Australian CPI Numbers Unable to Make a Lasting Difference, AUD/USD Bearish Pinbar Points to Possible Losses in the Days Ahead

The Aussie has rejected off of trend line resistance on several occasions in the last couple of weeks. Since the yearly high was set on the 21st of April, the pair’s trading range has narrowed significantly. Let’s look at a daily chart of this pair:

As you can see, the pair has been trading very much sideways. Today the pair printed a pinbar candle at an important resistance level (a descending trend line). This descending trend line has really received a lot of play during the last couple of weeks. Let’s look at a weekly chart of the pair:

On this weekly chart, the 100-day exponential moving average has firmly resisted the pair. If we look at all the topside wicks over the last 28 weeks it is evident that the pair is having a hard time overcoming the current resistance levels which it faces. Now when a currency pair keeps failing at a certain resistance zone, it increases the probability that this pair could face more downward pressure in the near future. The AUD/USD looks like it could roll over soon (turn lower), which will definitely draw many bearish market players to this pair.

The US dollar has been doing pretty well lately, and if we get some more dollar strength in the next week or two, the AUD/USD could come under some pressure.

USD/CAD

This pair has been on my radar for many weeks already. Although the pair has been sluggish to move higher over the last couple of weeks, it has managed to rise substantially since the yearly low was recorded on the 4th of May. Look at the following chart:

The pair has been printing higher highs and higher lows for many weeks already and has gained traction above the very important 200-day moving average. The BOC (Bank of Canada) has adopted a very dovish stance at their last meeting. There has also been a decline in oil prices lately. Now if we consider these factors, we can come to the conclusion that a further advance in the USD/CAD exchange rate could be under way, especially if further US dollar strength is added to the equation.

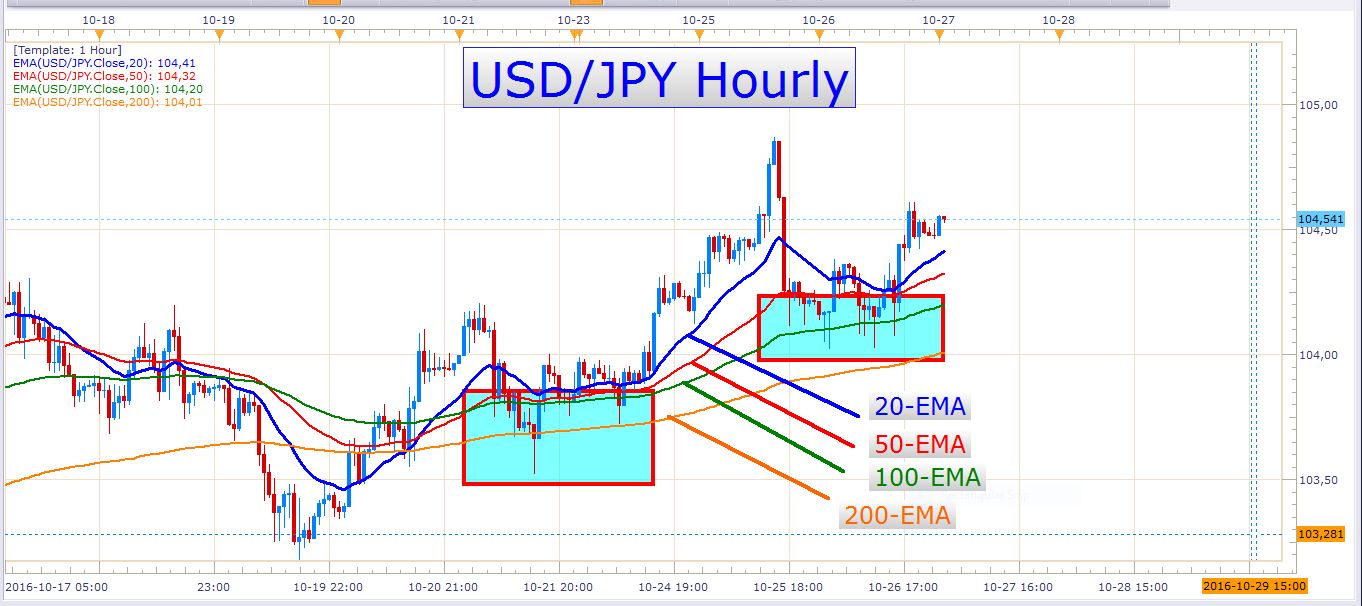

USD/JPY

This pair has also advanced over the last few weeks, and at the moment my bias can only be bullish on it. I am keeping an eye open for dips to buy, and my favorite time frames to take entries on at the moment are the 4-hour and hourly time frames. Look at the following chart:

