Comparing the US and the UK manufacturing data and their impact on respective currencies

The UK manufacturing data was published this morning at 08:30 GMT and it showed that this sector slipped into contraction. It declined by nearly four points, which puts the UK manufacturing sector from expanding moderately well to a nasty contraction which might turn into a recession. We had a first taste of it in mid-July but it included only half of the month and now the numbers for the entire July are even worse.

The US manufacturing data was published a while ago and although it missed the expectations it showed that this sector is still expanding. The USD was little moved by the miss, while the GBP lost about 100 pips in most major forex pairs. The manufacturing factor is not the most important sector in the US but it definitely takes a bigger share than the share the UK manufacturing sectors has in the UK economy.

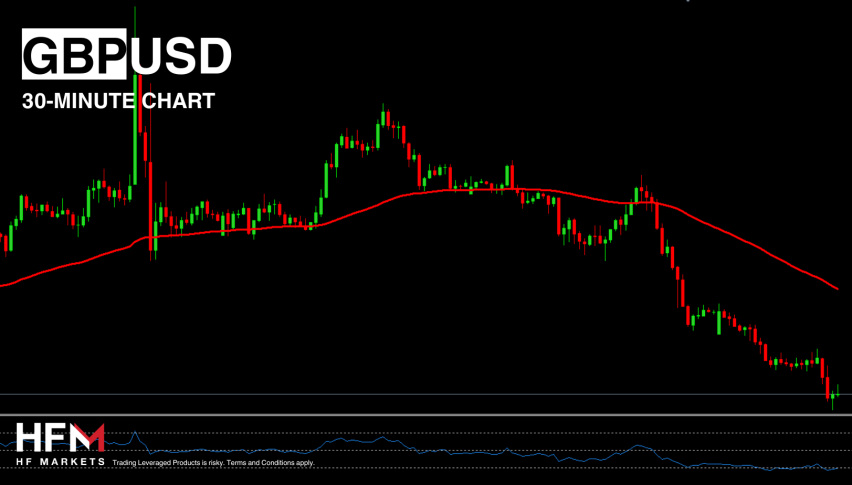

GBP/USD fell about 100 pips after the UK manufacturing data disappointed

So why this impact on the GBP when no one ever minded the UK manufacturing PMI until last month?

1 – The UK manufacturing fell in contraction

2 – The contraction came very quickly after the Brexit referendum and the 4 point decline in a month is scary

3 – What will come next? We saw the awful UK service sector numbers in mid-July. Will the service PMI get worse this time? Will it get worse in the months to come? Will the other sectors of the UK economy go down the same hole?