The Day After the Carnage

Yes, the December FED meeting is over at long last. I don´t really like these anticipated forex events because usually they´re like the New Year´s Eve/Day when you prepare for that kiss the whole year but it doesn´t come. This time, though, the FED delivered the kiss. I guess Yellen is not the kind of girl that lets you down.

The FED increased the interest rates last evening by 25 bps (basis points) and after a short hesitation, the Buck started its journey. Not long after, the FED chairwoman, Yellen, held the usual press conference and she sounded sort of hawkish according to market consensus. She has a habit of being overly cautious, but not yesterday, which took the market by surprise a little.

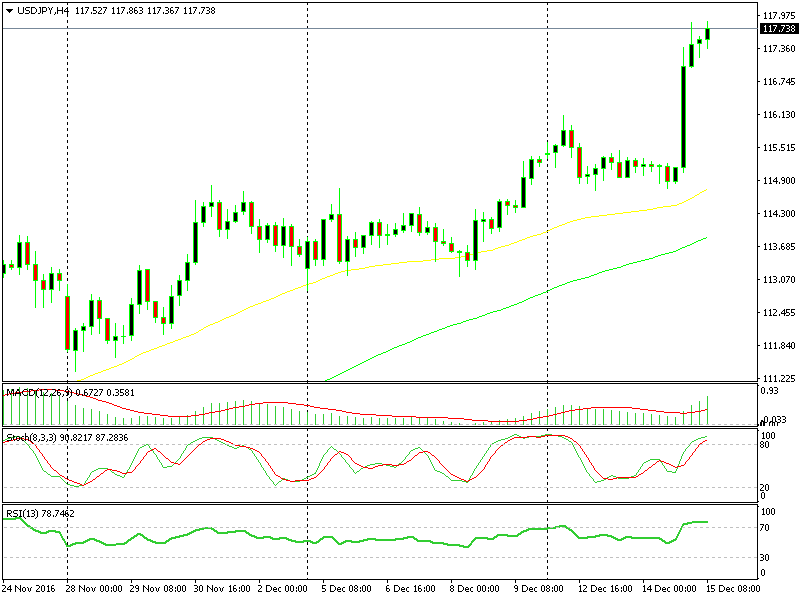

The 1.05 level in EUR/USD is finally broken now that this forex pair has tumbled about 200 pips, while USD/JPY gained 300 pips. The positive Japanese manufacturing data couldn´t match the positive market sentiment towards the USD at the moment.

The USD/JPY uptrend keeps getting stronger.

The USD/JPY uptrend keeps getting stronger.

By the way, the French manufacturing and services PMI was posted a while ago and it was quite impressive, which must be positive for the Euro. But, that´s not enough to face the bearish market sentiment and reverse EUR/USD right now. However, as I said last night, we must keep these sorts of data in mind in order to prepare for the perfect wave in a few months.

Many important resistance and support levels have been broken last evening in most major forex pairs. We´ll be back with you shortly to have a look at the new resistance and support levels.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account