6 Best Forex Brokers in Switzerland

The 6 Best Forex Brokers in Switzerland – Rated and Reviewed. We have listed the Top Forex Brokers accepting traders in Switzerland.

In this in-depth guide, you will learn:

- The Best Forex Brokers in Switzerland – a List

- Top MT4/MT5 Forex Brokers in Europe

- Swiss Forex Trading Apps for Beginners

- Is Forex Trading Legal in Switzerland?

- Which Brokers do Swedish Traders follow on Instagram?

and much, MUCH more!

6 Best Forex Brokers in Switzerland – A Comparison

| 🔎 Broker | 🚀Open an Account | 🤝 Accepts Swiss Traders | 💶 Min. Deposit (CHF) |

| 🥇 Saxo Bank | 👉 Click Here | ✅Yes | None |

| 🥈 IC Markets | 👉 Click Here | ✅Yes | 181,39 |

| 🥉 Moneta Markets | 👉 Click Here | ✅Yes | 45,35 |

| 🏅 Pepperstone | 👉 Click Here | ✅Yes | 119,40 |

| 🎖️ CMC Markets | 👉 Click Here | ✅Yes | None |

| 🥇 Tickmill | 👉 Click Here | ✅Yes | 90,70 |

6 Best Forex Brokers in Switzerland (2024)

- ☑️ Saxo Bank – Overall, the Best Forex Broker in Switzerland

- ☑️ IC Markets – Top Forex Broker followed on Instagram

- ☑️ Moneta Markets – Best MT4/MT5 Forex Broker

- ☑️ Pepperstone – Popular Forex Broker for Active Traders

- ☑️ CMC Markets – Best Overall Offering

- ☑️ Tickmill – Best Mobile Trading Experience

Saxo Bank

Saxo Bank is a highly regulated Danish investment bank that specializes in Online Forex Trading and Investments. Moreover, Saxo Bank (Switzerland) Ltd. is regulated by the Swiss Financial Market Supervisory Authority FINMA. The Classic, Platinum, and, VIP accounts are integrated with the SaxoTraderGO and SaxoTraderPRO trading platforms.

The following trading instruments and products are available:

- 185 Forex spot pairs and 140 futures

- over 8,800 instruments

- approximately 23,500 equities

- Various commodities

- 250 futures contracts

- 45 FX vanilla options

- Over 3,200 listed options

Furthermore, more than 7,000 exchange-traded funds from over 30 exchanges are available.

| 🔎 Broker | 🥇 Saxo Bank |

| 📌 Year Founded | 1992 |

| 👤 Amount of staff | Approximately 2,000 |

| 👥 Amount of active traders | Over 800,000 |

| 📍 Publicly Traded | ✅Yes |

| ⭐ Regulation and Security | Very High |

| 🛡️ Regulation | FSA FCA |

| 📈 Account Segregation | ✅Yes |

| 📉 Negative balance protection | ✅Yes |

| 📊 Investor Protection Schemes | ✅Yes |

| 💹 Account Types and Features | SaxoTraderGO, SaxoTraderPRO |

| 🅰️ Institutional Accounts | Available |

| 🅱️ Managed Accounts | Available |

| 💴 Minor account currencies | ✅Yes |

| 💶 Minimum Deposit | Varies by account type and region |

| ⏰ Avg. deposit processing time | Typically 1-2 business days |

| ⏱️ Avg. Withdrawal processing time | Typically 1-2 business days |

| 💵 Fund Withdrawal Fee | No standard fee, may vary depending on method |

| 💷 Spreads from | 0.4 pips (varies by instrument and market conditions) |

| 💳 Commissions | Variable, depending on account type and trading volume |

| 💸 Number of base currencies | Over 40 |

| 💲 Swap Fees | Varies depending on account type and instrument |

| ▶️ Leverage | Up to 1:200 (varies by asset class and jurisdiction) |

| ⏹️ Margin requirements | Varies by asset class |

| ☪️ Islamic account | Available |

| 🆓 Demo Account | ✅Yes |

| ⌚ Order Execution Time | Typically milliseconds to seconds |

| 🖥️ VPS Hosting | Available |

| 📊 CFDs Total Offered | Thousands |

| 📉 CFD Stock Indices | ✅Yes |

| 🍎 CFD Commodities | ✅Yes |

| 📈 CFD Shares | ✅Yes |

| 💴 Deposit Options | Bank transfer, credit/debit cards, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit cards, e-wallets |

