What are On-chain synthetic Assets?

A synthetic asset is a tokenized blockchain-based derivative of an underlying asset.

Also referred to as synths, synthetic assets, also known as crypto synthetic assets, can be described as a combination of traditional derivative assets and cryptocurrencies.

However, unlike the traditional financial world, synthetic assets add a record for a derivative on a blockchain, thereby creating a crypto token for it. Simply, synthetic assets are tokenized derivatives, with the growth in decentralized finance seen to fuel their growth in the crypto space.

Introduction to Synthetic Assets

Synthetic assets are a revolutionary class of digital assets that have emerged within the decentralized finance (DeFi) ecosystem. These assets are designed to replicate the value and behavior of real-world assets, such as stocks, commodities, and fiat currencies, without necessitating actual ownership of the underlying asset. By leveraging smart contracts, synthetic assets are created and traded on decentralized exchanges (DEXs), offering greater accessibility and flexibility in financial markets. This innovative approach allows investors to gain exposure to various asset classes without the traditional barriers, making synthetic assets a cornerstone of the evolving DeFi landscape.

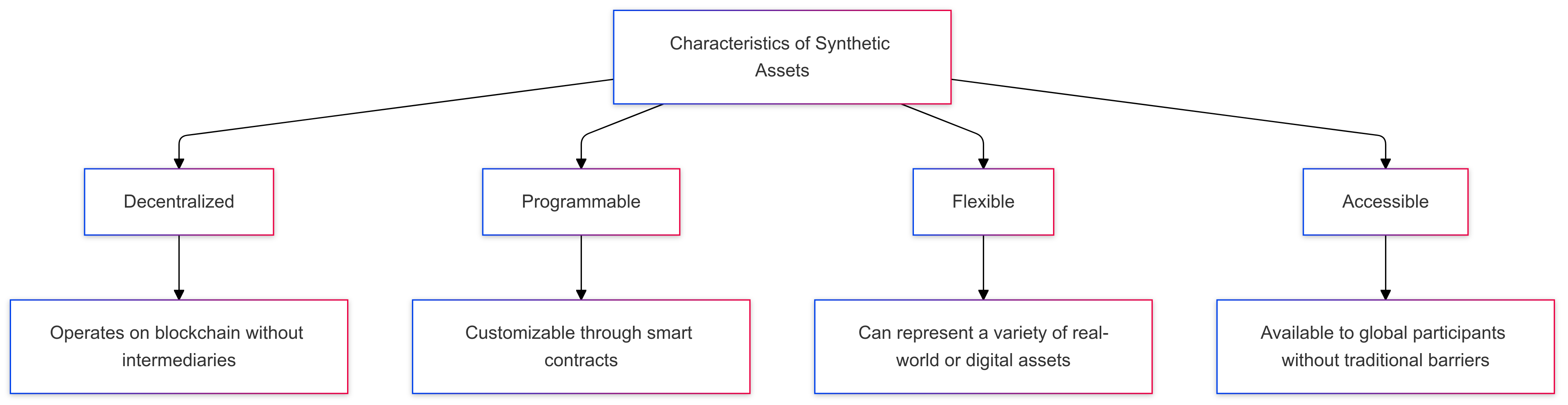

Characteristics of Synthetic Assets

Synthetic assets possess several distinctive characteristics that set them apart from traditional assets:

- Decentralized: Synthetic assets are created and traded on blockchain networks, enabling peer-to-peer transactions without the need for intermediaries. This decentralization ensures transparency and reduces the risk of manipulation.

- Programmable: Utilizing smart contracts, synthetic assets can be programmed to mimic the behavior of traditional assets. This programmability allows for the creation of complex financial instruments that can adapt to various market conditions.

- Flexible: Unlike traditional markets, synthetic assets can be traded 24/7, providing greater liquidity and flexibility. This continuous trading environment allows investors to respond to market changes in real-time.

- Accessible: Synthetic assets democratize access to financial markets, allowing anyone with an internet connection to trade, regardless of geographical location or financial status. This inclusivity is a significant advantage over traditional financial systems.

How Do Synthetic Assets Work with an Underlying Asset?

Synthetic assets work similar to the traditional financial derivatives assets, such as forwards, futures contracts, and options. The only difference between synths and traditional financial derivatives such as forwards, futures, and options is that traditional derivatives are backed by a contract while synths are backed by non-fungible tokens commonly referred to as NFTs in DeFi. Basically, the non-fungible tokens are smart contracts built on the blockchain technology.

In trading, synths function in the same way as the traditional derivatives so that when the price or value of the underlying blockchain-based asset moves, the value of the synthetic asset moves. In simple terms, synthetic assets mirror the underlying blockchain assets in terms of pricing and value.

