The Euro Continues Its Slide as Draghi and European Election Polls Weigh

The ECB (European Central Bank) president Mario Draghi is at the European Parliament today and he´s talking inflation. The ECB dismissed any inflation claims in their last meeting a few weeks ago, but only a few days later we saw some of those guys admit inflation individually.

Now though, we see the ECB reverse its position again. Draghi said that inflationary pressures are really subdued. He´s arguing that this sort of inflation is not self-sustaining and he´s right to some degree.

We now that higher oil and energy prices have been a major factor in the recent inflation pickup. Besides, the ECB and BOJ (Bank of Japan) are also pumping cash into the financial markets for their QE programmes, which obviously puts upside pressure on the prices.

By the way, former PIMCO chairman also pointed this out not long ago. He said that without the ECB and BOJ QE programmes, the US economy would probably be in recession right now.

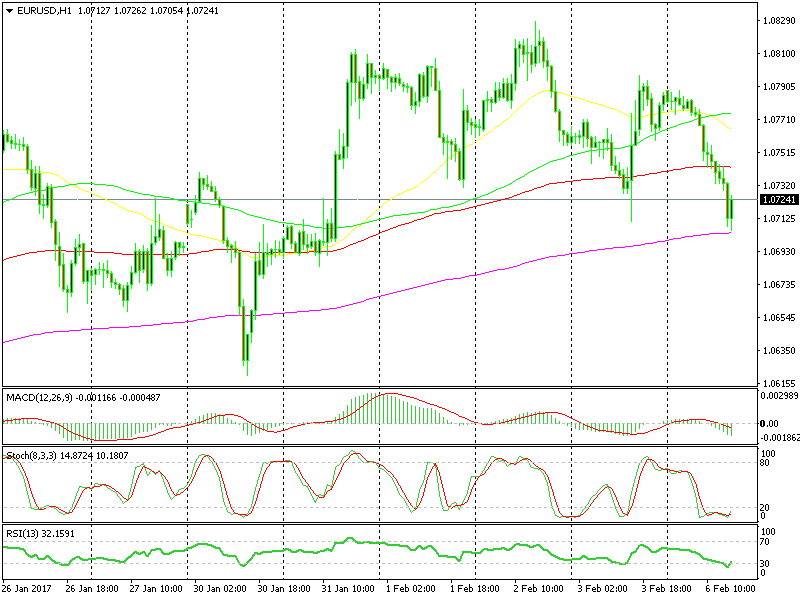

The 200 SMA is holding on

The 200 SMA is holding on

In the meantime, EUR/USD continued to slide until it reached the 200 smooth moving average in pink in both H1 and H4 forex charts.

Right now, this forex pair is about 20 pips above the lows. The 200 SMA and the 1.07 level seem to be pairing up into providing some solid support for now. So, we can say that the 1.07 level is a good spot to look for a short term buy position.