When you’re let down by the one thing you don’t expect

There are many disadvantages which Brexit brings to the UK economy such as uncertainty, declining investor confidence and eventually denied access to the European single market. Besides that, there are some vague possible benefits. One of them is inflation.

Governments and particularly central banks look at inflation numbers for inflationary pressure which means higher prices due to higher demand. But personally, I fall in that group of economists who don´t see inflation as such an important economic indicator because it might be misleading. Global oil prices have been distorting inflation in many countries in the last two years, so the recent changes in the inflation haven´t been supported or justified by the real economy.

In the case of Brexit, that´s even clearer. The GBP declined bout 15-20% which would help inflation, but to me, that still doesn´t count for anything. It doesn´t indicate a pickup in the economic activity. Anyway, inflation is one of the main economic indicators for the BOE (Bank of England) and in an ideal world it would help exports while attracting tourists.

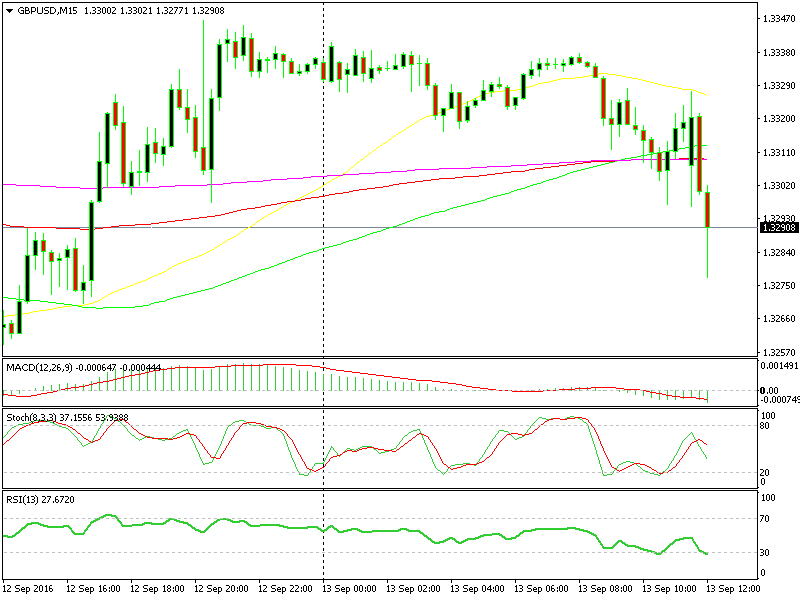

GBP/USD has undone the gains induced by FED´s Brainard yesterday

But, even after a 15-20% decline in the GBP, the inflation in the UK isn´t holding up. The inflation report was published a while ago and all you can see is red numbers. As you know, when the numbers are green the economic data is better than expected and vice versa.

I don´t know where to start it, the headline figure for 2016 came 0.2% lower, the core inflation for the year and for August also missed the expectations. Besides that, the producer and the house price inflation came out a lot worse than expected. This comes after all those high expectations about inflation, which would eventually lead the British economy to great prosperity.

Anyway, the numbers are what they are and the Pound is not liking it. After a run of positive economic data from the UK, this party might have come to an end and the GBP bulls don´t like what they see as the Pound starts sliding down.