The 4 Best Forex Brokers in Azerbaijan – Rated and Reviewed. We have reviewed the top 4 Forex Brokers offering Islamic, Swap Free, and Standard Accounts to Azerbaijani Traders.

In this in-depth article you will learn:

- The Best Forex Brokers in Azerbaijan – a List

- Forex Trading in Azerbaijan – Legit and Legal?

- Pasha Capital Login – How to Open an Account

- How to Buy and Sell Stocks in Azerbaijan

- Best Online Broker in Azerbaijan for Beginners

and much, MUCH more!

4 Best Forex Brokers in Azerbaijan – a Comparison

4 Best Forex Brokers in Azerbaijan (2024)

- ☑️ XTB – Overall, the Best Forex Broker in Azerbaijan

- ☑️ PASHA Capital – Azerbaijan-Based Forex Broker

- ☑️ Admirals – Best Forex Broker for Beginners in Azerbaijan

- ☑️ Tickmill – Fast and user-friendly Islamic Account Registration

XTB

Recognized as a leading exchange-listed Forex and CFD broker, XTB provides access to hundreds of global markets. XTB offers three different account types; Standard, Pro, and Islamic. All accounts are partnered with the proprietary xStation 5 Trading Platform. No Minimum Deposit is required.

Islamic Account

The XTB Islamic Account is Sharia Compliant and offers the following notable features:

- 1,500 markets including FX, Crypto, Indices, Commodities & ETFs

- Leverage up to 200:1

- Fast, reliable execution

- xStation and MetaTrader 4 Trading Platforms

The account is free of special fees, interests, and, daily swaps.

Pros and Cons

Our Insights

From our perspective, XTB is an excellent broker choice for Beginner and Professional Traders. The registration process is quick and easy. Additionally, the Customer Support is unmatched.

PASHA Capital

As an Azerbaijan-based Forex Broker, PASHA Capital’s services include brokerage, margin trading, underwriting, and financial advisory. Account Types on offer include Classic and Individual with a minimum deposit of 200 USD / 340 AZN.

The PASHA Capital proprietary trading platform is available across desktop, web, and, mobile.

Islamic Account

With PASHA Capital listed as a local broker, an Islamic Account is expected. No mention is made.

Pros and Cons

Our Insights

PASHA Capital claims to be a well-established Azerbaijan-based Forex Broker with ties to Raiffeisen Bank and PASHA Holdings. However, we have found the broker questionable with no valid regulation.

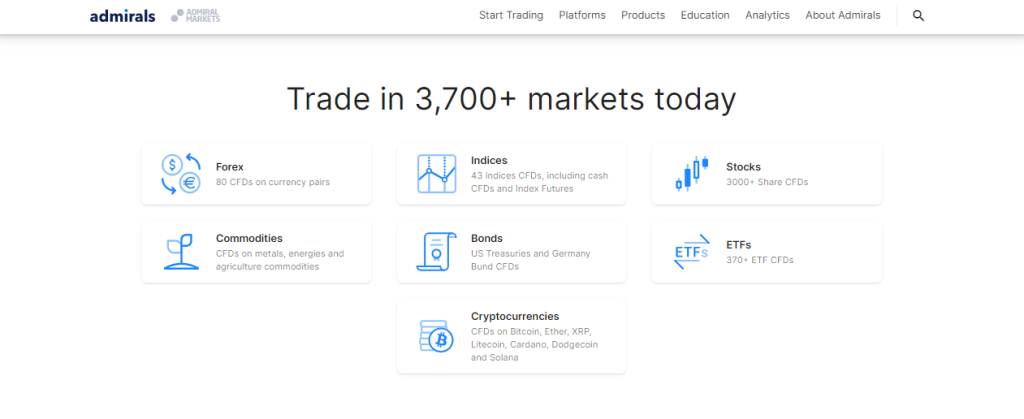

Admirals

Admiral Markets, or Admirals, is an FSCA-regulated and authorized Forex Broker with a global presence. Admirals offers access to 5 Live Account Types, including an Islamic Option. The minimum deposit required is 25 USD

