Lesson No 1 – Where do the major fx pairs stand after the FED melodrama?

Have you followed the FED series "We don´t know what we want, we don´t know when we want it" which were screened around the globe in the last two weeks or so? I bet you couldn´t keep up with it and the way it has moved the financial markets around. Now the FED season has come to an end until Wednesday next week, so let´s have a look at some of the major forex pairs and see what the price action is trying to tell us.

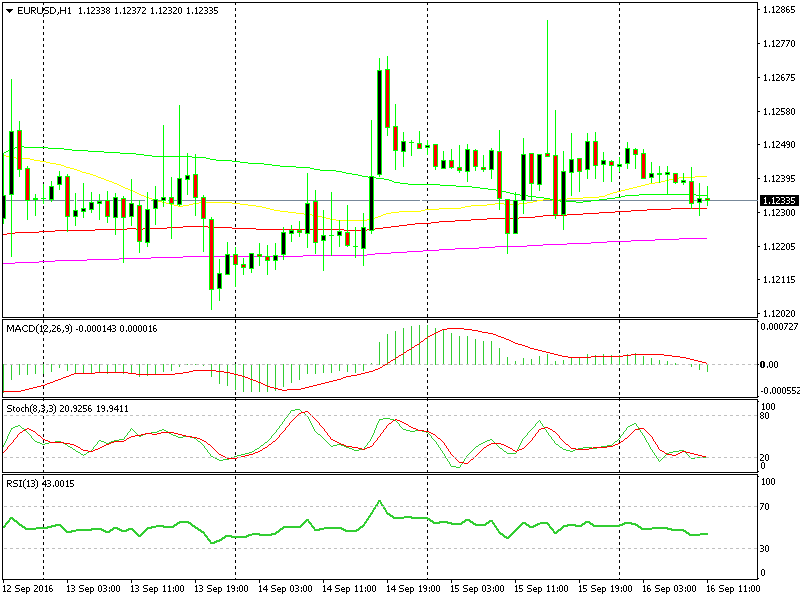

EUR/USD – The Euro was the first to try to reap some benefits after Brainard´s dovish comments yesterday evening, but the other major currencies made the most of those comments and EUR/USD was left trailing the other major pairs. In fact, all other major currencies finished the day up against the Buck, while EUR/USD finished the day unchanged.

EUR/USD is right back where it started before Brainard hit the screens

GBP/USD – This forex pair was the prime beneficiary of the USD weakness yesterday. The positive sentiment towards the GBP added strength to this forex pair and it closed the day about 100 pips above the lows. That positive sentiment only lasted until this morning when the UK inflation figures turned everything upside down, sending this forex pair 150 pips lower.

USD/JPY – The Japanese yen is a safe haven currency so when there is uncertainty in the financial markets the cash flows towards the Yen as well as toward gold. If you don´t agree that Brainard threw out of the window any rate hike expectations in next week FOMC meeting, then you must at least agree that she increased the uncertainty in the forex market. That´s like a lullaby the ears of Yen buyers. Most of the JPY gains have been erased today but the fear trade in USD/JPY is still in the money.

Commodity Dollars – The commodity block behaved in similar fashion yesterday. All of them made reasonable gains against the USD varying from 50 to 90 pips. The run for yield underpinned the Commodity Dollars. Today though, we see that the commodity block is feeling heavy and all of them are down against the USD.

What can you make of these moves? What does the price action tell you? We will answer these question in the second part of our own series "Reading the price action" which is coming up shortly in our live market update section, so stay tuned.