10 Best FSCA Regulated Forex Brokers

The 10 Best FSCA Regulated Forex Brokers of 2025 – Rigorously Tested, Expertly Reviewed, and Trusted by Millions of Traders in South Africa and across the globe.

Top 10 FSCA Regulated Brokers – a Head-to-Head Comparison

10 Best FSCA Regulated Forex Brokers (2025)

- HFM – Overall, The Best FSCA Regulated Forex Broker in South Africa

- IFX Brokers – Known for its MT4 and MT5 Platforms

- Octa – FSCA Registration and Local South African Presence

- AvaTrade – High Trust Score amongst South African Traders

- Exness – No Overnight Fees, and a Variety of Account Types

- JustMarkets – No-Commission Copy Trading Options

- BDSwiss – Competitive Triple Zero account

- FXTM – Robust Research Materials and Trading Signals

- FP Markets – Competitive Pricing with Low-Latency Execution

- OANDA – One-Click Trading, and Multiple-Asset Product Suites

Top 10 Forex Brokers (Globally)

1. HFM

HFM holds a regulation from several authorities, including South Africa’s Financial Sector Conduct Authority (FSCA) under license number 46632, ensuring it complies with local financial laws and offers protection for South African traders.

Frequently Asked Questions

What is the minimum deposit at HFM?

HFM sets different minimum deposits based on the account type. Accounts like the Cent and Zero Account require no minimum deposit, while others, such as the Pro Account, start at $100, and the Pro Plus may require $250.

What trading platforms does HFM offer?

HFM offers the widely used MetaTrader 4 and MetaTrader 5 platforms across desktop, web, and mobile. They also provide their own HFM Platform, built into their mobile app, to deliver a seamless and intuitive trading experience.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA Regulated | No Local Offices in SA |

| Low Minimum Deposit | Inactivity Fees Apply |

| Multiple Account Types | Commission on Zero Account |

| High Leverage | Leverage Can Be Risky |

| MetaTrader 4 & 5 | Limited Product Range |

| South African ZAR Accounts | No Crypto Deposits |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a well-regulated forex and CFD broker offering flexible account types, competitive spreads, and strong platform support. With FSCA regulation and local ZAR accounts, it’s a solid choice for South African and global traders alike.

2. IFX Brokers

IFX Brokers, based in South Africa, offers a range of trading instruments, including currencies, indices, commodities, and cryptocurrencies. The broker provides local customer support, ZAR accounts, and competitive trading conditions.

Frequently Asked Questions

Where is IFX Brokers based?

IFX Brokers’ headquarters stand in Jeffreys Bay, Eastern Cape, South Africa. The Financial Sector Conduct Authority (FSCA) in South Africa regulates them, reflecting their strong roots and primary base of operations within the country while serving an international client base.

Is IFX Brokers suitable for beginners?

Yes, IFX Brokers is generally considered suitable for beginners. They offer a low minimum deposit (from $10 for Standard or Cent Account for new clients), user-friendly MT4/MT5 platforms, and a free demo account for practice.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA Regulated | No International Regulation |

| Local Broker | Limited Platform Choice |

| Low Minimum Deposit | Limited Education Tools |

| Islamic Accounts Available | No Stock CFDs |

| Wide Range of Instruments | Inactivity Fees May Apply |

Final Score

| # | Criteria | IFX Brokers |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

The FSCA regulates IFX Brokers, a reliable South African broker that offers low minimum deposits, ZAR accounts, and competitive spreads. Ideal for local traders seeking MetaTrader 4/5 access and flexible Islamic account options with strong local support.

3. Octa

Octa is a global trading platform founded in 2011, serving clients in 180 countries. With over 42 million accounts and 277 instruments, it offers commission-free access to CFDs and supports traders with free educational tools and expert market analysis.

Frequently Asked Questions

Which trading instruments are available on Octa?

Octa grants access to 277 instruments, including CFDs on equities, major and minor forex pairs, precious metals, energy products, global indices, and a range of cryptocurrencies.

Does Octa charge commissions or conceal any fees?