On this chart, you can see that pullbacks to these four exponential moving averages have offered good opportunities to get long. You’ll notice the pinbar candles which rejected off of these exponential moving averages, and the pretty fine buying opportunities they offered.

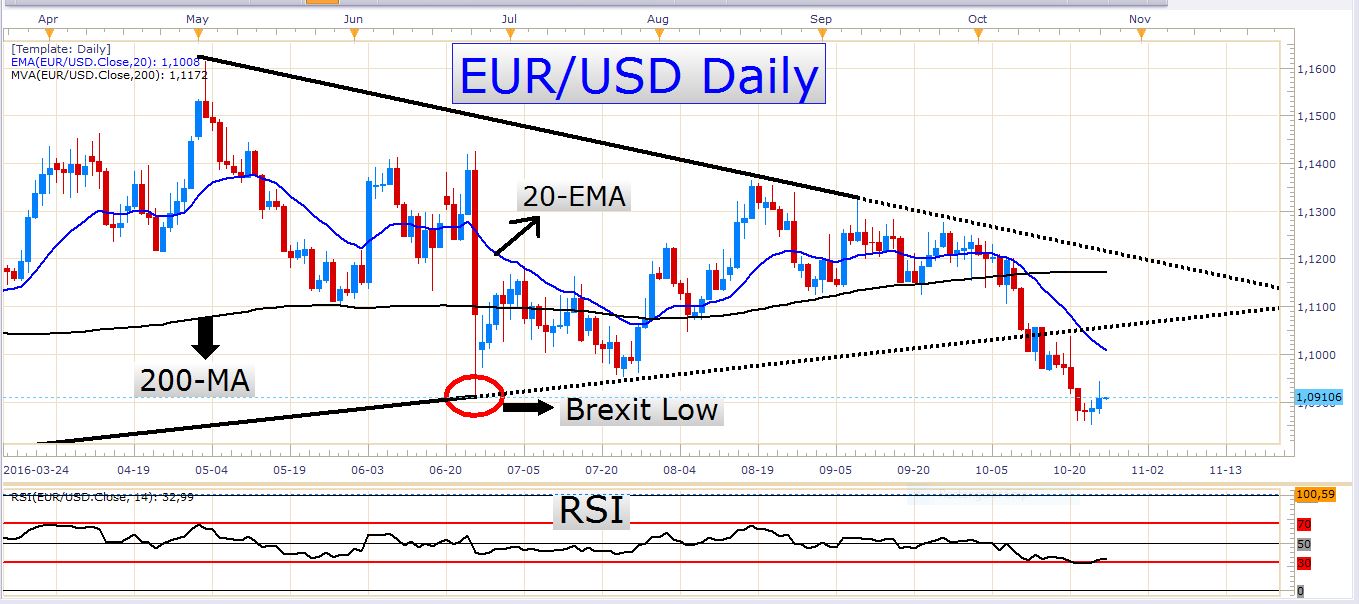

EUR/USD

The EUR/USD has declined pretty aggressively during the last few days, and my bias on it is still firmly bearish. Look at this chart:

The RSI indicator is close to oversold which tells us that the momentum is still very bearish. Of course, you don’t need this indicator to notice the strong downward pressure on this pair, but it gives us a definite measurement of the momentum of the pair.

Economic news events

Tomorrow the UK will release their preliminary GDP (Gross domestic product) numbers which could perhaps have a notable impact on the pound.

Out of the US, we have core durable goods orders at 12:30 GMT and pending home sales at 14:00 GMT.

The US dollar is generally strong, and traders can watch out for opportunities to take advantage of its strength.

Have a great trading day!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account