The US Dollar Bull-Run is Accelerating. Will We See More Dollar Strength Going into the US GDP Release Tomorrow?

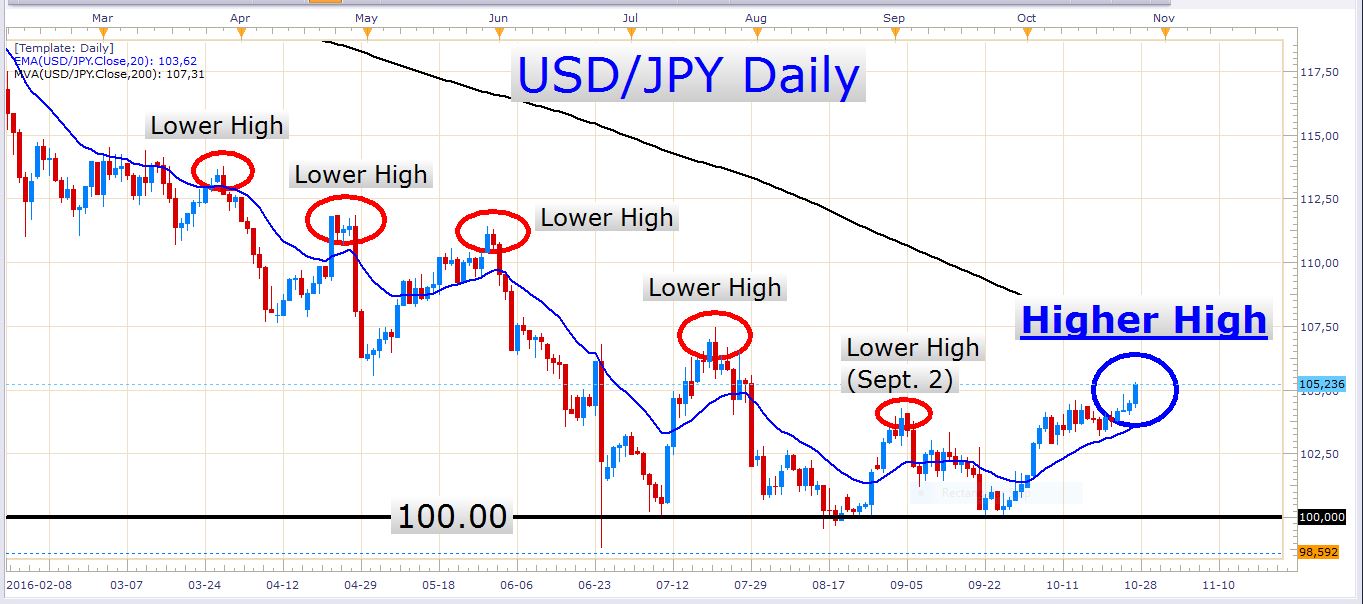

The USD/JPY was the hot major pair to trade today. The dollar gained about 84 pips against the Japanese yen. The pair has also broken through an important lower swing high that was formed on 2 September. Let’s look at a daily chart of the USD/JPY:

USD/JPY Daily Chart

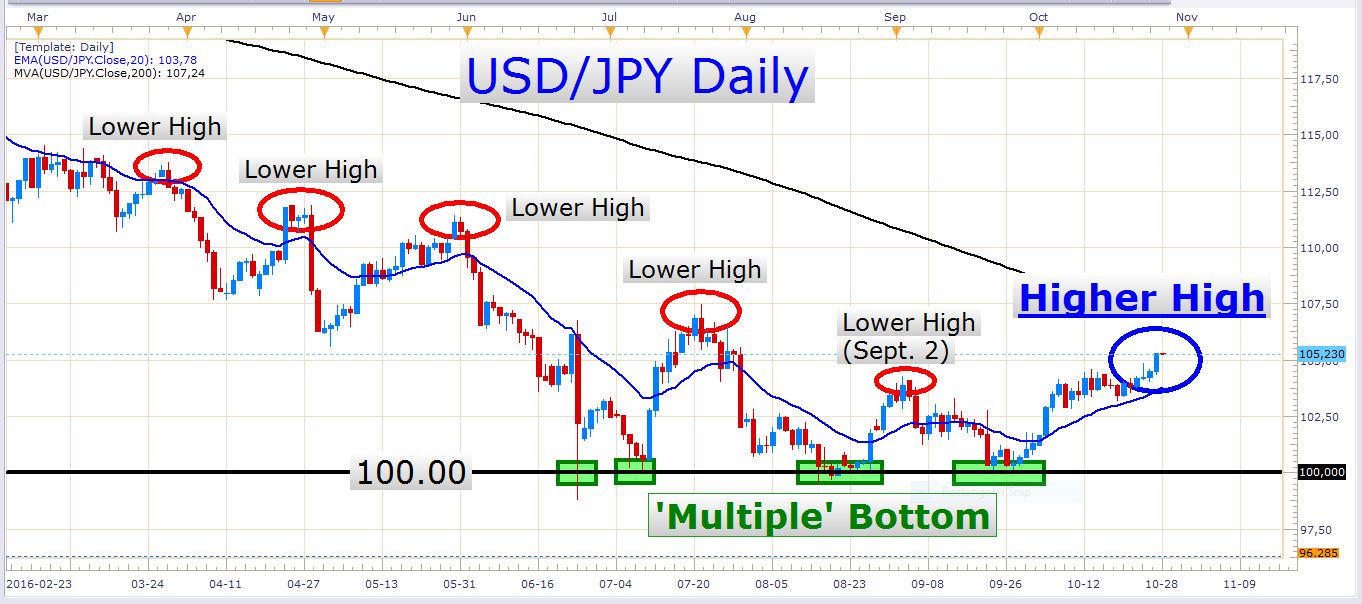

The blue circle marks the higher high that was formed. The formation of higher highs and higher lows are crucial characteristics of an uptrend. Conversely, the formation of lower highs and lower lows are crucial for a downtrend. The wave formation of a trend is a very important factor which professional traders analyze when they make trading decisions. The technical picture of the USD/JPY has undergone a very important structural shift. Not only has a higher swing high been formed on the daily chart, but also a triple bottom in the region of the big psychological 100.00 level. Or perhaps I should rather say that a ‘multiple' bottom has been formed because the price actually touched and rejected off this zone several times. Look at the following chart:

Call it what you want, this bottoming pattern has built a strong layer of support into the USD/JPY over the last couple of weeks. It would really take a lot of selling pressure to overcome this big 100.00 level, especially if the US dollar remains as strong as it is at the moment.

