A few weeks ago we were thinking about opening a long term sell forex signal in USD/CAD. This pair had been inching higher for quite some time, following oil prices, but in the opposite direction. Oil prices were declining and had already lost nearly 10 cents since they topped out a few weeks beforehand.

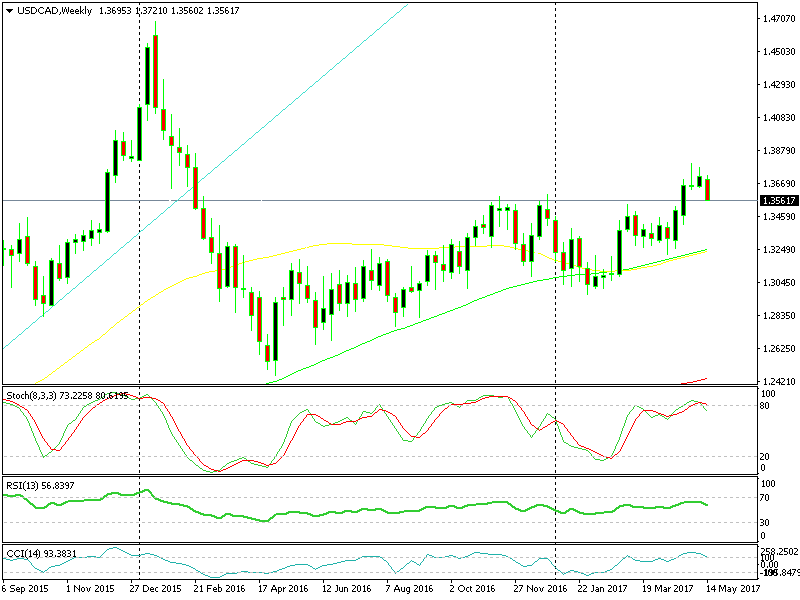

So, USD/CAD was oversold on all time frame charts, particularly on the weekly and monthly charts, and oil prices were looking like they reached a bottom, for the time being. Hence, the idea to open a long-term sell signal in this forex pair.

We didn´t open that signal at the time and this pair is about 200 pips lower now from the top near 1.38, but the opportunity is still there.

Technically, the weekly chart looks bearish

Technically, the weekly chart looks bearish

As you can see, the weekly chart is still overbought and headed down, so the retrace or the reversal has just started. There´s still a lot of potential to the downside if the reverse takes place for real.

The Canadian inflation and retails sales might provide the ignition for the reverse. Retail sales and CPI (consumer price index) will be up shortly. We´re expected to see some positive numbers, but if the reversal is to happen, then there should be some positive deviation in today´s economic figures.

If retail sales and CPI even slightly exceed expectations, that would be seen as positive for the CAD. So this might be the time to open that long-term sell signal, although, we have to see the data first.