The FED Pushed the Dollar into Overdrive on Wednesday, EUR/USD at its Lowest in 14 Years

I like it when the market makes big moves. It’s always easier to make money in a trending market than in a range-bound market. I hope you stayed on the right side of the prevailing trends today, and you must have made some profits if you held long dollar exposure. You see, trading financial instruments becomes much easier as soon as you align yourself with the prevailing trends. The trend is your friend. That is something that will never change.

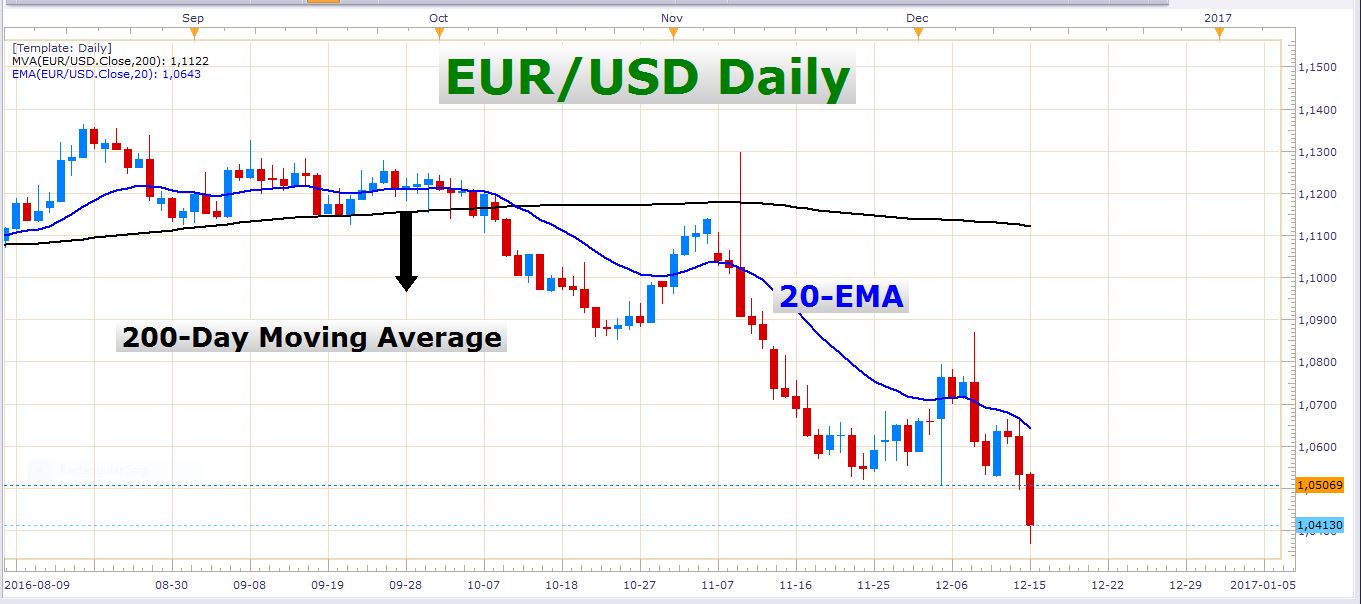

I’m excited about the multi-year lows that were set by the EUR/USD today. Before Thursday, this pair traded in a wide range of about 1200 pips for almost two years. So finally we have a fresh low to work with. The 2015 low, which was broken on Thursday, was a very significant technical level. You can know for sure that every fund manager and every currency trading institution in the world has taken note of what happened in the EUR/USD today. Let’s look at a few charts:

Thursday’s trading volume on the EUR/USD was above average. Volume is very important in trading. High trading volume is often an important confirmation of trend direction. Let’s take this last daily bar as an example. The candle was a large bearish one which closed close to its low. The volume was above average which tells us that there will probably be some follow through selling in the days to come. Of course, there could be a pause or a weak retracement, but the probability of the pair moving lower over the course of the next two weeks is very high.

Some traders like to trade the initial break of a significant level. Others prefer to wait for a breakout-retest setup before entering. Then you get traders who split their position between the two. The breakout has already occurred, so we need to wait for a retracement to achieve the most optimal short entry. Have you ever wondered where the big boys park their orders? Look at the following chart:

Look at the green entry zone on this chart. There are definitely a bunch of large sell orders lying in this region. If we get a retracement into this zone, it could be a great opportunity to enter short. The horizontal black line is at 1.04624, which is the 2015 low.

Parity. A small word, but a massive psychological level for the EUR/USD. With Thursday’s important technical break, parity is the next major level ahead. If the current US dollar strength persists, the 1.0000 level could soon be on the cards. The Eurozone still faces many economic and political risks which could put further pressure on the Euro, and of course, on the EUR/USD.

I’m currently holding short exposure on the EUR/USD and I would like to add some more short positions if we get a run-up into the zones mentioned in the chart above. The EUR/USD is not the only pair with great potential, though. Let’s look at the AUD/USD:

AUD/USD

I have been eyeing this resistance zone for quite a while now. This resistance zone, backed by the 200-day moving average, was just too much for the bulls to overcome. The impulsive decline over the last two days compels us to choose the short side on this pair. I am already short on the AUD/USD, and I think we still have much downside available on this pair.

Of course, there are many other pairs with much potential. On Wednesday evening and on Thursday, I played long positions on the USD/CAD, USD/CHF, USD/JPY, other Yen crosses, and the DAX. I also sold gold for a juicy intraday profit. As mentioned above, I am also short EUR/USD and AUD/USD. The trends on these instruments could easily provide some more profits in the days ahead, so keep an eye open for opportunities on them.

Tomorrow is Friday, which means market participation could wane somewhat as we move into the weekend. Nevertheless, large market movements occur on Fridays from time to time, so don’t be caught off guard.

Have a splendid day in the markets!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account