| 💻 Trading Platforms | SaxoTraderGO, SaxoTraderPRO |

| 🖱️ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex trading tools | Advanced charting, research tools, trading signals |

| 🥰 Customer Support | Very Responsive |

| 🗯️ Live chat | ✅Yes |

| 💌 Support Email | Varies by Region |

| ☎️ Support Contact | Varies by Region |

| 🐦 Social media | Facebook, Twitter, |

| 🔖 Languages | Multiple languages including English, Danish, German, etc. |

| 🏷️ Forex course | ✅Yes |

| ✏️ Webinars | ✅Yes |

| 📔 Educational Resources | Yes (includes articles, videos, and courses) |

| 🫰🏻 Affiliate program | ✅Yes |

| 🫶 Amount of partners | Numerous |

| 🤝 IB Program | ✅Yes |

| 🌟 Sponsor notable events/teams | Various |

| 💰 Rebate program | ✅Yes |

| 😊 Suited to Beginners | ✅Yes |

| 😎 Suited to Professionals | ✅Yes |

| ♒ Suited to Active Traders | ✅Yes |

| 💡 Suited to Scalpers | ✅Yes |

| 🌞 Suited to Day Traders | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Instructional resources | High Fees when Compared |

| Multiple Trading Platforms | Futures and options - complicated cost structures |

Our Insights

The Benefits of Trading with Saxo include Excellent Educational Materials and dedicated Customer Support.

IC Markets

IC Markets is a renowned Forex and CFD Provider best suited to Active day traders and Scalpers. ASIC, CySEC, FSA, and, the SCB regulate it. Furthermore, additional safety measures include Negative Balance Protection, the Segregation of Client Funds, and, an insurance policy.

Accounts offered are cTrader, Raw Spread, Standard, and, Demo. In addition, The minimum deposit is 200 USD. Moreover, trusted trading platforms include MetaTrader 4, MetaTrader 5, cTrader, IC Social, Signal Start, and, ZuluTrade.The following trading instruments and products are available:

- 64 currency pairings for trading

- 22 commodities

- 25 indices

- 11 distinct bond instruments

- 18 cryptocurrency alternatives

- 1,600 stocks

Moreover, four futures contracts are available. In addition, deposit and withdrawal Options include Bank Wire Transfer, Skrill, and, Neteller.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Ultra-tight spreads from 0.0 pips | Regulated only by FSA (Seychelles) |

| Supports MT4, MT5, cTrader, TradingView | No cent accounts |

| Leverage up to 1:1000 | Overnight holding fee on Islamic accounts |

| No deposit or inactivity fees | Some features/platforms may be complex for beginners |

| Broad asset selection & copy trading options | Limited stock CFD offering compared to equity brokers |

Our Insights

The benefits of trading with IC MArkets include a multi-lingual website, spreads from 0.0 Pips, and a leverage of up to 1:500.

Moneta Markets

Moneta Markets is a trusted Forex Broker with a Global reach. The FSCA, FSA Seychelles, CIMA, and, ASIC regulate it. Moreover, additional security measures include SSL encryption, two-factor authentication (2FA), and, Client fund segregation.

Account types offered are Direct STP, Prime ECN, and, Ultra ECN. Base currencies include AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, and, HKD – with a minimum deposit of 50 USD. Additionally, Spreads start from 0.0 Pips, with a leverage of up to 1:1000.

Trading Platforms available are PRO Trader, App Trader, MetaTrader 4, MetaTrader 5, and CopyTrader. The following trading instruments and products are available:

- 44 FX pairs

- 19 commodities including hard and soft commodities

- 16 indexes

- Over 700 Share CFDs are accessible

- Over 50 ETFs

Moreover, 30 Crypto CFDs are available.

