record highs of $ 1,427 in the first week of February, which now looks a long way down, as buyers keep pushing the price above the 2018 highs.

The bullish momentum for cryptos resumed after the latest big pullback in April. While other cryptos like Bitcoin were finding it hard to resume the bullish trend since then, Ethereum was continuing the surge until the middle of May. But, the crash came, after China started a war on cryptocurrencies, banning Bitcoin mining in several provinces. Although, the decline stopped above $1,700 and Ethereum is again taking the lead again in this bounce, but let’s see if Ethereum will break above May’s low soon.

Recent Changes in the Ethereum Price

| Period | Change ($) | Change % |

| 3 Months | +1,905 | +201.6% |

| 6 Months | +1,570 | +294% |

| 1 Year | +2,805 | +742% |

| 3 Years | +2,897 | +924% |

| 5 Years | +3,040 | +9,800% |

Bitcoin surged to $ 65,000 by the middle of April and has climbed above $60,000 again now as buyers are back in control, while Ethereum broke the 2017-18 high of $ 1,427 as the surge continued until the middle of May 2021 for ETH/USD, according to most Ether brokers. Although after climbing to record highs of $4,380 and leading the cryptocurrency market for about month, Ethereum went through a massive retreat, like most cryptos. However, the crash has ended and Ethereum resumed the bullish trend, which is backed by the fundamentals behind Ethereum, and particularly by the new upgrade to Ethereum 2.0 via the London Hard Fork.

Looking back in the past year since the coronavirus pandemic started, Ethereum found itself in the middle of a massive bullish run in cryptocurrencies; while the majority of the market has been surging higher, some important cryptos remained stagnant, with Ethereum being among the best performing altcoins. There are quite a few reasons for this, with the sentiment turning massively bullish for digital currencies for safety reasons, at a time when no fiat currency is safe.

The new development with Ethereum 2.0 will make Ethereum more scalable, thus more attractive once again. The coronavirus and the uncertainties related to it turned the investors towards cryptocurrencies in 2020 which has continued well into 2021, but the political changes around the globe have also added further fuel to this bullish momentum, which has benefited Ethereum immensely, as it has attracted large investors. Other fundamentals have also been positive for Ethereum, with Ethereum 2.0 in the process of being fully launched, which will make the Ethereum network more reliable as the DeFi transactions boom. Although, there’s an unspoken war on cryptos now, but they seem to have been overcome the initial panic and have turned bullish again.

Ethereum Live Chart

Ethereum Price Prediction for the Next 5 Years

Cryptocurrencies are taking a lot of attention in financial markets once again, after the rollercoaster this year. While certain shares, like Amazon and Tesla, have performed extremely well in the times of COVID-19, the crypto market outperformed everything until April/May. The value of this market increased manyfold, as digital currencies earned safe-haven status, although they lost a hefty portion of early 2021 gains in May and June. Cryptos have turned bullish again now, with Bitcoin breaking the resistance zone at $50,000, while Ethereum is trading above the $3,000 level again. In this article, we will take a look at the factors that are keeping the ETH/USD bullish, and the projections for the future.

Ethereum Turning Into a Safe Haven During Coronavirus Times

COVID-19 has turned out to be extremely beneficial for cryptocurrencies. Traditionally, cryptocurrencies have been seen as risk assets during their short lifespan, which means that they increase in value when the market sentiment is positive and traders are seeking higher returns on riskier financial instruments. When the sentiment turns negative, risk assets turn bearish, and that’s what Ethereum did when the coronavirus first made its way to Europe in February last year. Markets were still in normal mode back then, and cryptocurrencies tumbled lower. But, since the middle of March 2020, the world has changed, and cryptocurrencies have turned from risk assets into safe havens, towards which traders turn for safety in times of trouble.

Bitcoin has been leading the crypto market as always, but Ethereum has had its fair share of gains as a safe haven for nearly a year. All the countries around the globe went through a severe crash in spring 2020, during the lockdown period, and despite a bounce in summer, the global economy is still suffering, with certain economies, like the Eurozone and the EU, enduring a double-dip recession in 2020. Governments and central banks have been pouring out excessive amounts of cash non-stop, some of which spilled into cryptos and will continue to do so for at least a couple of years. In this environment, with the global economic meltdown and the excessive amount of cash in the markets, no traditional currency is safe to hold, so traders and investors are turning to cryptocurrencies more and more.

