Just a while ago we opened a sell forex signal in AUD/USD. I was actually looking at EUR/UD but decided to go with AUD/USD instead for a few reasons.

Trading between 2 moving averages

Trading between 2 moving averages

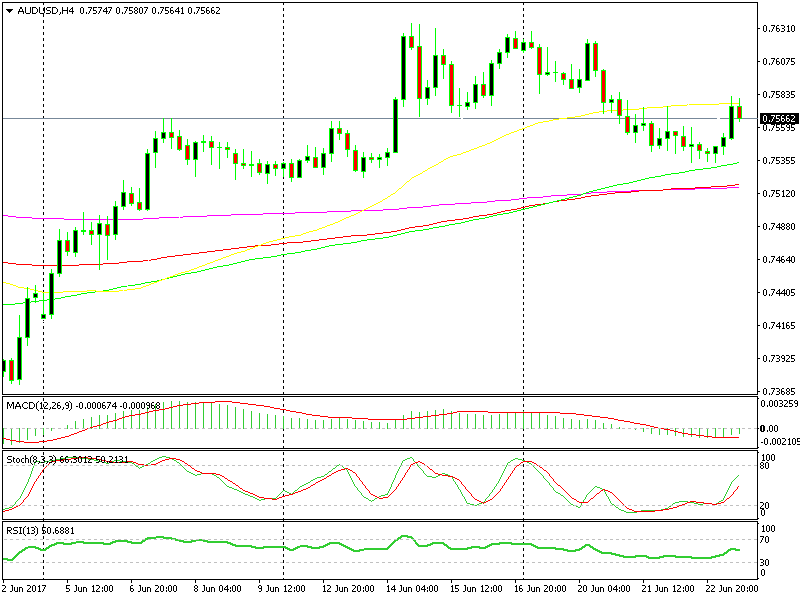

- The previous candlestick formed an upside down hammer which is a reversing signal after a uptrend

- The hourly forex chart is overbought

- The H4 chart is almost overbought as the stochastic indicator approaches the top of the range

- The 50 SMA yellow is providing some solid resistance as you can see from the forex chart above

- The Australian Dollar has been the weakest among major currencies, so it´s safer to go against the weakest link

Besides the above reasons for our sell forex signal in AUD/USD, this pair has been declining in the last 4 out of 5 trading days, which means that the momentum on the daily chart is down.

So, this 50 pip climb today in the H4 chart is more of a retrace of the downtrend. Although the bigger trend is up there´s an even bigger trend which points down, hence the short term signal.

New Instruments in Our Forex Signals Service

We’ve recently incorporated some exciting new financial instruments into our trading signals service -gold and crude oil We will add more instruments soon, such as CryptoCurrencies, so keep an eye out for analysis on these new instruments.