How Do You Make Crypto Synthetic Assets?

Synthetic assets are made through a process referred to as tokenization. Tokenization in blockchain technologies refers to the conversion of a meaningful piece of data into a random string of characters which has no traceable link to the original data.

The process creates a new asset called a token. The token or digital certificate stands for the real-world asset and is issued to the investor as ownership rights. Powered by blockchain, the token cannot be breached to reveal original data.

If breached, then data would be meaningless since the token only gives a reference to the data and not the data itself. Tokenization takes place in accordance with synthetic asset protocols, which can be both decentralized and distributed.

Any asset can be the underlying asset for the token. The most popular in the recent past has been tokens whose underlying assets are digital art. This shows the extent of the financial revolution that comes with synthetic assets in DeFi.

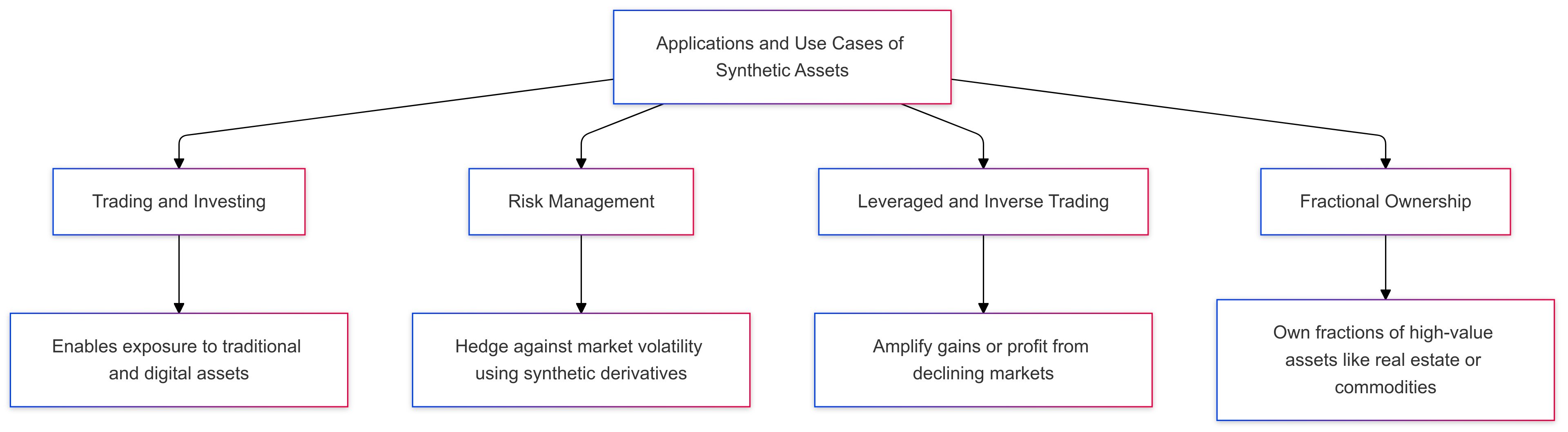

Applications and Use Cases

Synthetic assets offer a wide array of applications and use cases, making them a versatile tool in the financial markets:

- Trading and Investing: Synthetic assets can be traded on DEXs, providing greater accessibility and flexibility. Investors can gain exposure to various asset classes without the need for traditional intermediaries.

- Risk Management: Synthetic assets can be used to hedge against price fluctuations in traditional assets. This provides a more efficient and cost-effective way to manage risk, especially in volatile markets.

- Leveraged and Inverse Trading: Synthetic assets enable the creation of leveraged and inverse tokens, allowing traders to amplify their gains or bet against the price of an underlying asset. This can enhance trading strategies and potential returns.

- Fractional Ownership: High-value assets, such as real estate or art, can be tokenized into synthetic assets, allowing for fractional ownership. This makes these assets more accessible to a broader range of investors, breaking down traditional barriers to entry.

What are the Advantages of Trading Synthetic Assets?

There are many advantages of trading synthetic assets including those that apply to traditional derivatives. The benefits include hedging risk of exposure, market efficiency, access to unavailable assets or markets, and price discovery or determination.

With tokenized derivatives or synths, these advantages are extended. Synths create more liquidity than can be imagined under traditional derivatives with access to the global marketplace.

Any person can issue synths or tokenized derivatives so long they follow synthetic asset protocols. There are tools like Synthetix, an open-source synthetic asset protocol for the creation of synths. The ease of creating synths is behind the growing mentions of NFTs in the DeFi spaces.

Above all, synths and tokenized derivatives enjoy frictionless movement in a borderless trading ecosystem powered by the concepts of DeFi and blockchain.