Trading on Octa is commission-free, so you won’t incur per-trade charges. Do note, however, that spreads apply and overnight financing (swap) fees may be charged on positions held past market close.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Octa has multi-currency support across deposit methods | There are withdrawal restrictions on the deposit bonus |

| Deposits with Octa do not incur internal fees | There are limited deposit methods compared to other brokers |

| There is an attractive 50% deposit bonus | There are geographic restrictions on deposit methods |

| Octa keeps all client funds in segregated accounts | Currency conversion fees might apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa is a dependable, user-friendly broker offering tight spreads, diverse instruments, and account types for all skill levels. With responsive support, fast withdrawals, and zero deposit or withdrawal fees, it provides a smooth and cost-effective trading experience.

Top 3 FSCA Regulated Forex Brokers – HFM vs IFX Brokers vs Octa

Note: The Top 3 FSCA Regulated Forex Brokers are ranked based on a combination of User Trust Scores and verified Customer Reviews.

4. AvaTrade

AvaTrade, founded in 2006, is a heavily regulated global broker with FSCA oversight. It offers a wide selection of platforms and instruments, with a $100 minimum deposit and fixed spreads from 0.9 pips. Swap-free Islamic accounts and negative balance protection provide added security for global and South African traders.

Frequently Asked Questions

Does AvaTrade offer negative balance protection?

Yes, AvaTrade generally offers negative balance protection for its retail clients. This means your losses cannot exceed the funds in your trading account, preventing you from falling into debt with the broker.

Does AvaTrade offer Islamic accounts?

Yes, AvaTrade offers Islamic accounts for Muslim clients. These accounts are designed to comply with Sharia law by eliminating overnight interest (swap) fees. While regular overnight fees are removed, Islamic accounts may incur wider spreads or daily administration fees.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated Globally | Fixed Spreads Only |

| Low Minimum Deposit | No ECN/STP Accounts |

| Fixed Spreads | Inactivity Fee |

| Wide Range of Platforms | Limited Customization |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade operates as a globally regulated broker, including FSCA oversight in South Africa, providing fixed spreads, a wide range of trading platforms, and strong client protection. It’s ideal for beginner to intermediate traders seeking a secure and user-friendly trading environment.

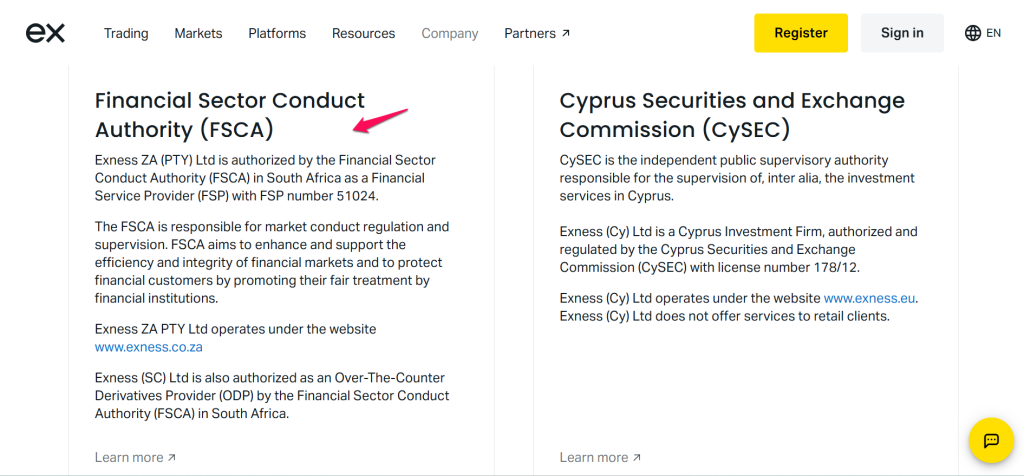

5. Exness

Exness, established in 2008, is a globally regulated broker, including FSCA oversight in South Africa. It offers low minimum deposits, a wide range of account types, competitive spreads, and fast execution speeds, making it suitable for both retail and professional traders.

Frequently Asked Questions

What trading platforms does Exness support?

Exness offers a variety of trading platforms, primarily supporting MetaTrader 4 and MetaTrader 5, both as desktop, web, and mobile versions. They also provide their proprietary Exness Trade mobile app for convenient on-the-go trading and the web-based Exness Terminal.

Does Exness offer Islamic accounts?

