US GDP Misses But Inflation And Wages Keep The USD Afloat

Another GDP report today and another miss. Actually, there were two GDP reports released at the same time; the US and Canadian GDP figures, both of which disappointed.

The Canadian economy was expected to grow by 0.1% in Q1 2017 but it remained flat, although we will have a thorough look at this when we analyze USD/CAD.

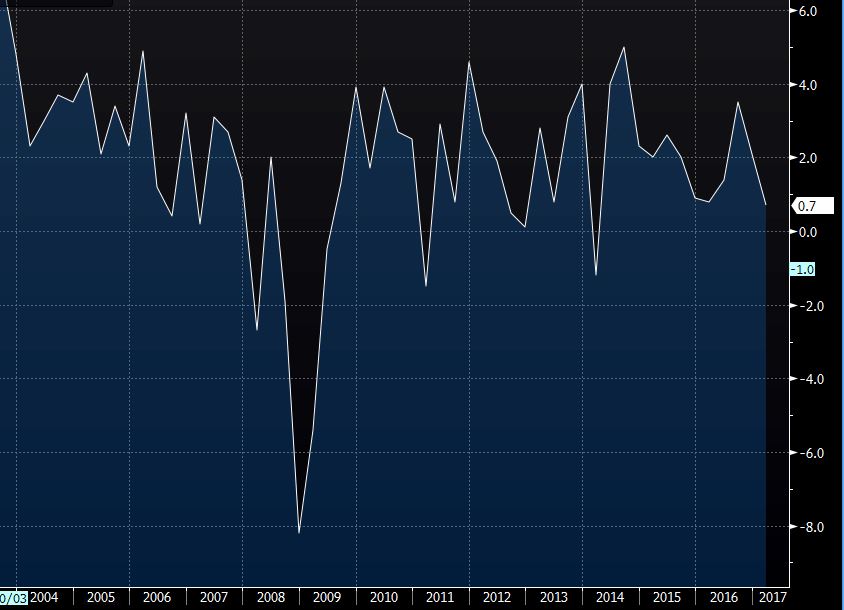

The US GDP miss was even bigger because the actual number was 0.7% while expectations varied from 1% to 1.3%, which is the lowest reading in the last 3 years.

A big miss but we remain within the range

A big miss but we remain within the range

It gets even worse when you see that consumer spending declined as well, from 0.8% in the previous reading to 0.3% in Q1.

But fortunately for us, since we have a long term sell forex signal in EUR/USD and a short term signal in AUD/USD, the USD is staying afloat. In fact, it is charging against most major currencies as I speak.

So, what's the reason for this? The reason is inflation and wages, both picked up and that´s what the forex market is most interested in right now.

GDP price index rose by 2 points from Q4 2016, while the employment cost index jumped to 0.8% from 0.5% previously. So, GDP doesn’t look good but the FED´s mandate is inflation and growth. Inflation is picking up as we said, while the jump in wages shows that the labor market is getting tighter.

As you can see, it´s this last two pieces of data which are driving the market at the moment and that´s going in favor on our forex signals, so looks like we will have another winning forex signal in AUD/USD.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account