Buy And Sell Orders This Morning

Here we are, more than a week after our last post about the buy and sell orders in the forex market, or as we like to call them support and resistance levels. The major forex pairs have made some substantial moves in such a long time and so have the support and resistance levels. Let´s have a look at some of these pairs in order to keep up with the new levels.

GBP/USD – This is the forex pair which has moved the most this week after the market sentiment turned really sour towards the GBP. The support levels are very scarce here, since this pair has reached a multi-decade low. We can count on 1.2700 1.2680 which was the low today, 1.2650, 1.26 and 1.25 as mild support levels.

The resistance levels are much easier to spot. They stand at 1.2740 which is where the 20 moving average stands on the hourly forex chart, 1.2770, 1.28 obviously which has been the low all summer and finally 1.2850. That´s the price I am looking to open a long term sell forex signal if the price gets there.

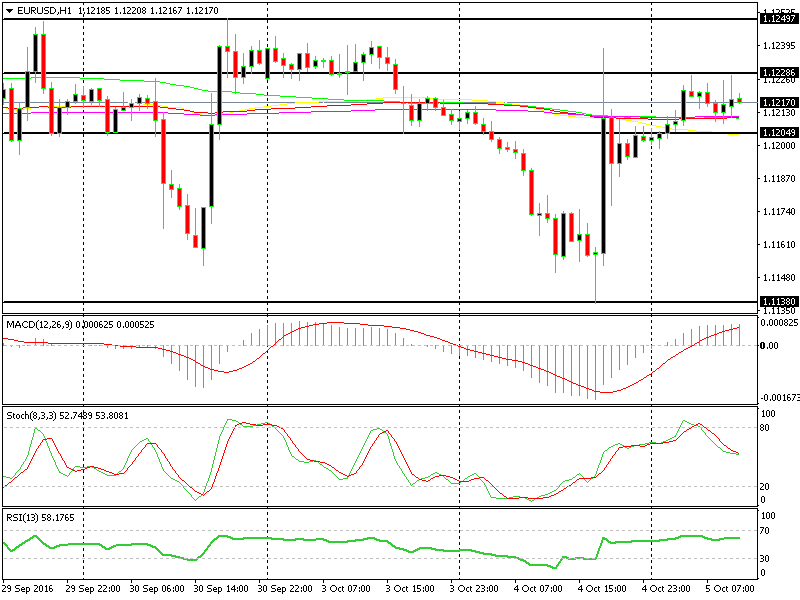

Support and resistance levels for EUR/USD

EUR/USD – The Euro pairs popped more than 100 pips higher yesterday in the afternoon on some ECB (European Central Bank) chatter. On our next market update, we will look more in detail of this matter. Anyway, that move was enough to bring into play some other support and resistance levels, besides the ones we saw yesterday.

As you can see on the forex chart above the first resistance line is drawn at yesterday´s high around 1.1230. Above that comes the second line at 1.1250, then 1.1280, 1.13 and 1.1330. I don´t think we´ll see the price move above there today, after all, this is not the beast that the GBP/USD has become, right?

The support levels are pretty visual too. We have drawn the first support line at 1.1200 – 1.1210 which has been a decent support level in the last several weeks. The next line on our forex chart stands at 1.1130 but the support stretches between 1.1120-30, followed by 1.1100. The lowest support levels in sight are 1.1050 and 1.10.

We don´t know how much the price will move today and which levels will come into play, but better to be prepared and keep an eye on them for some good trading opportunities.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account