US Dollar Strength Prevails Going into the FOMC Minutes, EUR/USD Drifting Lower and the USD/JPY Higher

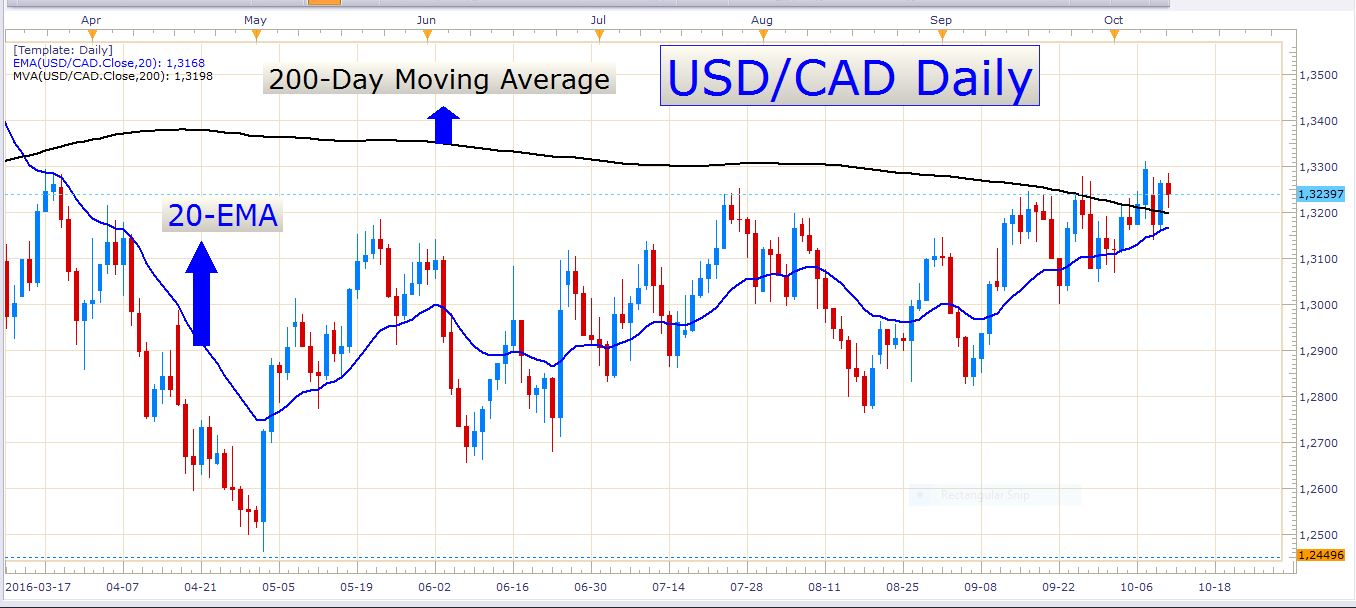

It seems like the Greenback’s popularity is growing daily. During the last ten trading days, the US dollar has been constantly gaining ground against its leading counterparts. Today the USD/JPY posted a pretty impressive day and is currently pressing through the swing high that was formed on the 2nd of September. Look at the following chart:

USD/JPY Daily Chart

In the last 12 trading days, this pair has gained more than 400 pips already. What we’re seeing here, is the formation of higher highs and higher lows – characteristics of an uptrend. Although we can’t say that the pair is in an uptrend yet, we can’t negate the powerful bounce we’ve seen in the exchange rate recently. The 200-day moving average is only about 360 pips away, and there is a major resistance level at around 107.494 which is just a bit more than 300 pips away. If the pair continues to trade higher and manages to conquer these levels, an uptrend could very well come into play.

