US GDP and Goods Orders Not Enough of a Christmas Present for USD Bulls

The USD bulls were so active in November and during the first half of December, but you can't find them anymore nowadays. They have probably packed their bags and ski boots and already left for the holiday or perhaps they made enough profit already, so they're now staying on the sidelines.

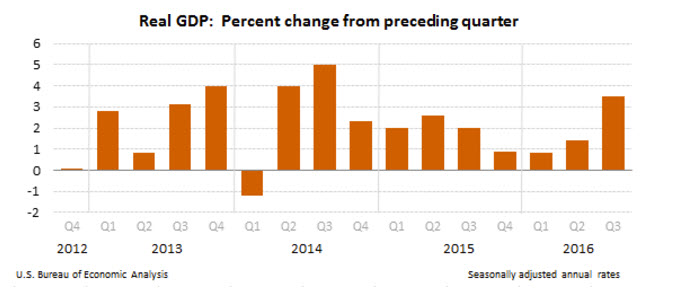

That's because such great numbers would send the Buck surging in normal times, but not today. The second estimate for the US Q3 GDP was 3.2% but the final number today was 3.5%, a great number in my opinion. It's true that Q3 is long past us and we're closing Q4, but it shows that the US economy is doing even better than previously assumed and it already was in a good place.

The uptrend in the recent quarters is evident

The uptrend in the recent quarters is evident

The durable goods orders posted a big miss, but it comes after a great previous reading. This means that there was a big distortion last time which came as a result of soybean exports from what I've heard, so today's miss in goods orders balanced things out.

The core durable orders, which are most important, beat the expectation by 0.3%. The capital goods orders, which exclude the defense and air crafts, came out even better at 0.9%. Yet, the USD buyers are nowhere to be seen. There was some love for the Buck for a few minutes, but that wasn't enough to hit the take profit target of our sell forex signal in EUR/USD. Well, the US buyers might have left for Christmas but they will surely come back and today's US economic data will be enough to start the next leg of the USD uptrend.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account