Besides the economic difficulties, global politics have also helped fuel the bullish momentum in cryptocurrencies. The western political landscape is changing, which makes the situation increasingly uncertain from an economic and a social point of view. On the other side of the planet, it seems like China is cracking down on private capital and business people. The founder of Alibaba and the Ant Group, Jack Ma, hasn’t been seen for some time, and some even claim that he is missing. Some of the funds have been frozen, which is panicking other rich Chinese nationals, who are transferring their funds into cryptocurrencies. So, the digital market is benefiting from this new safe haven status, and as we will explain below, Ethereum is likely to keep this status, as the DeFi transactions keep soaring.

Surging DeFi Transactions Are Great for Ethereum

The increasing uncertainty for investors, or anyone who has spare cash for that matter, has led to a higher demand for cryptocurrencies, which in turn has increased the use of the decentralized finance (DeFi) system. Global politics are trying to make it difficult for cryptocurrencies, with China banning Bitcoin mining for environmental purposes presumably, but the decentralized finance market is growing at enormous sped nonetheless. In fact, the DeFi transactions have absolutely surged during this time. In January this year, the total value locked (TVL) in DeFi exceeded $ 78 billion for the first time ever by August. This means that there is more than $78 billion worth of capital deployed in various DeFi protocols in the system. This surge is due to the fact that DeFi is not subject to central banks and other intermediary institutions.

This is great for Ethereum, since a large part of the DeFi system is built on the Ethereum network. Therefore the faster DeFi transactions grow, the more Ethereum benefits. So, the fast growth of the Ethereum ecosystem in the last year is mainly a result of growing DeFi. In the middle of last year, the total value locked in DeFi transactions was heading for $ 1 billion. Now the value has increased around 20 times, and this is expected to continue in the future, as the investor demand for cryptocurrencies increases, attracting both miners and speculators into the game.

The volumes for Ethereum futures keep making record highs

The monthly volumes for Ethereum have also surged since the middle of 2020, and the pace is picking up further. The volume for Ethereum futures reached $ 257.06 billion in December last year, while in May they exceeded $700 billion. That means a 4.4% increase compared to the previous month. The spot volume on cryptocurrency exchanges also reached a record high in December, at $ 379 billion. All this data means that the Ethereum network will continue to grow, benefiting the cryptocurrency further. This also acts as a cushion in case of a crash in the crypto market. In that case, Ethereum would lose considerable value, but it would still remain well above the pre-coronavirus trading levels. Not that this will happen any time soon, but we should just take it into consideration.

Ethereum 2.0 and Other Upgrades

The Ethereum network is based on decentralized finance, and DeFi is known as “Lego Money”. DeFi orders can be separated into individual parts, which can then be placed together again to create a different batch of orders. The smart contracts, decentralized applications (DApps) and protocols are mostly run on the decentralized Ethereum network.

But as the DeFi volumes increase, the Layer 1 blockchain networks become less reliable for such a high volume of transactions. These transactions declined from a record of $162.02 billion in volume with Uniswap v3 going live that month, to $80.85 billion in June 2021 and $56.47 billion in July, but that’s still enormously high and with the reversal in August, these DeFi transactions will pick up again. The Layer 1 blockchain capacity for processing transactions is quite limited, which means that the number of transactions per second (TPS) is limited. This is expected to be solved with the introduction of Ethereum 2.0, which was introduced on December 1, but it hasn’t gone fully operational yet. According to Vitalik Buterin, it should be implemented completely at some point in 2021.

The expectations for Ethereum 2.0 were that it would become a reliable super-fast version of the previous Ethereum blockchain version, which it is living up to, so far. The transition to the Power of Stake (PoS) consensus algorithm and sharding of the Layer 2 payment channels are enabling this. The Layer 2 payment channels are built on top of these existing blockchains. It increases the speed of transactions considerably, which means that the Layer 2 transactions will be more suitable for small everyday retail transactions.

