BOE Turns Hawkish But Is It Really Justified Or Will GBP Plunge?

The BOE (Bank of England) meeting today was supposed to pass without any surprises, but they had something planned for us. The vote to hike interest rates was 7-0-1 previously in favor of the status quo and it was meant to remain the same.

But Sounders and McCafferty joined Forbes in favor of a rate hike. It doesn’t mean that they will hike the interest rates or start tightening the monetary policy anytime soon, but this is a hawkish shift in their policy.

It makes you think that they might know something that we don´t about the UK economy. But after reading the statement, I think that they don´t know much.

They say that inflation has picked up considerably and at 3% this is true, but they also acknowledged the weaker consumption and wage growth. In fact, the statement was quite dovish which doesn’t explain why there are now three votes to hike the rates.

It´s true that inflation is worryingly high but the economy is not in the best place either, Theresa May managed to make a mess of British politics a week ago and Brexit looms, as we mentioned in the previous forex update.

I think the market will soon understand that there won´t be any rate hikes soon unless something extraordinary happens, and the Pound will start reversing soon.

So, I think that this is a good time to start thinking about a long-term GBP short trade. The trade will probably be against the USD, but I will write a proper market update tomorrow about why now is a good time to look for such a trade.

The trend is your friend, right?

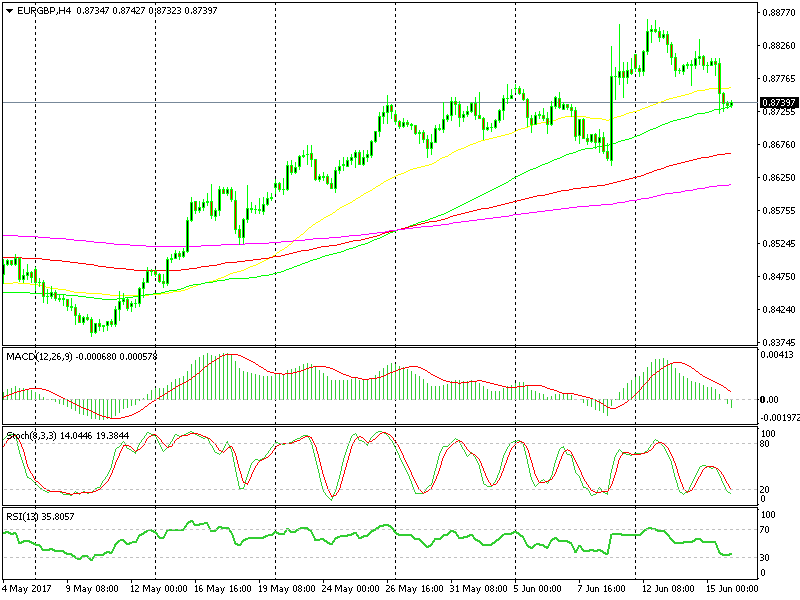

By the way, we just opened a buy forex signal in EUR/GBP because this pair is oversold on the H4 chart, while the 100 SMA (green) is providing support.