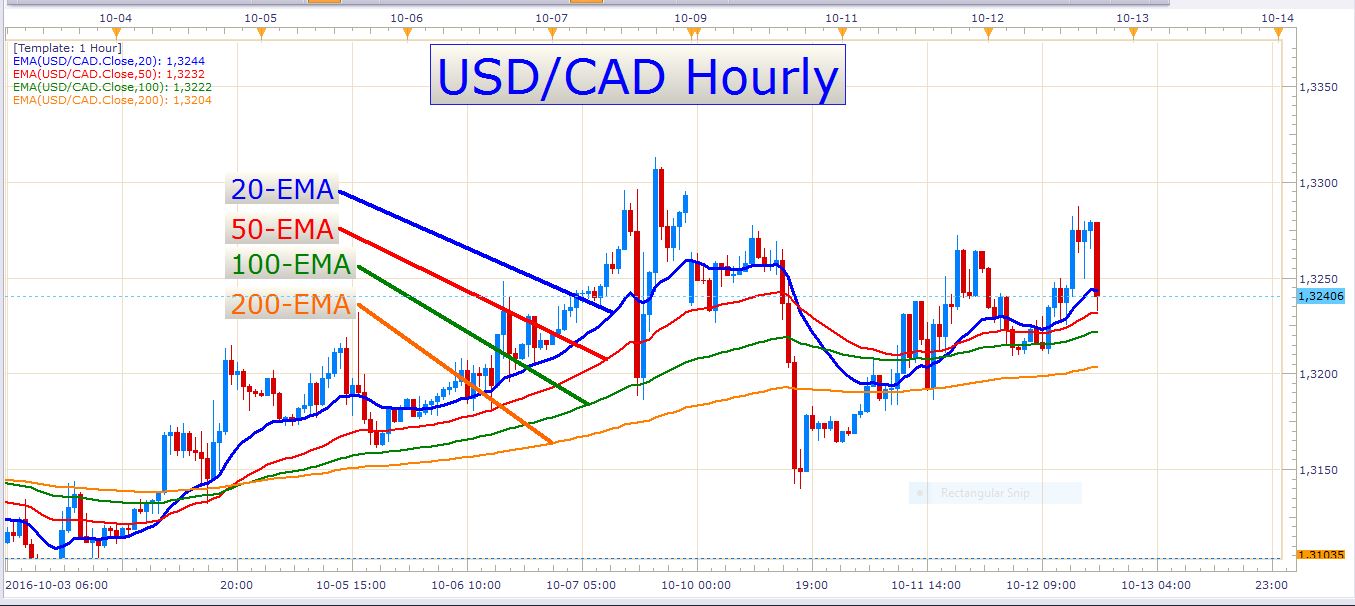

At the moment the strong bullish move on the USD/JPY is quite extended, and if you’d like to enter long positions on this pair it could perhaps be wise to wait for a pullback to appear first. Chasing strong moves like this is often an easy way to lose money. Entering trades on price retracements allows you to use tighter stops and hit larger targets easier. Look at these examples on a 4-hour chart:

USD/JPY 4-Hour Chart

EUR/USD

I like the determined selling we’ve seen on this pair in the last few days since it has broken through the 200-day moving average. Over the last couple of weeks, the price action on the EUR/USD has been jerky and without clear direction. It looks like the pair might still trade a bit lower in the next few days, especially if we get some follow-through of the current bullish momentum on the US dollar. At the moment the pair is rather oversold, and if you look at the large distance between the 20-EMA and the current market price, it confirms the oversold condition of this pair at the moment. Under normal conditions, it is better to wait for some sort of a retracement to take place, even on a large timeframe like a daily chart. Let’s look at a daily chart of the EUR/USD:

EUR/USD Daily Chart

The pair has broken through the bottom of this triangle today, and the Brexit candle’s low might be the next support level of interest. I do think we could get a retracement in the next day or two that might offer good setups to short the pair. Even though we might not get a retracement to the 20-EMA on a daily chart soon, there should be multiple retracements toward moving averages on smaller charts. This gives us the opportunity to find more trades, as a retracement to the 20 EMA on a daily chart doesn’t happen all the time, but it does happen frequently on an hourly chart. Traders can also trade with smaller stop losses in terms of pip distance. Let’s look at an hourly chart of the EUR/USD:

.JPG)

Here you can see how the 20-EMA has lately offered great resistance to the price, and if you look at the two red circles on the chart, it is clear that these entries that were taken on the 20-EMA, or slightly below it (for traders trading with confirmation type of strategies), have been high-quality entries. Perhaps we’ll have the same type of opportunities to trade pullbacks off the hourly chart soon. I would still prefer to see some kind of a retracement on the daily chart before I start looking for fresh opportunities on the smaller timeframes like for example on an hourly chart.

