USD Feeling Alive Again, But Don’t Trust These Moves

We mentioned in the weekly review, as well as on the first update yesterday, that the end of the year is a strange time to trade forex since most forex traders rearrange their forex accounts and square up their long term trades. If you´re wondering why you might have never done this, don’t think too much. I´m talking about guys that run multi-billion Dollar/Euro/Pound pension and hedge funds.

These guys have to review their trade portfolios and reevaluate the strategy for their open or potential trades during this time. Besides that, the multinational companies transfer cash from one country to another for year-end payments. So, don´t be surprised to see strange things happen during this time.

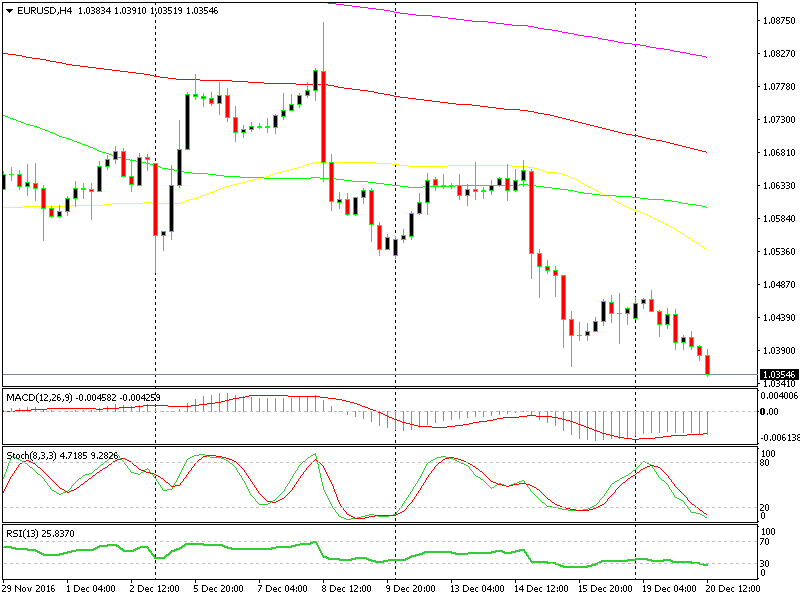

Judging by the price action in the last several winter holiday periods, I have this opinion that we might see some range trading until forex traders come back from the holidays. But the Buck resumed its uptrend yesterday after a two-day retrace. It started moving higher again a couple of hours ago and last week´s bottom in EUR/USD is already gone.

Last week´s low has been breached, but will we see a continuation of this move or will price reverse?

Last week´s low has been breached, but will we see a continuation of this move or will price reverse?

We are seeing some USD gains across the board today, which is the way to go since the USD fundamental analysis is massively hawkish, at least for about a year. But the move still seems pretty slow comparing to what we have seen recently.

This means that although the market might have made its mind made up to go with the Buck, traders are being cautious not to invest too heavy before the new year. So that´s why I´m being careful not to marry a position. That´s what strange means; breaking a support/resistance level before stalling right there or reversing. So, get what you can now and enjoy your holidays because we´ll have plenty of time to ride the long term trends in 2017.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account