Dollar Tumbles, AUD/USD Enters Sell Zone

With forex trading, we should never become too comfortable with certain market conditions. Trading is like war, or like staying in South Africa – you need to be wide awake. Today was one of those days which caught many traders off guard.

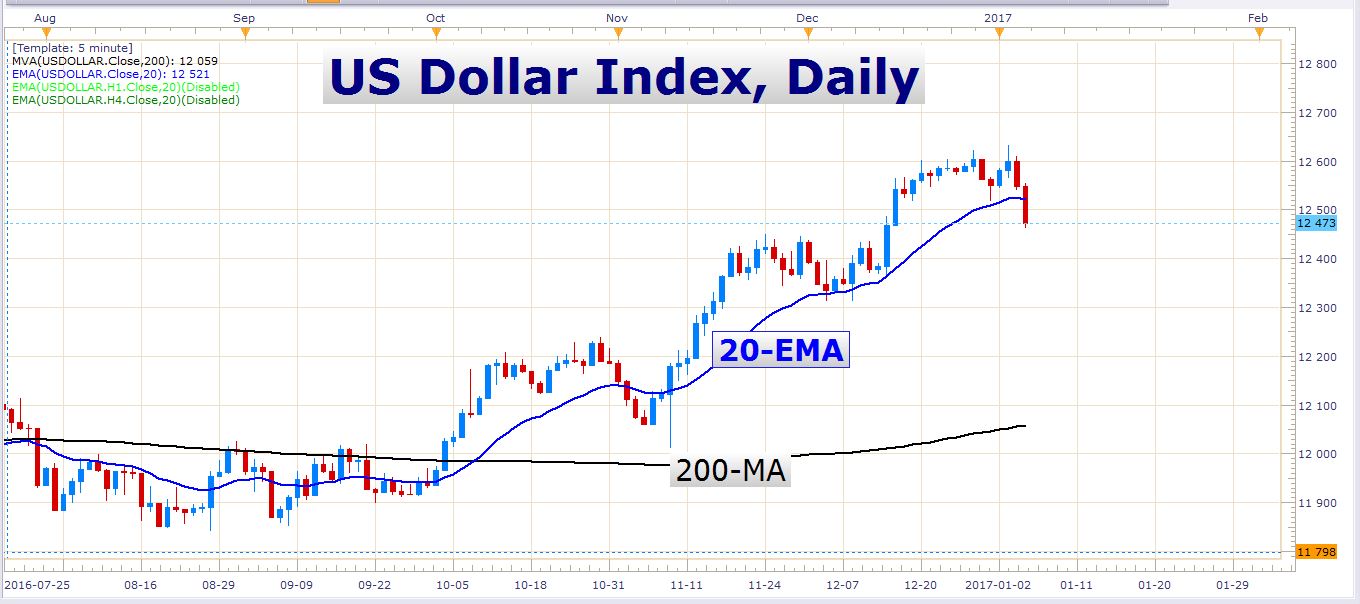

After a very extended winning streak, the US Dollar took a sizeable knock today. This decline is the largest daily decline since September last year. Look at this chart of the US Dollar index:

Many institutions and traders are engaged in long US Dollar exposure. Some have already trimmed some of this exposure during today’s decline, however.

This aggressive type of decline has certainly stopped out many traders, and if it continues, there should be some more casualties along the way. All the other major currencies advanced against the Dollar today. What’s going on with Buck?

AUD/USD – What’s Happening Down Under Mate?

The Australian Dollar certainly doesn’t like being down under! This currency posted another impressive gain against the US Dollar today.

