Forex Versus Commodities – Where Will We Find the Big Action This Week?

The markets have generally been tough to trade in the last couple of months. The GBP/USD has been trading in a wide range for about six months while the EUR/USD has been trading in an even larger range for about two years. Yes, we saw a multi-year low in the EUR/USD early in January, but this was merely a false breakout from this large range.

The AUD/USD, USD/CAD, USD/CHF, and the USD/JPY are also trading in ranges at the moment. Surely, there have been good trading opportunities within these ranges, but the massive moves we’re all looking for have been mostly absent. You see, it is generally much easier to make money in trending markets than in a ranging environment, especially for less experienced traders.

AUD/USD – Facing Some Stubborn Resistance

AUD/USD Weekly Chart

AUD/USD Weekly Chart

The AUD/USD has been trading in a well-defined range which spans about 600 pips. The price is currently hovering in an important resistance zone which is still standing despite many onslaughts against it.

The slow stochastics indicator, which oscillates between overbought and oversold levels, is basically overbought at the moment.

This doesn’t mean we should pull the trigger immediately, of course. We need to consider many other factors, which includes the candlestick formation. This latest weekly candle is a rather aggressive bullish candle, and it could be dangerous to sell this pair directly after an impulsive rise like this.

The ideal trigger would be to see a strong bearish rejection candle at this range resistance, either on a weekly or a daily chart. This would be the last piece of the puzzle we need for the conviction to take a short trade backed by the confluence of several bearish factors. The first factor being that the price is currently situated at the range top. The second being the overbought nature of the pair, as indicated by the slow stochastics indicator. The third factor being this decent price action trigger which we're still waiting for – a strong bearish rejection candle confirming that the range is still in play. Here is an example of one of the types of bearish rejection candles, the pinbar:

GBP/JPY Daily Chart (2014)

GBP/JPY Daily Chart (2014)

Now, let’s look at the commodity market which is more exciting than FX at the moment…

Gold – Close to a Big Fib Level

Gold Daily Chart

Gold Daily Chart

As you can see in this chart, the gold price has retraced much of its recent losses. This bounce has run into some resistance between the 50% and 61.8% Fibonacci levels, however.

The zone between these two levels may provide good value to traders looking to short gold again. The 61.8% Fibonacci retracement is known to offer great trading opportunities in the opposite direction of the retracement. I’ll be keeping an eye on this zone for sell signals in the week ahead.

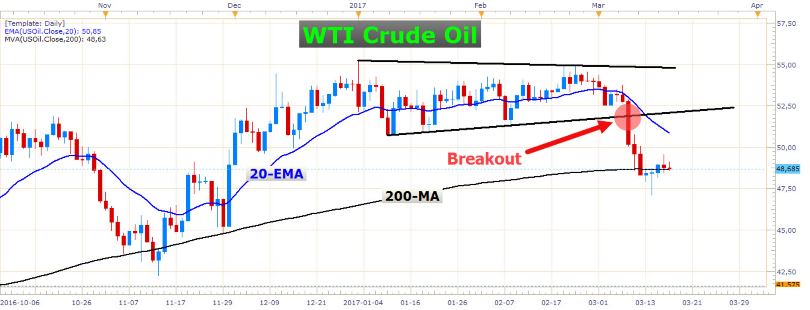

WTI Crude Oil – This is Exciting!

WTI Crude Oil Daily Chart

WTI Crude Oil Daily Chart

WTI Crude traded in a really tight congestion from December 2016 until the first few days of March this year. Long lasting, tight consolidations like this often lead to powerful breakouts when they eventually break. It’s almost like a lot of energy is built up when a consolidation is really tight and lasts for a substantial time. This is exactly what happened in this case. The range floor broke and the price fell a few dollars in no time.

The fact that the price broke through the $50 per barrel level so convincingly is really encouraging if you’re bearish. This is a significant psychological level which could turn out to be an important resistance level in the weeks ahead.

We can expect the bears to follow through with more selling in the next week or two. I’ll be on the lookout for bounces to sell. The impulsive nature of this recent leg lower strongly suggests that more selling could be on the way soon.

Have a profitable week!