Euro Slips As Draghi Plays His Hand

A little while ago, we opened a long-term signal in EUR/USD with the idea in mind that ECB president Draghi would try to talk the Euro down since they don´t like EUR/USD above 1.10. That would make it difficult for inflation to reach the ECB targets.

Speaking of inflation, Draghi said that the mandate of the ECB is inflation itself and not growth. That gives him some time because Eurozone inflation took a hit in March, while German inflation numbers today missed expectations as well.

EUR/USD is not substantially lower mainly because of current market sentiment towards the Buck, but 50 pips are enough for now. This tells us that the market took Draghi's statement as dovish.

In my view, these were the comments that sent the Euro down:

- Does not see a need to deviate from the comments in the opening statement

- We have not discussed exiting stimulus

The market is expecting a date for the beginning of the end for the monetary economic stimulus program and a change to a more hawkish sentiment, but Draghi refused both this time.

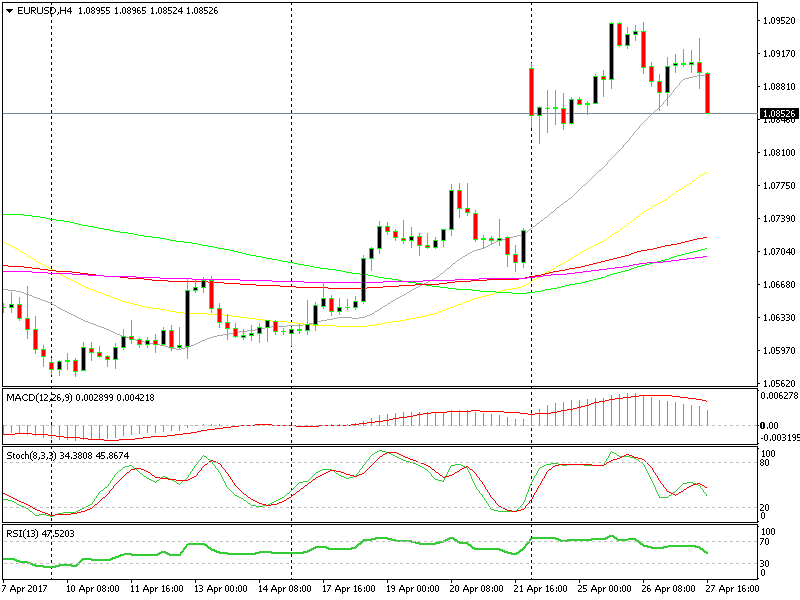

We finally broke below the 20 SMA (gray)

We finally broke below the 20 SMA (gray)

The Euro is still on the slide and I think that if the sentiment turns positive for the Buck in the following trading sessions, EUR/(USD might reach 1.07 and even 1.06 soon. Let´s hope it does since our forex signal here is looking pretty good at the moment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account