NZD/USD – Is the Retrace Over?

This morning the US Dollar took a beating, with Yen and the Euro enjoying some of the best times in the last three weeks. This was partly due to Fillon who won the elections of the French Conservative Party and partly due to some position readjusting and profit taking from forex traders who bought USD/JPY near the 100 level. Kudos to the guys who kept their USD/JPY longs for a long as they did, pocketing more than 1,000 pips.

So we can say that the USD has been trading in a downtrend today, which is a retrace of the bigger uptrend that started three weeks ago. Today's downtrend in USD pairs can be translated as a NZD/USD uptrend.

But in the last few hours, we have seen a retrace of the retrace or a trend within today's trend, which in itself is part of the bigger trend.

Will today´s uptrend resume again?

Will today´s uptrend resume again?

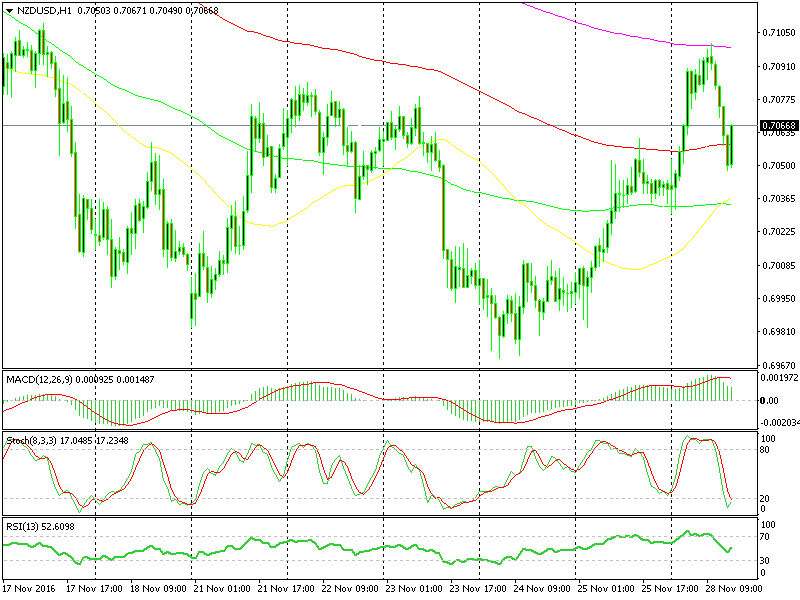

We opened a sell NZD/USD signal up at the 200 smooth moving average (200 SMA) in pink this morning which hit take profit, but now the price has reached oversold levels. So, we considered this as a good opportunity to open another signal in this forex pair, but this time, a buy forex signal.

What persuaded us to take this forex trade?

As we said, although the bigger trend is down, today's NZD/USD trend is up, so that's one signal pointing up. The other signal, according to technical analysis, comes from the stochastic indicator, which has already reached the oversold levels.

The price right now is hanging around 0.7959, which provided resistance on Friday and might turn into a support level now. So there you go, another buying signal. On top of all this, the 100 SMA in red is very close to the price and if the price closes above that on the H1 forex chart, then it will be another solid technical indicator to support the BZD/USD buy scenario. Of course, you never know how a forex trade will evolve; the market can change in a heartbeat, but the technical analysis points up so up we go, too.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account