Yes, Exness offers Islamic accounts for Muslim clients, designed to comply with Sharia law. For residents of designated Islamic countries, accounts are automatically assigned swap-free status. Other clients can request it, though Exness analyzes trading behavior to ensure compliance with swap-free rules.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA Regulated | No Bonuses or Promotions |

| Low Minimum Deposit | Limited Educational Resources |

| Tight Spreads | Not ECN/STP |

| High Leverage | Leverage Restrictions in Some Regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness operates as a globally trusted broker under FSCA regulation in South Africa, providing low minimum deposits, tight spreads, and fast execution. With multiple account types and platforms, it suits both beginner and experienced traders seeking a flexible trading environment.

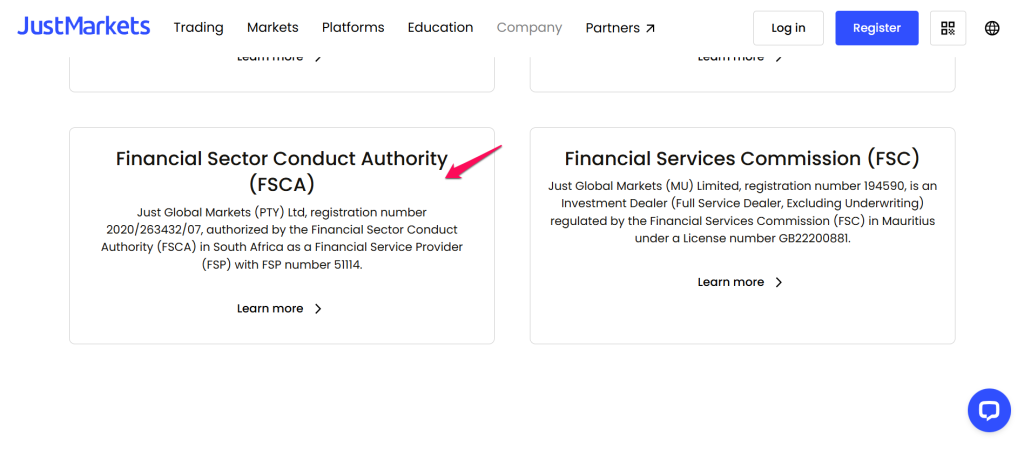

6. JustMarkets

JustMarkets, founded in 2012 and regulated by the FSCA (FSP 51114) along with CySEC, Seychelles, and Mauritius regulators, offers diverse account types starting from $10, ultra-tight spreads (down to zero pips), high leverage up to 1:3000, MT4/MT5 support, plus proprietary apps, and fast execution suited for a range of traders.

Frequently Asked Questions

Is JustMarkets a trusted broker?

Yes, JustMarkets is considered a trusted broker. It holds multiple regulations from various authorities, including CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and FSC (Mauritius). They also emphasize client fund segregation, negative balance protection, and advanced security measures.

What trading platforms does JustMarkets offer?

JustMarkets primarily offers the widely popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, available for desktop, web, and mobile. They also provide their proprietary JustMarkets Trading App for a streamlined mobile experience, integrating account management and trading features.

Pros and Cons

| ✓ Pros | ✕ Cons |

| FSCA Regulated | No Fixed Spread Accounts |

| Low Minimum Deposit | Limited Education Materials |

| Tight Spreads | Not Available in All Countries |

| MT4 & MT5 Support | Pro/Razor Accounts Require Higher Deposits |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

JustMarkets is a multi-regulated broker, including FSCA oversight, offering low deposit options, tight spreads, high leverage, and fast execution. It caters to both beginners and experienced traders with flexible account types, MT4/MT5 platforms, and Islamic account availability.

7. BDSwiss

BDSwiss is authorized and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa under license number 49479. Additionally, BDSwiss holds licenses from the Financial Services Commission (FSC) in Mauritius and the Financial Services Authority (FSA) in Seychelles.

Frequently Asked Questions

What trading platforms does BDSwiss offer?

BDSwiss offers multiple trading platforms to suit diverse needs. These include the popular MetaTrader 4 and MetaTrader 5, available across desktop, web, and mobile. They also provide their proprietary BDSwiss WebTrader and the BDSwiss Mobile App.

What leverage does BDSwiss offer?