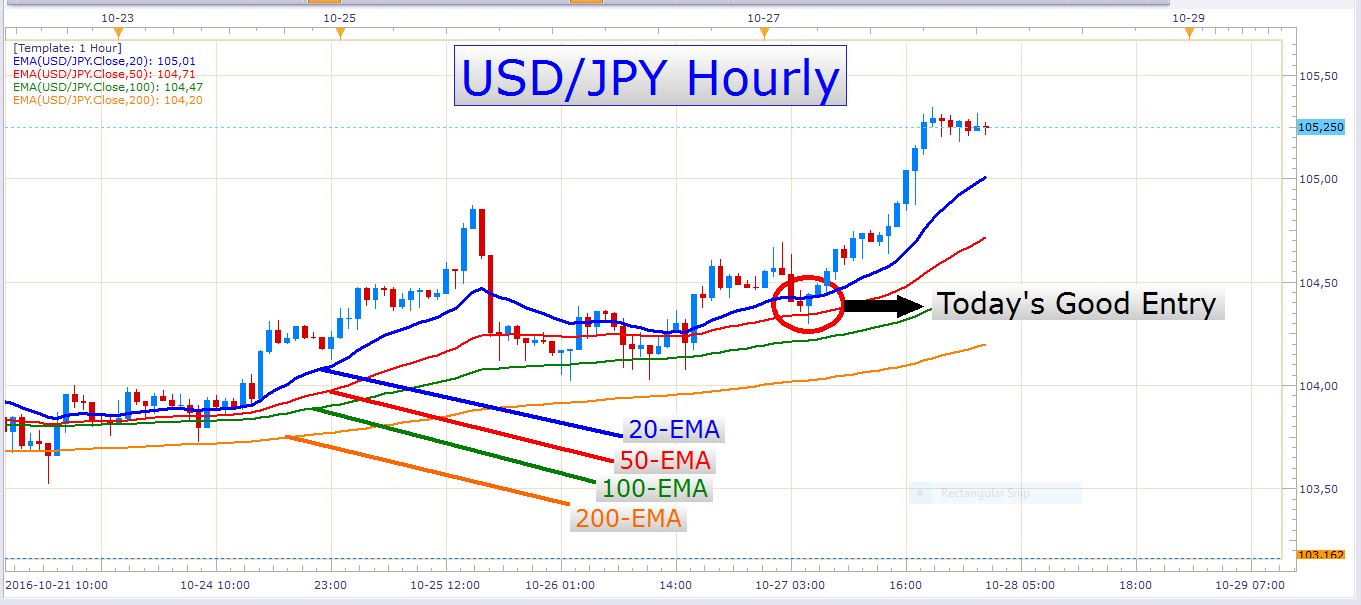

Yesterday I talked about buying dips on the USD/JPY. There was a very good opportunity to buy such a dip today. Look at this chart:

USD/JPY Hourly Chart

Here the price pulled back to the 20-EMA and the 50-EMA before shooting up again. If I were in front of my pc at the time, I would definitely have traded this.

I will be on the lookout for more long opportunities on this pair, and as long as the bullish momentum stays intact, this pair remains a hot buy.

AUD/USD

I wrote a lot about this pair in yesterday’s article, and as I expected, the price declined today. Here is a daily chart of the AUD/USD:

AUD/USD Daily Chart

Although I wouldn’t enter a position on this pair at the moment, there is certainly a lot of potential for trading it over the next couple of weeks. It looks like the pair is having a tough time keeping its head up, and the path of the least resistance is to the downside. If you are interested in shorting this pair I would recommend waiting for a retracement to appear first, as well as favorable candlestick setups like for example pinbars rejecting off of key levels.

GBP/USD

Although this pair has been trading very much sideways over the last few days, today’s price action suggests that we could perhaps see the pound trade lower against the dollar over the next few days if we’re lucky. Let’s look at a daily chart:

GBP/USD Daily Chart

Of course, this pair has been trading sideways for quite a while now. This makes it difficult to trade it profitably. It is much easier to make money out of a trending market than out of a ranging market. At the moment the GBP/USD is caught up in a type of a triangle / consolidation, and this favors a continuation of the bearish momentum that preceded this consolidation. These consolidations tend to last longer than we many times anticipate, though, and do not be amazed if this sideways chop continues for another few days.

Tomorrow we have the release of the US third quarter GDP numbers. This will be a preliminary release. GDP (gross domestic product) is a very important gauge for a country’s economic welfare. Hence we could possibly get some volatility around the release which is scheduled for 12:30 GMT.

Besides the US GDP numbers, there aren’t any important news releases scheduled for tomorrow.

The US dollar has generally been strong over the last couple of days, and it doesn’t look like we’re going to encounter any significant dollar weakness soon. At the moment, the dollar remains a great currency to buy against the Euro, the Japanese yen, the Australian dollar, the Canadian dollar, and many other currencies.

Good luck, and have a great weekend!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account