USD/CAD

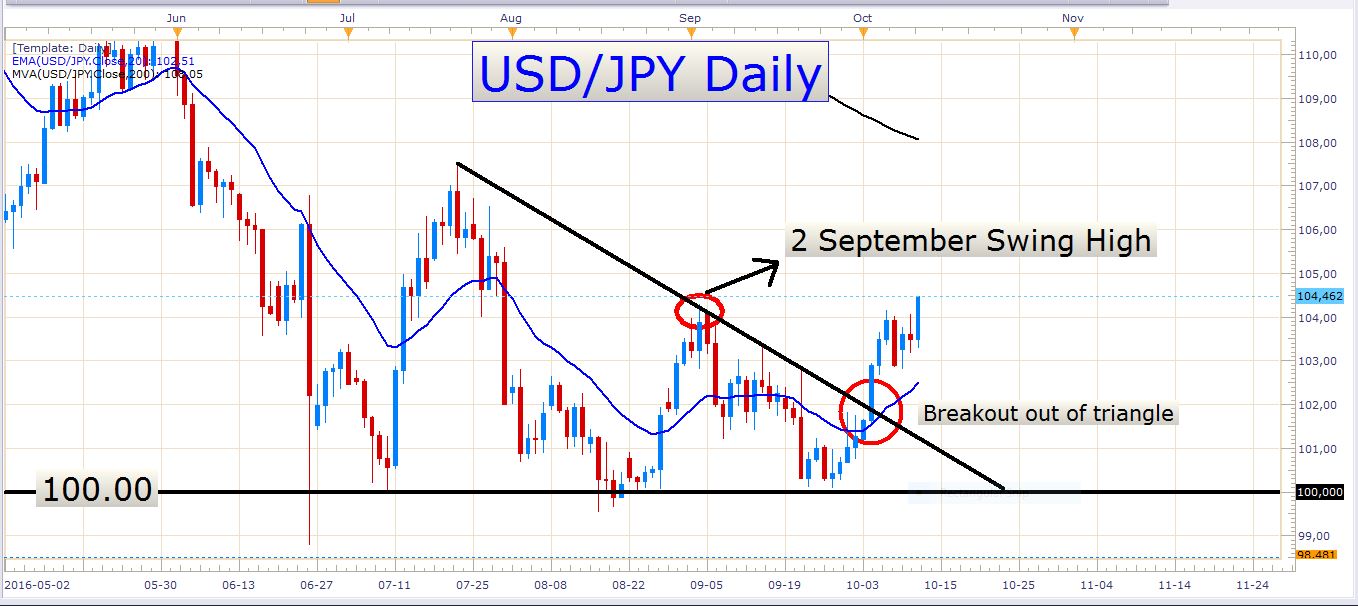

The price is still supported by the 20-day exponential moving average and is still clear of the 200-day moving average. My bias on this pair is still bullish, and I am on the lookout to buy dips. Here is a daily chart of this pair:

USD/CAD Daily Chart

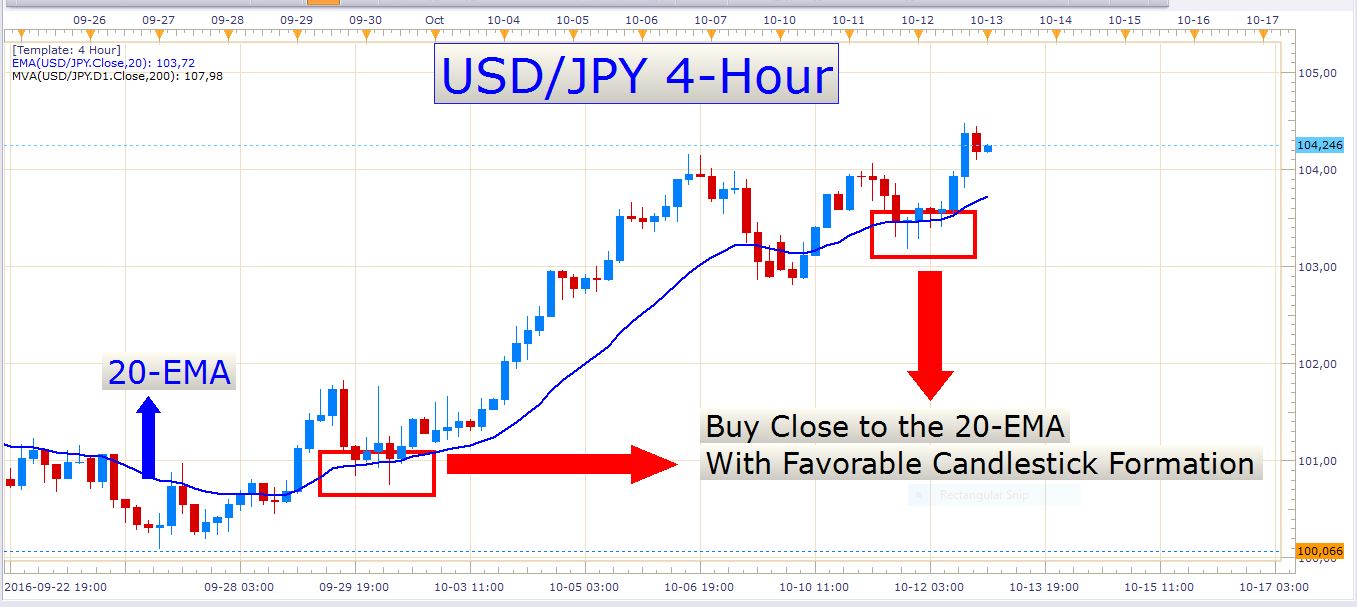

And an hourly chart:

USD/CAD Hourly Chart

Here you can see that the exponential moving averages on this chart are once again aligned, which indicates that some decent bullish momentum has returned to the market. Pullbacks to any one of these exponential moving averages can be traded, depending on the shape of the candlesticks that form on the retracement. Remember that it helps a lot when the exponential moving averages are all aligned, as this gives you the confirmation that you're trading in the direction of the prevalent market momentum.

Tomorrow’s economic calendar

Tomorrow is a very light day in terms of economic data. The most important event is probably the US Crude Oil inventories at 15:00. This could have an effect on the USD/CAD because of the Canadian dollar’s high correlation to crude oil prices.

Have a great trading day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

.JPG)