EUR/USD – A Lost Opportunity?

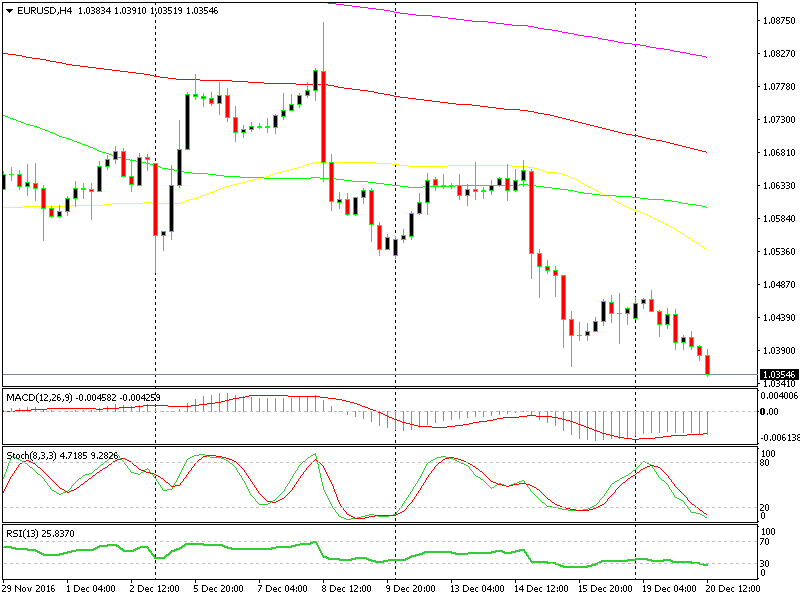

In the past couple of weeks, EUR/USD has lost the will to live, diving head first from 1.0870s to 1.0360s. These sort of moves happen very quickly and you don´t get many chances to embark on the train because the risk/reward ratio is to high, unless you're in from the top.

That said, the direction is set so you don´t have to figure that out, which is a big plus for forex traders since it removes one of the big unknowns in this game. This opens up the door to some good trading opportunities during whatever pullbacks price action might offer, if you can get the entry right.

So, after the latest tumble since the FED rate hike last Wednesday, I have been waiting for a retrace to open a short term signal in this forex pair. After bottoming out last Thursday for the short term, the price has pulled up slowly, thus attracting the interest of EUR/USD sellers.

A trading setup we missed

A trading setup we missed

The 20 moving average (20 SMA) was what I was waiting for. That comes around 1.05 in the H4 EUR/USD chart, which has been a very strong support level for two years. It´s only normal that this support level turns into resistance now that it has been broken. So, I was waiting for the price to get there, but it seems like I waited too long.

The stochastic indicator was oversold when the price reached 1.0480, which is another strong sell signal, yet I held back because I didn't really like the risk/reward ratio. Now the price is about 70 pips lower so that opportunity is dust in the wind. I`m not beating myself up about that because there will be many other trades. Rather than chasing the price, I prefer to wait for the price to come to the levels that my trading strategy points at. Money management is big deal in this business.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account