BDSwiss offers varying leverage depending on the entity and account type. Generally, they provide dynamic leverage up to 1:2000 for certain instruments like major forex pairs. However, for clients under stricter regulations, leverage is capped at 30:1 for retail accounts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple authorities | Limited product range |

| Competitive spreads | Higher minimum deposit |

| MT4, MT5, and WebTrader | No US clients allowed |

| High leverage | Inactivity fees |

| Wide range of account types | Customer support can sometimes be slow |

Final Score

| # | Criteria | BDSwiss |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

BDSwiss is a well-regulated broker offering competitive spreads, fast execution, and access to popular trading platforms like MT4 and MT5. It suits both beginners and experienced traders, though its product range and education tools are somewhat limited.

8. FXTM

FXTM is a globally recognized forex and CFD broker founded in 2011, serving over 2 million clients worldwide. It is regulated by several authorities, including the FSCA in South Africa (FSP 46614), as well as CySEC, FCA, CMA, and the FSC in Mauritius.

Frequently Asked Questions

What trading platforms does FXTM offer?

FXTM primarily supports the globally popular MetaTrader 4 and MetaTrader 5 platforms. These are available as desktop applications (for PC and Mac), web-based versions (WebTrader), and mobile apps (for iOS and Android), offering flexibility for traders to access markets anywhere.

Can I open a demo account?

Yes, FXTM offers a free demo account with virtual funds. It provides a realistic trading experience using MetaTrader platforms, allowing you to practice strategies and familiarize yourself with market conditions without any financial risk.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple authorities | Limited range of cryptocurrencies |

| Low minimum deposit | No proprietary desktop trading platform |

| Leverage up to 1:2000 | Inactivity fees |

| Fast order execution | Customer support may not be 24/7 in all languages |

| Islamic (swap-free) accounts available | No US clients accepted |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FXTM is a well-regulated broker offering low minimum deposits, fast execution, and flexible account options, including ECN and Islamic accounts. It suits both beginners and experienced traders, though some features and fees vary by region and account type.

9. FP Markets

FP Markets is a globally recognized forex and CFD broker regulated by multiple authorities, including the FSCA in South Africa (FSP 50926), ASIC in Australia, and CySEC in Cyprus.

Frequently Asked Questions

Is FP Markets FSCA regulated?

Yes, FP Markets (Pty) Ltd is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa with FSP Number 50926. This means they adhere to local regulations, offering segregated client funds and negative balance protection for South African traders.

What trading platforms are offered?

FP Markets offers a selection of trading platforms, including MetaTrader 4 and MetaTrader 5, available across desktop, web, and mobile. They support cTrader for advanced order types and Level II pricing, and the IRESS platform for DMA.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by top-tier authorities | Offshore regulation |

| Competitive spreads | Iress platform is only available for Australian clients |

| Multiple platforms | Higher Minimum Deposit |

| High leverage | Limited educational content |

| Demo account available | Limited bonus/promotional offerings |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FP Markets is a well-regulated broker offering competitive spreads, fast execution, and access to multiple trading platforms. It suits both beginner and advanced traders, though some features, like Iress and certain instruments, may vary by region.

10. OANDA

OANDA’s FSCA regulation ensures South African traders benefit from local oversight and client fund protection, while its global licenses provide strong transparency, security, and compliance standards for all clients.

Frequently Asked Questions

What trading platforms does OANDA offer?

OANDA offers its proprietary OANDA Trade platform (web and mobile), known for its intuitive design and advanced charting. They also support the popular MetaTrader 4 (MT4) and, in some regions, MetaTrader 5 (MT5). Additionally, OANDA integrates with TradingView.

Does OANDA offer demo accounts?

Yes, OANDA offers demo accounts with virtual funds. These accounts mirror live trading conditions, allowing you to practice strategies and familiarize yourself with their OANDA Trade platform (MT4), and in some regions, MT5. Demo accounts typically expire after 180 days.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by multiple top-tier authorities | Limited product range |

| No minimum deposit | No cryptocurrencies trading |

| Competitive spreads | Limited promotions and bonuses |

| Fast execution speeds | Customer support can be slow during peak times |

| Free demo accounts | Platform may be complex for beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is a highly-regulated, well-established global broker with over 25 years of experience, making it a trusted choice. It excels with competitive spreads, diverse platforms (OANDA Trade, MT4, TradingView integration), and strong research, catering to both new and experienced traders, primarily in forex.

What is an FSCA-Regulated Broker?

An FSCA-regulated broker is authorized by South Africa’s Financial Sector Conduct Authority to offer financial services. This ensures the broker follows strict rules for client protection, fair trading, transparency, and financial stability within the South African market.

