USD/JPY – Another Support Level Gone

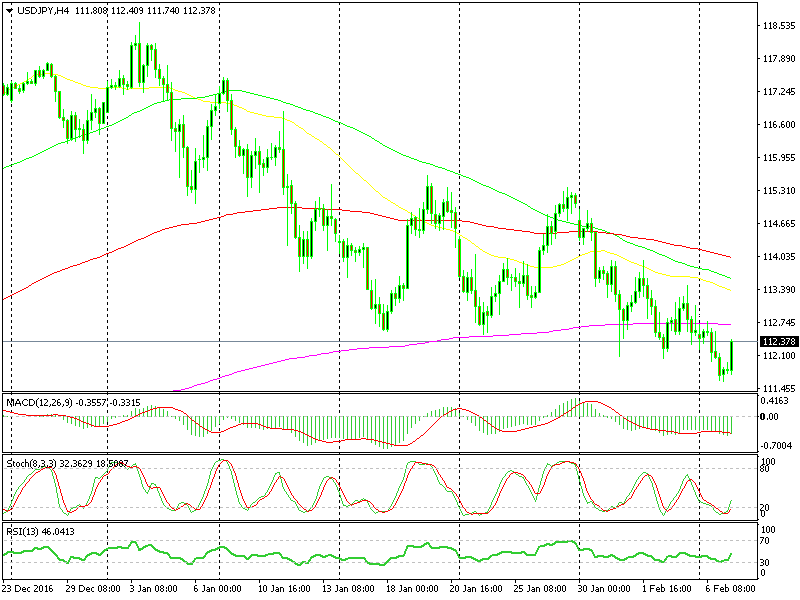

USD/JPY has been in a very strong uptrend during the last two months of 2016. But this year it seems that the trend has reversed, at least in the near term.

During this move lower from the top at the end of January, 112.50 became strong support at first. But with Trump targeting the Buck, that support level had to let go at some time.

After that, the 112 level came into play and we have highlighted it many times in our updates recently. It survived several attempts from USD/JPY sellers and reversed the price 150-200 pips higher a couple of times.

You could argue why we didn´t open a long term buy forex signal down there, but the fundamentals don´t favour the upside in this forex pair right now. Trump is moaning about the weak Yen and strong Dollar, while the market sentiment is sort of horrible at the moment, which is weighing on this pair.

I can´t go against such a downtrend.

I can´t go against such a downtrend.

The H4 USD/JPY chart above shows that this support level had no other options but to let go at some point. The highs were getting lower and so were the lows, which means that sooner or later, something´s gotta break.

So, that´s why we hesitated to open a long term trade at 112. The best place for me to consider longs in this pair is at around 110. It is a big round number, has provided support and resistance before, and a couple of moving averages are sitting around there. See you down there, guys.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account