Counter-Trending

As we said in the previous market update, Euro pairs have been in an uptrend with EUR/USD, gaining about 300 pips during this month. The move in EUR/USD has been partly due to USD weakness and partly due to Euro strength.

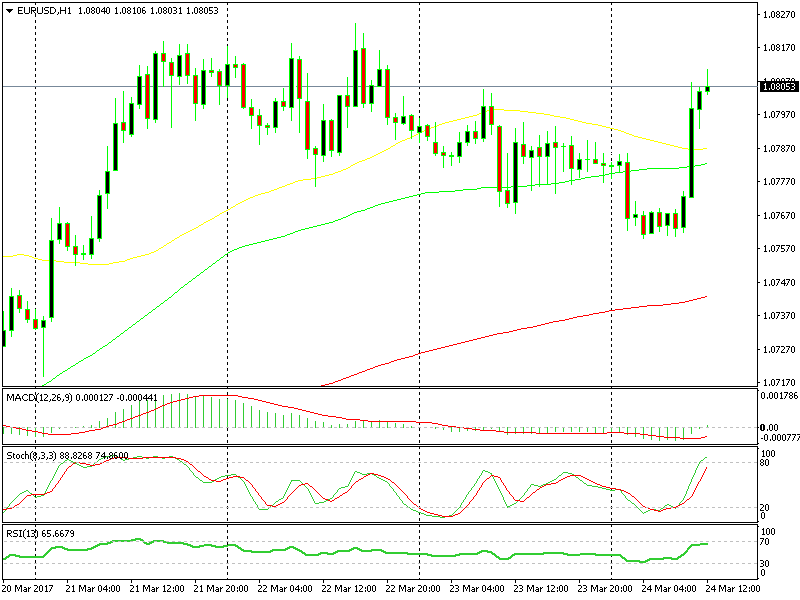

In the last couple of hours or so, this forex pair jumped up above 1.08 once again. Based on this we can say that this level has seemingly lost importance if we look strictly look at support and resistance levels.

We know that these massive levels have a 20-30 pip buffer zone on either side, so the real resistance right now comes at 1.0820-30.

We just opened a short term sell forex signal at 1.0808, which goes against the trend, but I think that there´s a good chance of grabbing 20-25 here.

The highs are actually getting lower – that´s another positive sign for us

The highs are actually getting lower – that´s another positive sign for us

I would have loved to wait until 1.0820, but judging by the price action this might be the top for now. The price couldn´t move above 1.0810 after the great Eurozone economic data this morning. It also hasn´t been able to do so in the last couple of hours either, despite being close.

This sort of price action signals that Euro bulls get cold feet around the 1.08 level. Personally, I haven´t felt any buying pressure around here in the last week or so around this area. So, I think that we have some good chances shorting this forex pair right now right here, despite counter-trending.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account