Are You Ready to Play the CAD? – Two Reasons for Continued Loonie Strength

As you may have noticed, the major currency pairs have recently not been producing the powerful, consistent trends most traders are dreaming about.

Trading is generally much tougher when the instruments you’re watching aren’t moving enough for you to hit large targets and achieve big reward-to-risk ratios. In powerful trends, this is often not too difficult if you have a good strategy and, of course, the necessary discipline.

Luckily, there is one major currency which was catapulted into motion this week by central bank remarks – the Canadian dollar or the Loonie.

Before we examine the Canadian dollar technicals and fundamentals, let me give you a bit of background of the Canadian dollar and the most important CAD pair, the USD/CAD.

About the Canadian Dollar and the USD/CAD

The Canadian dollar, or Loonie, was the sixth most traded currency in 2016. The USD/CAD, which is a major currency pair, was the 5th most traded pair in 2016, with an average daily turnover of $218 billion. Impressive, isn’t it?

The USD/CAD is a popular pair among investors because of its immense liquidity and reasonable volatility.

Because the United States is Canada’s most important trade partner and because the U.S. dollar is the world’s most prominent currency, the Canadian dollar is mostly valued in terms of its big brother (the USD).

The Two Big Neighbors

The United States is Canada’s largest trading partner by far. The Canadian economy is largely dependent on commodity exports of which oil is the most important product.

Because of Canada’s great reliance on exports to the United States, the state of the U.S. economy affects the Canadian economy directly.

Obviously, the USD/CAD exchange rate plays an important role in the profitability of Canadian exports to the U.S., on which it is so dependent.

For example, when the Canadian dollar weakens, it supports Canadian exporters in that they get more money for the same products, which makes them more competitive.

Both the Canadian dollar and the U.S. dollar are backed by strong, established economies.

The Canadian Dollar as a Reserve Currency

I’m sure you know that the U.S. dollar is the world’s primary reserve currency. But did you know that numerous central banks also keep the Canadian dollar as a reserve currency? The Canadian dollar is kept by many banks in South- and Central America and has played an important role in the Bahamas since the 1950’s.

Oil and the Canadian Dollar

As I already mentioned, Canada’s most important export commodity is oil. This means that Canada smiles when the oil price bounces and frowns when it falls.

The Canadian dollar is highly correlated to the oil price. This makes the Canadian dollar vulnerable to volatility in the price of oil, which is the most traded commodity on this planet.

Compared to some other oil producing countries, Canadian oil producers need to work harder to extract oil which makes it more expensive. For this reason, the Canadian economy (and hence the CAD) is especially sensitive to fluctuations in the oil price.

With a sudden rise in the oil price, the USD/CAD could be expected to decline because a stronger CAD means this pair will move lower. (Provided that the USD doesn’t strengthen proportionately, or more, for some reason).

New Instruments in Our Forex Signals Service

We’ve recently incorporated some exciting new financial instruments into our trading signals service – gold and crude oil. For more information on how to use our profitable signals and how to trade these two volatile commodities, simply click on the links above.

So Why Could We Expect the CAD to Rise Even More?

1st Reason: Positive Fundamentals

Perhaps you’ve read the live market update (BOC Turns Hawkish – Is This The Start Of Another Downward Move?) by our leading analyst, Skerdian Meta, which he posted on Monday.

In this article, he talks about how the BoC (Bank of Canada) has been ignoring the recently better economic conditions until basically this week.

One economic indicator that specifically caught my attention, is the Canadian employment change number (of May) which shattered expectations with an impressive 54,500 new jobs that were created.

It’s like their eyes have opened all of a sudden and they realise that the interest rate cuts they did two years ago have had the desired effect on their lagging economy.

Both Stephen Poloz (governor of the BoC) and Carolyn Wilkins (senior deputy governor of the BoC) have uttered hawkish comments about the state of the Canadian economy. These comments moved the Canadian dollar in a really positive way, of course.

Although the outlook for the Canadian economy and the CAD looks good at the moment, we should keep in mind that its economic recovery would be aided by a weaker currency.

Therefore, the BoC may not be in too much of a hurry to hike rates. Nevertheless, if the Canadian economy keeps gathering pace, the BoC won’t be able to delay rate hikes for too long.

What I like about this situation, is that we could be in the early stages of a sustained economic recovery in Canada. If this were the case, the outlook for the Canadian dollar could be really great over the next few years.

If we were to see a steady appreciation of the Loonie over the course of the next two or three years, now could be a great time to engage in long-term long (buy) positions on the Canadian dollar.

With all that said, let’s take a look at a few charts and see what we can glean from the technical side.