DeFi eliminates the role of financial intermediaries that characteristically raise the transactions through duplicitous efforts especially when the trading is across borders.

Trading synths in DeFi attracts almost insignificant cost and without any limitations of geographical borders. Besides, traders can enjoy anonymity which lacks in centralized exchanges for traditional finance. Transactions can still be traced in a distributed ledger making privacy a key step-up in synthetic assets trading.

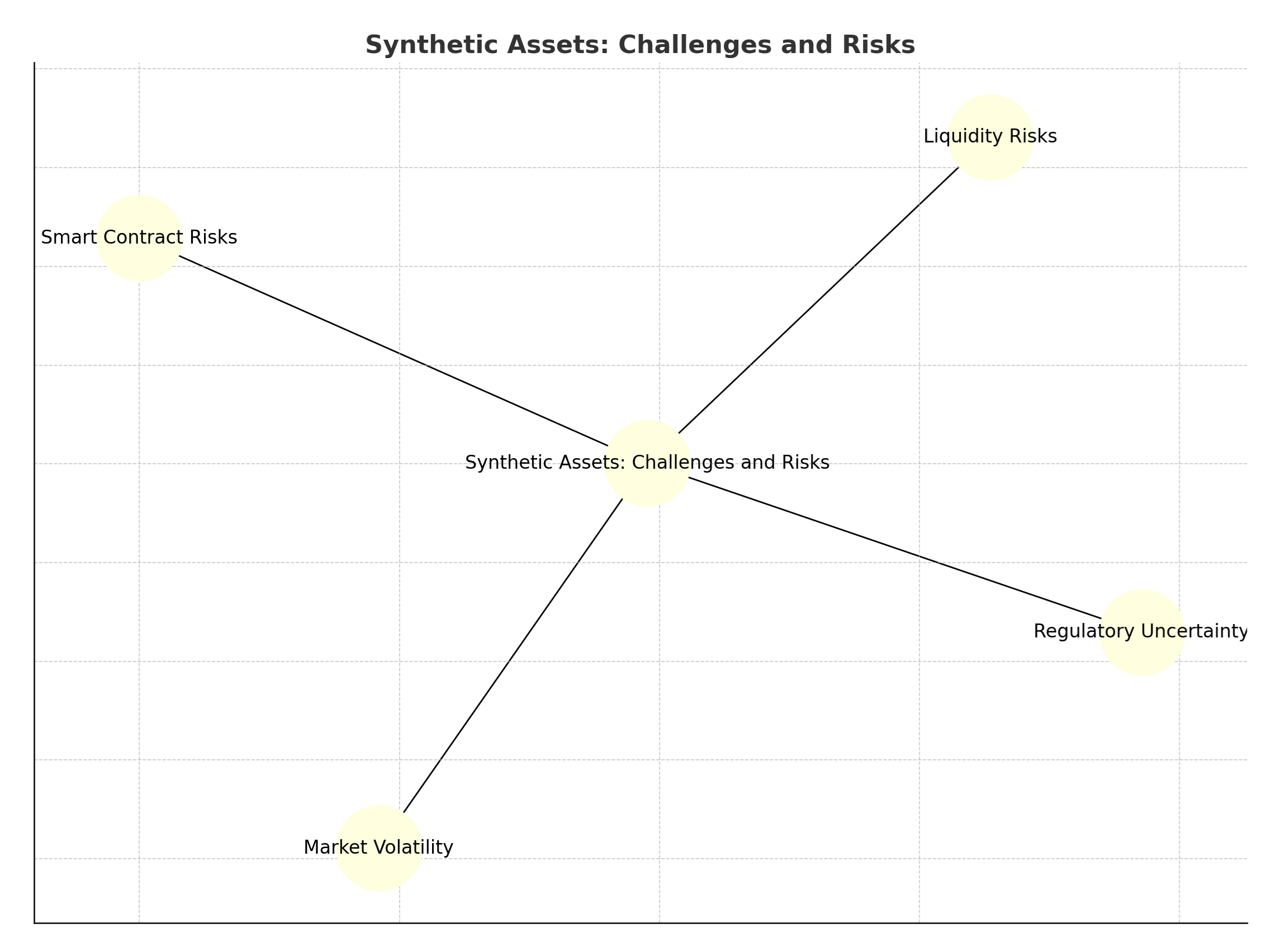

Synthetic Assets Challenges and Risks

While synthetic assets offer numerous benefits, they also come with several challenges and risks:

- Regulatory Uncertainty: The regulatory landscape for synthetic assets is still evolving. There is a risk that governments may impose restrictions or regulations that could impact their use and trading.