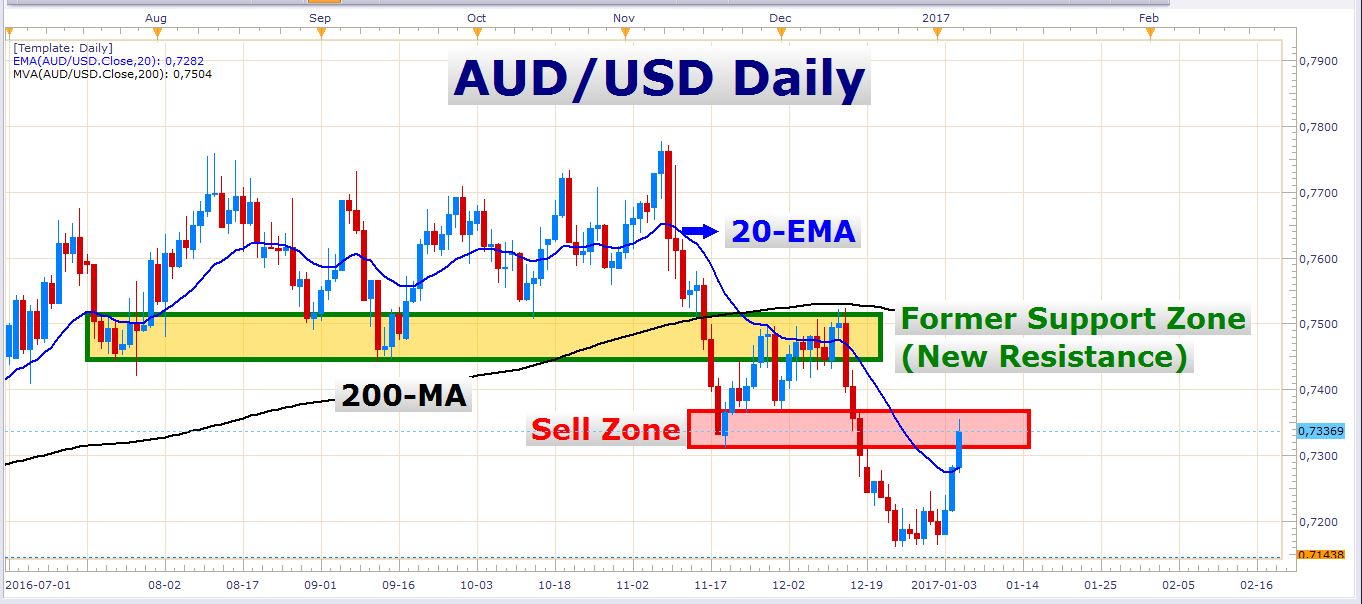

In the previous article, I wrote about the Australian Dollar’s impressive defense against the strong US Dollar. On that particular day, the Australian Dollar performed much better than the other major currencies. Let’s look at a daily chart of the AUD/USD:

This is quite an impressive rise in the exchange rate. Look at the sharp angle at which the pair advanced over the last few days.

Just because the Aussie has popped up into an attractive sell zone, it doesn’t mean we should just pull the trigger right away, especially when we see such a very aggressive rise into resistance. I am always careful when I see such aggression. So how can we tackle this situation without getting our fingers burnt?

It’s actually very simple. Wait for the right price action trigger. The ideal would be a juicy daily pinbar candle with a large range and a long wick. Let’s say a range of about 80 pips or more, with the candle preferably closing lower than its open. This is my picture perfect of a good reversal signal in this particular instance.

Of course, we might not get the perfect entry signal, and there are several different signals we can use, but the bottom line is, that we need to get some sort of confirmation that the bears are starting to fight back again before we take action.

A conservative target would be the last major swing low at 0.71600.

Although this setup has great potential, I’d like to stress it again that we need to get a solid price action signal first, before can enter a short trade.

NFP Friday is Here

Tomorrow we have the release of the notorious US Nonfarm Payrolls numbers at 13:30 GMT. This is the most anticipated piece of US economic data and is released on a monthly basis. Of course, the unemployment rate and participation rate numbers will also be released, as well as some other data.

At the same time, the Canadians will release their employment change numbers, which is also a very important piece of economic data.

Have a splendid day in the markets!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account