Aave (AAVE) 2022-2024 Price Prediction: Rising Popularity of DeFi Driving the Bullish Trend

Bitcoin (BTC) Price Prediction For 2022: BTC/USD Targeting $100,000

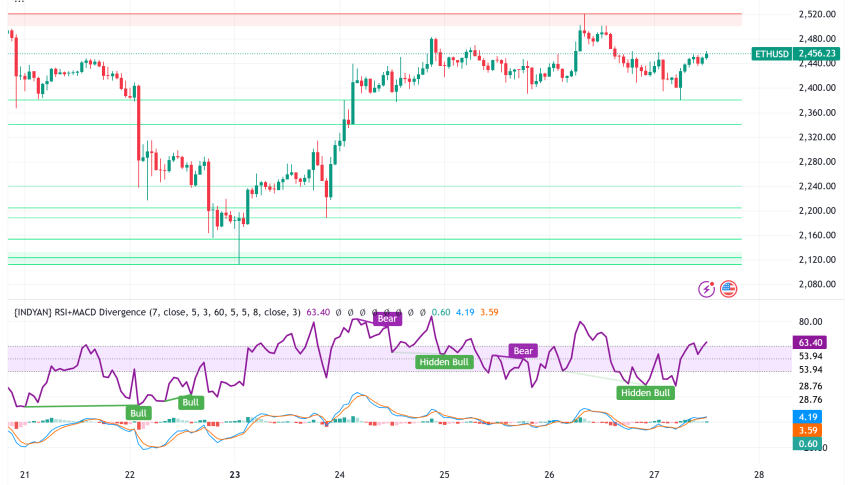

Ethereum Technical Analysis

Ethereum started at around $ 10 and it traded around that level from 2015 until early 2017, when it started its bullish move, increasing to above $ 400 by June that year. That means a 4,000% increase in value. That was the first sign that this cryptocurrency would be a market favourite, and that buyers would take charge. After trading between $ 200 and $ 400 for several months, the extraordinary demand for cryptocurrencies came, and Ethereum surged higher, getting pretty close to $ 1,500 by January the following year. But that wasn’t to last, and the big bullish move was followed by a big bearish reversal in 2018, which took the price down to the 20 SMA (gray) on the monthly chart, where it bounced gain, although the bounce didn’t last too long. The bearish trend resumed again, pushing the price below that moving average, which turned into resistance, and it remained there until August last year. The decline continued, with the ETH/USD dropping just below $ 100, but that wasn’t a proper break, and it pulled up above that level again. Then, Ethereum traded sideways until October 2020, when the breakout finally happened, which was followed by many big bullish candlesticks until the middle of May, when the price formed a doji, followed by a pullback in June. But, now Ethereum has turned bullish once again.

The massive doji candlestick in May, indicated a bearish reversal

On the weekly time-frame chart, the area around the $ 100 level turned into support for Ethereum, and this lasted for nearly 2 years, while the area around $ 400 provided resistance, keeping the price within a range until summer 2020. Ethereum moved above the 200 SMA last summer, as the demand for cryptos increased, and then this moving average turned into support. After a slight retrace during August and September last year, despite PayPal adopting Ethereum back then as one of the cryptos for transactions on its site, the 20 SMA caught up on the weekly chart and started pushing Ethereum higher. Eventually, the bullish momentum picked up pace and Ethereum ended up at $4,380 before retreating down in the second half of May 2021. Although, the support area above $1,700 held on three attempts. Now the 20 SMA (gray) has been broken and the price has moved above the range on the weekly chart, trading comfortably above $3,000.

The zone above $1,7000 was a great buying area

On the daily time-frame, the bullish trend from October until mid-May is also quite visible. The price retreated during the crypto crash, but the 100 SMA (green) held as support on the daily chart, until June. We saw several attempts to resume the bullish trend as the price bounced off the 100 SMA, but the 50 SMA (yellow) acted as resistance at the top, so Ethereum took another dive in June. Although, the 200 SMA (purple) took over as support on this chart. The low at $1,700 proved to be too strong of a support zone, reversing the price three times and eventually, sellers gave up. Now the top of the range has been broken, leaving Ethereum in the middle of a strong bullish momentum, with the 20 SMA (gray) having turned from resistance into support, confirming the bullish trend.

The 50 SMA has turned into support again for Ethereum mon the daily chart