| 🔎 Broker | 🥇 Moneta Markets |

| 📈 Established Year | 2019 |

| 📉 Regulation and Licenses | FSCA, FSA Seychelles, CIMA, ASIC |

| 📊 Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅Yes |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | PRO Trader, App Trader, MetaTrader 4, MetaTrader 5, CopyTrader App |

| 📌 Account Types | Direct STP, Prime ECN, Ultra ECN |

| 💴 Base Currencies | AUD, USD, GBP, EUR, SGD, CAD, NZD, JPY, HKD, BRL |

| 📍 Spreads | From 0.0 pips |

| 💹 Leverage | 1:1000 |

| 💵 Currency Pairs | 44; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 50 USD |

| 💷 Inactivity Fee | None |

| 🔊 Website Languages | English, French, German, Spanish, Vietnamese, Thai, Russian, Arabic, Portuguese, Chinese, etc. |

| 🪙 Fees and Commissions | Spreads from 0.0 pips, commissions from $6 round turn |

| 🤝 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States, Canada, Hong Kong |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, indices, shares, ETFs, bonds, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| 1,000+ tradable assets, including forex | Some account types may have volume constraints |

| Multilingual support | Limited Education |

| Tight Spreads | No Negative Balance Protection |

| No deposit or withdrawal fees | Inconsistencies reported in customer support quality. |

| Strong Regulation | Limited Product Range |

| MetaTrader 4 and 5 | Limited Account Types |

Our Insights

The benefits of trading with Moneta Markets include the ability to trade over 30 Crypto CFDs, and, commodities such as gold, oil, silver, and agricultural products.

Pepperstone

Pepperstone is an award-winning Forex and CFDs Broker. ASIC, BaFin, CMA, CySEC, DFSA, FCA and, the SCB regulate it. Moreover, Client Funds are kept in a segregated account. The Standard and Razor Accounts are integrated with MetaTrader 4, MetaTrader 5, cTrader, TradingView, and, Capitalise.ai.

The following trading instruments and products are available:

- 70 Forex pairs

- 17 commodities

- 28 indices

- Over 1,000 shares

Moreover, there are 100 ETFs available for Trade. Deposit and Withdrawal options include Neteller, Skrill, and, Visa.

| 🔎 Broker | 🥇 Pepperstone |

| 💴 Minimum Deposit | AU$200 |

| 📈 Account Types | Standard Account, Razor Account |

| 💵 Base Currencies | USD, GBP |

| 📉 Spreads | From 0.0 pips EUR/USD on the Razor Account |

| 📊 Leverage | 1:500 (Pro), 1:200 (Retail) |

| 💶 Currency Pairs | 70, minor, major, and exotic pairs |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Fully digital account opening | Mostly CFDs offered |

| Great customer service | Basic Trading Platforms |

Our Insights

The benefits of trading with Pepperstone include CFD trading resources and Trusted Customer Support.

CMC Markets

CMC Markets is a leading and well-regulated global provider of online trading in shares, spread betting, contracts for difference, and foreign exchange. BaFin, FCA, ASIC, MAS, FMA, IIROC, and, the DFSA regulate it. Moreover, Client Funds are kept in segregated accounts.

Accounts offered are CFD, Spread Betting, and, Corporate. No Minimum deposit is required. Trading Platforms available are MetaTrader 4, Next Generation, and, a Proprietary Trading App. The following trading instruments and products are available:

- Over 330 currency pairings

- 80+ indices

- 12 cryptocurrencies

- 9,500+ shares

- Share Baskets

- 50+ treasuries

Furthermore, over 10,000 ETFs are available.

| 🔎 Broker | 🥇 CMC Markets |

| 💴 Minimum Deposit | 0 USD |

| 5️⃣ Ease of Use Rating | 5/5 |

| 🎁 Bonuses | Yes |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| Next Generation platform | High Fees |

Our Insights

The benefits of trading with CMC Markets include a wide range of educational resources and devoted, trusted customer support.