2nd Reason: Positive Technicals

Let’s first look at the USD/CAD:

USD/CAD Daily Chart

USD/CAD Daily Chart

This week’s price action on the USD/CAD has punched through two important technical levels. The first level that was breached is the 200-day moving average (the black moving average). Secondly, an important swing point was breached (marked with the red circle).

Although the price didn’t close below this swing point today, it has been breached and will probably not hold much longer.

Impulsive Selling

Can you identify the impulsive selling that has brought the pair lower over the course of the last couple of weeks? One of the characteristics of impulsive price action is the formation of long, aggressive candles in the direction of the impulse.

During this decline, the average range of the bearish candles is much larger than the average range of the bullish candles. Clearly, there was a substantial market imbalance.

Head and Shoulders

Furthermore, the USD/CAD daily chart reveals a head and shoulders pattern which may point to further losses. You will see it clearly in the following chart:

USD/CAD Daily Chart

USD/CAD Daily Chart

We don’t have a perfectly clear neckline in this instance, but the black line on this chart gives us something to work with. The other option for a neckline is the 200-MA which has also been broken.

I’m not too fond of trading head and shoulders patterns but there certainly is much value in this technical pattern. Whether we like head and shoulders patterns or not, we have a lower swing high and a lower swing low in play, plus the price has broken below the 200-day moving average. All these are characteristics of a downtrend.

Now let’s look at a weekly chart to get a better idea of the bigger picture:

USD/CAD Weekly Chart

USD/CAD Weekly Chart

Here we can see that the price has broken below the 20-EMA and the 50-EMA. The 100-EMA and the purple trend line are at the same level.

As you can see in this chart, this is the critical level that has supported the price for more than a year. I’m not so sure if this support level will hold much longer, though.

Keep an eye on this important level, as a convincing break below it should mightily enforce the bearish tilt on this pair. Also, this supporting trend line could turn into a sturdy level of resistance after it gets broken:

USD/CAD Weekly Chart

USD/CAD Weekly Chart

Other CAD Pairs to Watch

Since Wednesday’s (2017/06/14) FED interest rate hike, the U.S. dollar has recovered some of its recent losses.

With this recent dollar strength in mind, there might be some weaker currencies (than the dollar) to buy the Canadian dollar against. This can be more advantageous, especially to shorter-term traders.

Long-term traders should be able to get a good bearish play from the USD/CAD, seeing that the U.S. dollar is currently in a downtrend. I doubt whether Wednesday’s rate hike by the FED is enough to turn around the Buck.

Also, the bounce caused by this rate hike wasn’t majorly spectacular. On a daily chart of the U.S. Dollar Index, the price is currently sitting on the 20-EMA. Here is the chart:

U.S. Dollar Index Daily Chart

U.S. Dollar Index Daily Chart

Does it look like a FED rate hike occurred two days ago? Not at all.

So the other CAD pairs I have in mind, are the CAD/JPY, GBP/CAD, and the EUR/CAD. It’s not to say these pairs will work better than the USD/CAD, but they are certainly good candidates.

For today, let’s only look at the CAD/JPY which has pushed aggressively higher in the last couple of days:

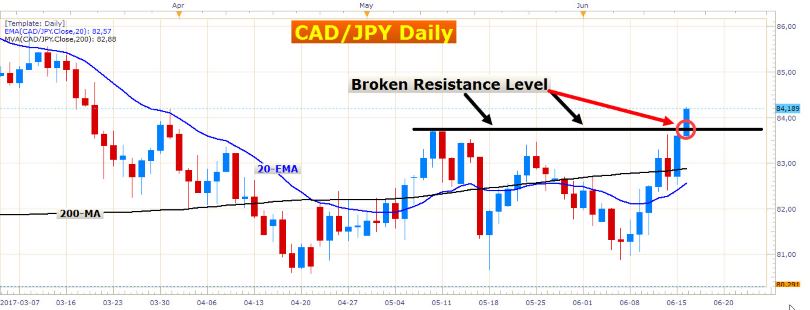

CAD/JPY Daily Chart

CAD/JPY Daily Chart

The price has broken through this important resistance level and is firmly trading above both the 200-day moving average and the 20-EMA. I’ve been trading this pair in the last couple of days and took some profits right at this black line of (former) resistance.

The ideal situation would be if the price pulled back to this black line of former resistance and respected it as new support. A daily rejection candle off of this line can be a powerful trigger to go long again.

With all that said, if you’re going to trade the Loonie in the weeks ahead, try to match it up with some of the weaker currencies. At the moment, the other commodity currencies like the Australian dollar and New Zealand dollar are relatively strong, so try to avoid them, at least for now.

By the way, don’t forget that we have a plethora of valuable information on our website which includes trading strategies, live market updates and morning briefs by our experts Skerdian and Arslan, broker reviews, and of course, our prized forex signals.

Profitable trading!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account