Criteria For Choosing an FSCA Regulated Forex Broker

| Criteria | Description | Importance |

| FSCA License Verification | Ensure the broker is officially registered with the FSCA and listed on its website. | ⭐⭐⭐⭐⭐ |

| Segregated Client Funds | Broker should keep client funds separate from company funds to protect traders. | ⭐⭐⭐⭐⭐ |

| Trading Costs (Spreads & Commissions) | Check spreads and commissions to ensure cost-effective trading. | ⭐⭐⭐⭐☆ |

| Execution Speed | Faster execution helps avoid slippage and improves trading accuracy. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Look for reliable platforms like MT4 or MT5 with full functionality. | ⭐⭐⭐⭐☆ |

| Customer Support | Access to helpful, fast, and local support, ideally in your language. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Methods | Brokers should offer fast, secure, and local friendly funding options. | ⭐⭐⭐⭐☆ |

| Account Types Available | Variety of accounts (e.g., Islamic, Pro) to suit different trading needs. | ⭐⭐⭐⭐☆ |

| Educational Resources | Useful for beginners to learn trading strategies and platform use. | ⭐⭐⭐☆☆ |

| Reputation & Reviews | Check trader feedback and reviews from trusted sources. | ⭐⭐⭐⭐☆ |

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From account types and fees to trading platforms and execution, we provide straightforward answers to help you understand the FSCA Regulation and choose the right broker confidently.

Q: How can I check if a forex broker is licensed by the FSCA? – Thabo

A: You can verify a broker’s FSCA license by visiting the official FSCA website (www.fsca.co.za), navigating to the “Financial Service Providers” search, and entering the broker’s FSP number or name. If the broker doesn’t appear there, it is not regulated by the FSCA.

Q: Do FSCA-regulated brokers offer Islamic accounts with no swap fees? – Mohammed

A: Yes, many FSCA-regulated brokers offer Islamic (swap-free) accounts tailored for traders who follow Shariah principles. Request it during registration and confirm that the broker does not charge hidden fees in place of swaps.

Q: Can I fund my FSCA-regulated forex account using local banks or mobile money? – Zanele

A: Most FSCA-regulated brokers provide local deposit options such as EFT (Electronic Funds Transfer), Ozow, and bank cards. Some also support mobile payment gateways like SnapScan or PayFast. Always check the broker’s payment section for local methods.

Q: What kind of trader protections does the FSCA provide compared to the FCA or CySEC? – Luis

A: The FSCA enforces strict rules on broker conduct, including segregation of client funds, risk disclosure, and fair marketing. However, unlike the FCA or CySEC, the FSCA does not provide a compensation scheme, so traders rely solely on regulatory oversight for protection.

Q: Is the FSCA regulation strong enough to trust a broker for long-term trading? – Rajesh

A: Yes, FSCA is a credible regulator, especially in Africa. It monitors financial conduct, enforces licensing, and investigates misconduct. While it may not have the global reputation of FCA or ASIC, it’s still a reliable authority, especially when paired with other licenses.

In Conclusion

FSCA-regulated forex brokers give South African traders a safer trading environment by providing strong local oversight, investor protection, and transparent practices. When traders choose an FSCA-licensed broker, they ensure compliance with national laws and reduce the risk of fraud or misconduct.

You Might also Like:

- HFM Review

- IFX Brokers Review

- XM Review

- AvaTrade Review

- Exness Review

- JustMarkets Review

- BDSwiss Review

- FXTM Review

- FP Markets Review

- OANDA Review

- Tickmill Review

Faq

FSCA-regulated brokers typically offer moderate leverage limits to help manage trading risks. While they may not allow extremely high leverage like offshore brokers, the limits are designed to protect retail traders from excessive losses.

Yes, many FSCA-regulated brokers accept international clients. However, availability may depend on local laws in your country, so it’s important to check if the broker serves your region.

You’ll typically need to submit a valid ID or passport, proof of address (like a utility bill or bank statement), and sometimes a source-of-funds declaration. These steps are required for identity verification and anti-money laundering compliance.

Yes, many FSCA-regulated brokers offer accounts denominated in South African Rand (ZAR), allowing local traders to avoid currency conversion fees and manage funds more conveniently.

You can file a complaint directly with the FSCA by completing their online complaints form or emailing them. Include all relevant documents and broker communication to support your case.