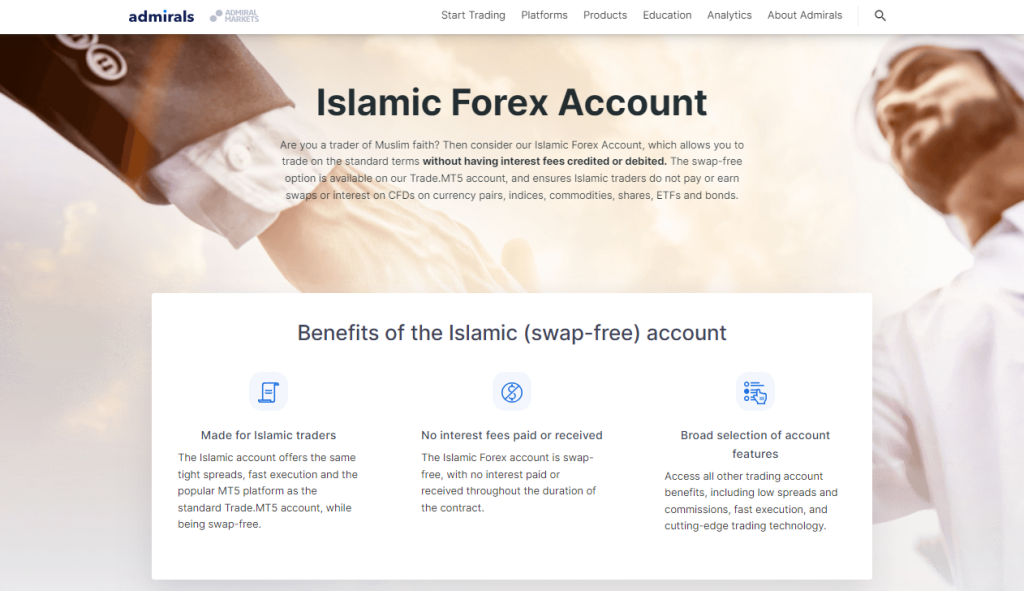

Islamic Account

The Admirals Islamic, Swap-Free option is available on the Trade.MT5 account and partnered with the MetaTrader 5 platform. Notable features include:

- No interest/swap adjustments on overnight positions

- No spread widening

- No specific up-front commissions

- No restrictions on trading styles or strategies

The Swap-Free option has the same trading conditions as the standard trading accounts.

Pros and Cons

Our Insights

Admiral Markets, or Admirals, provides attractive trading conditions and low fees. From our perspective, Admirals suits beginners best, offering multiple account types and educational resources.

Tickmill

By providing premium trading products and services, Tickmill has established itself as a trusted market leader. Tickmill offers three account types: Classic, Raw, and Islamic, requiring a minimum deposit of 100 USD / 170 AZN. Additionally, Tickmill makes a 30 USD Welcome Bonus available.

Islamic Account

The Tickmill Islamic, Swap-Free account has no swap or rollover interest on overnight positions. The Swap-Free Option is available on the Classic and Raw Spread accounts. The minimum deposit required is 100 USD / 170 AZN.

Pros and Cons

Our Insights

We recommend Tickmill to any level of trader due to its low forex fees, bonus offers, and comprehensive educational resources.

Is Forex Trading Legal in Azerbaijan?

Forex Trading is Legal in Azerbaijan and there are no current restrictions on selling, buying, and exchanging foreign currency in the foreign exchange market.

In Conclusion

Forex Trading in Azerbaijan has notably increased in popularity, as International Brokers now accept clients from this region. When selecting a Forex Broker, traders should compare regulations, fees, platforms, and all the pros and cons.

Our Insights

From our perspective, Forex Trading in Azerbaijan should be approached by using a highly regulated Forex Broker. No specific laws or regulations govern forex trading in the country, and safety/security should be key.

You might also like: