The Weakest Link – Let’s Stick To AUD Shorts

Yesterday we highlighted the weakness in the AUD pairs. The RBA (Royal Bank of Australia) posted the minutes from its last meeting. The comments were on the dovish side, so the Aussie has been sliding ever since.

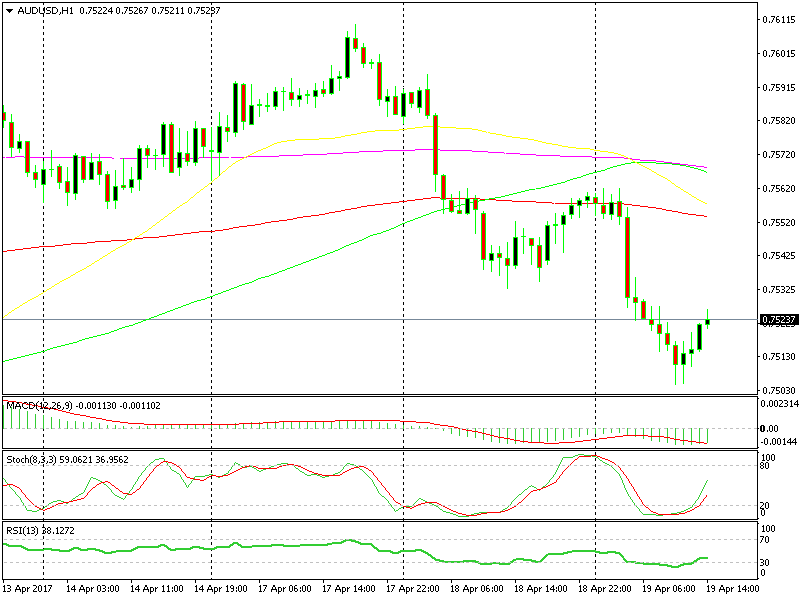

It looks like this is the beginning of another bearish trend for the AUD. Looking at the charts of forex majors, we can easily see that AUD/USD has been the only one to decline in the last two days, while the rest of the major currencies are substantially higher than the Buck.

That reinforces the idea that the AUD is the weakest link among majors. Once this wave of USD dumping is over, AUD/USD will likely appear even weaker.

This was the idea behind our sell forex signal in this pair yesterday. We opened it last night when the price reached the 100 SMA on the H1 forex chart and it didn´t take long to reach TP.

Let´s wait for a retrace before shorting AUD/USD

Let´s wait for a retrace before shorting AUD/USD

Right now this forex pair is extremely oversold so we´re staying out for the moment. But once we complete a retrace on the hourly chart we´ll try to pick another selling spot.

The best place would be yesterday´s low around 0.7535-40. By that time, moving averages will catch up with the price which would be a confirmation for the sell signal/trade. Let´s wait for a retrace here, because other forex majors have become extremely volatile and unpredictable right now.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account