You Can’t Deny The Buying Pressure In EUR/USD

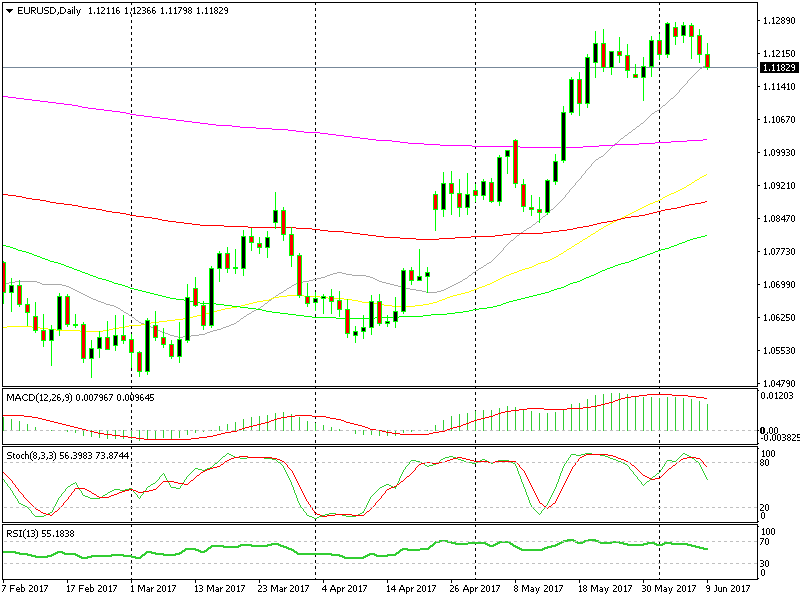

EUR/USD has seen a lot of upward pressure in recent months. The main reason for this uptrend is the positive sentiment that´s surrounding the Euro, though the negative sentiment towards the USD has done its part too.

Today´s statement from the ECB (European Central Bank) was sort of dovish, which should have sent the Euro diving 200-300 pips, but not today.

EUR/USD only lost about 50-70 pips today and even that has been reduced to around 50 pips now. The price moved below 1.12 a couple of times, but each time the buyers jumped quickly and took it back above this support level.

A similar thing happened last week when EUR/USD retraced lower, but it couldn´t even reach 1.11. The lowest this forex pair has moved to since the 400 pip surge two weeks ago, is 1.1075 in the same week.

This sort of price action shows that the buying pressure is there and it is increasing since the lows are getting higher. There is a top in place at 1.1270-80 at the moment, but if we don´t move lower soon I doubt it will last very long.

So, inflation and the ECB rate hikes aren't going anywhere soon and yet, every dip in EUR/USD is being bought by buyers. That tells you that money is flowing towards Europe and that´s probably because the asset prices are still low since the 2008 crisis.

A decent retrace is overdue, but we don´t know when this uptrend in EUR/USD will end. So, we will keep checking the price action to search for clues, such as lower tops.

The previous low at 1.1110 needs to be broken so we can consider this as a proper pullback

The previous low at 1.1110 needs to be broken so we can consider this as a proper pullback

Update: 1.12 has been broken and the price is threatening the 20 MSA (grey). Let´s see how far this latest pullback reaches.