- Market Volatility: Synthetic assets are subject to market volatility, which can lead to significant losses if not managed properly. Investors need to be aware of the risks associated with price fluctuations.

- Smart Contract Risks: Since synthetic assets are created using smart contracts, they are vulnerable to hacking and other forms of exploitation. Ensuring the security of these contracts is crucial to prevent potential losses.

- Liquidity Risks: Synthetic assets may have limited liquidity, making it challenging to buy or sell them quickly. This can impact the ability to execute trades efficiently, especially in volatile markets.

Role of DeFi in Synthetic Assets

Decentralized finance (DeFi) plays a pivotal role in the creation and trading of synthetic assets. DeFi platforms provide the necessary infrastructure and tools to support these innovative financial instruments:

- Providing Liquidity: DeFi platforms offer liquidity for synthetic assets, making it easier for investors to buy and sell them. This liquidity is essential for maintaining market stability and enabling efficient trading.

- Facilitating Trading: DeFi platforms facilitate the trading of synthetic assets, offering greater accessibility and flexibility. This allows investors to participate in the market without the need for traditional intermediaries.

- Offering Risk Management Tools: DeFi platforms provide a range of risk management tools, such as hedging and leverage, to help investors manage risk and maximize returns. These tools are crucial for navigating the complexities of synthetic asset trading.

- Providing Universal Market Access: DeFi platforms democratize access to financial markets, allowing anyone with an internet connection to trade synthetic assets. This universal market access breaks down traditional barriers and opens up new opportunities for investors worldwide.

By understanding these aspects, investors can better navigate the world of synthetic assets and leverage the opportunities they present within the DeFi ecosystem.

What is Mirror Trading Using Synthetic Currencies in Decentralized Finance?

Mirror trading is a strategy which allows traders to copy the trades of experienced professionals. It is a strategy primarily used in the forex markets. In DeFi, the creation of synthetic assets creates an opportunity for novice traders to mirror the trades of professional traders. Mirror trading is made possible through the creation of synthetic currencies which mirror real currencies.

Most importantly, mirror trading using synthetic currencies involves cryptocurrencies making it possible for traders to trade official currencies that are backed by economic and political stability through the trade of cryptocurrencies.

With mirror trading, a novice trader can actually enjoy the same returns as the experienced professional trader while at the same time avoiding the high management fees that professional fund managers charge for their strategies.

Mirror trading using synthetic currencies is another way through which DeFi levels the playing ground for the non-professional traders in the forex markets.

FAQs on Synthetic Assets

What Are Synthetic Assets?

Synthetic assets are blockchain-based financial instruments that replicate the value and behavior of real-world assets like stocks, commodities, and currencies. Unlike traditional derivatives, synthetic assets are tokenized and operate on decentralized platforms, enabling trading without owning the underlying asset.

How Do Synthetic Assets Work?

Synthetic assets derive their value from underlying assets through tokenization. For instance, a synthetic token mirroring gold would track gold’s price without requiring physical ownership. Smart contracts on blockchain platforms automate the creation and trading of these assets, ensuring transparency and efficiency.

What Are the Advantages of Trading Synthetic Assets?

- Accessibility: Trade global assets without geographical restrictions.

- Risk Management: Hedge against price volatility in traditional markets.

- Fractional Ownership: Access high-value assets like real estate or art in smaller, affordable units.

- 24/7 Trading: Unlike traditional markets, synthetic assets can be traded anytime.

What Are the Risks Associated with Synthetic Assets?

- Regulatory Uncertainty: Evolving legal frameworks may impact their usage.

- Smart Contract Vulnerabilities: Bugs or hacking risks can lead to financial losses.

- Liquidity Issues: Limited trading volumes can hinder swift transactions.

What Role Does DeFi Play in Synthetic Assets?

Decentralized finance (DeFi) platforms facilitate the creation and trading of synthetic assets by providing infrastructure for liquidity, risk management tools, and universal access. Platforms like Synthetix allow users to create and trade synthetic assets seamlessly, democratizing access to global financial markets.

Sidebar rates

HFM

wgt-lc-defi

- DeFi Lending

- DeFi Yield Farming

- AMM (Automated Market Maker)

- DEX

- Cross Chain Bridges

- Crypto Options

- Tokenized Bonds

- Crypto Derivatives

- On-chain synthetic Assets

- Cryptocurrency Perpetuals

- Cryptocurrency Staking

- Cryptocurrency Total Locked Value (TVL)

- Impermanent loss

- Rebase Token

- Decentralized Autonomous Organization

- Decentralized Application

- Gas Fees

- Liquidity Pools

- Cryptocurrency Tokenomics

- Pegged Stablecoins