Tickmill

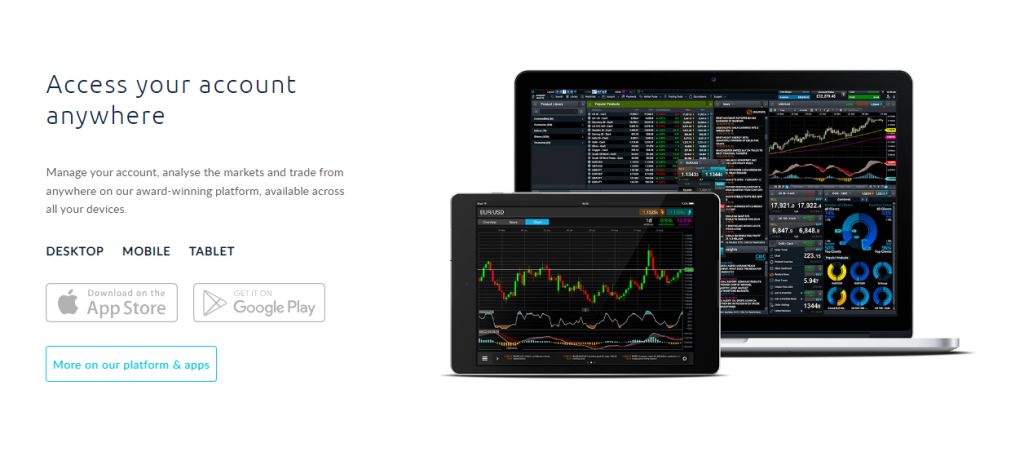

Tickmill is a highly regulated Forex and CFD Broker with a wide global reach. The Seychelles FSA, FCA, CySEC, Labuan FSA, and, the FSCA regulate it. Moreover, client funds are kept in segregated accounts. The Accounts available include Pro, Classic, VIP, and, Demo. The minimum deposit is 100 USD.

Trading Platforms offered are MetaTrader 4 and MetaTrader 5. Additionally, a Tickmill Mobile App is available. The following trading instruments and products are available:

- 62 currency pairings

- 23 Indices

- 3 energy contracts

- 4 precious metals

- 4 bond instruments

Moreover, a selection of eight cryptocurrencies is available.

| 🔎 Broker | 🥇 Tickmill |

| 💴 Minimum Deposit | $100 |

| 💵 Inactivity Fee | None |

| 📈 Spreads | From 0.0 pips on the Pro and VIP Accounts |

| 📉 Leverage | 1:500 |

| 💶 Currency Pairs | 62, major, minor, and exotic pairs |

| 📊 Scalping | ✅Yes |

| 💹 Hedging | ✅Yes |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, Tickmill App |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

Pros and Cons

| ✅ Pros | ❌ Cons |

| MetaTrader 4 and MetaTrader 5 | Limited range of instruments |

| Pro account with minimal commissions | Limited Trading Platforms |

Our Insights

The benefits of trading with Tickmill include a wide variety of 62 currency pairs, webinars delivered by qualified experts, and, trusted customer support.

Is Forex Trading Legal in Switzerland?

Forex Trading is legal, licensed, and, highly-regulated in Switzerland. Moreover, FINMA, or the Swiss Financial Market Supervisory Authority, governs banks, insurance companies, and, Trading Platforms.

In Conclusion

The popularity of Forex in Switzerland has seen a steep increase. Moreover, it is licensed and regulated by the Swiss Financial Market Supervisory Authority.

Our Insights

While reviewing the Best Forex Brokers that accept Swiss Traders, we found 6 excellent options. Furthermore, each broker has its list of Benefits, ranging from multiple account types to multilingual customer support. Moreover, Finding the Best Forex Broker will depend on a trader’s individual trading needs.

You might also like:

- Saxo Bank Review

- IC Markets Review

- Moneta Markets Review

- Pepperstone Review

- CMC Markets Review

- Tickmill Review

Frequently Asked Questions

Is Saxo Bank Regulated in Switzerland?

Saxo Bank (Switzerland) Ltd. is regulated by the Swiss Financial Market Supervisory Authority FINMA.

Is IC Markets regulated in Switzerland?

EEA clients, excluding Belgium, Switzerland, and Latvia, fall under the regulatory authority of the Cyprus Securities and Exchange Commission (CySEC)

Is Moneta Markets regulated globally?

The FSCA, FSA Seychelles, CIMA, and, ASIC regulate Moneta Markets.

Is Pepperstone available to Swiss Traders?

Pepperstone opens Trading accounts to clients living in Switzerland.

What is the Minimum Deposit to Open a CMC Markets Account?

No Minimum Deposit is required.

Does Tickmill offer the MetaTrader Suite?

Tickmill provides MetaTrader 4 and MetaTrader 5.