A Perfect Bearish Setup In AUD/USD… And We’re On The Right Side

On Friday, we decided to open a long-term sell forex signal in AUD/USD. Though this pair was in an uptrend at the time so it might not have seemed like a good idea, now we´re about 100 pips in profit. We are now perfectly positioned to take advantage of a great bearish setup.

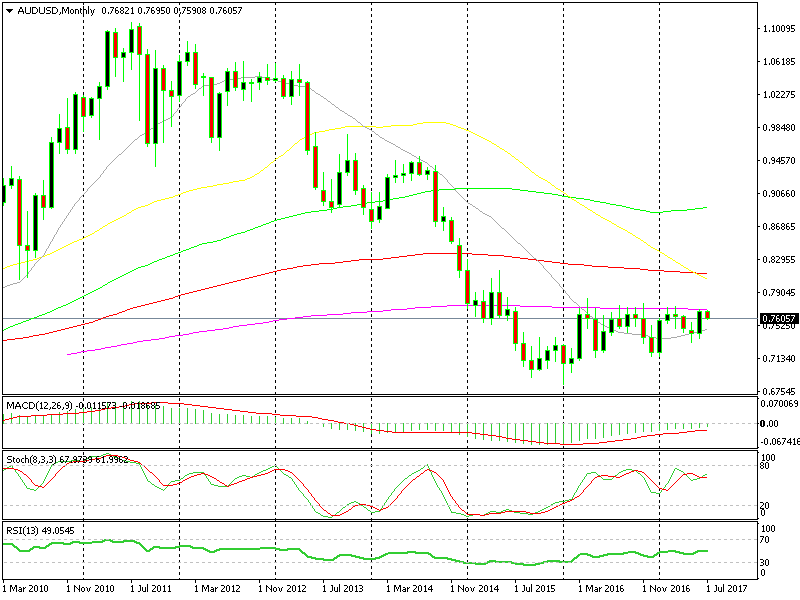

The 200 SMA is working again

One of the reasons we decided to open the signal was the picture in the monthly forex chart. If you look at the chart above, you can see that the 200 SMA (purple) has been killing all buyer attempts to take this forex pair higher over the last two years.

So, we thought that this moving average was the perfect selling indicator and the pair was just standing below it.

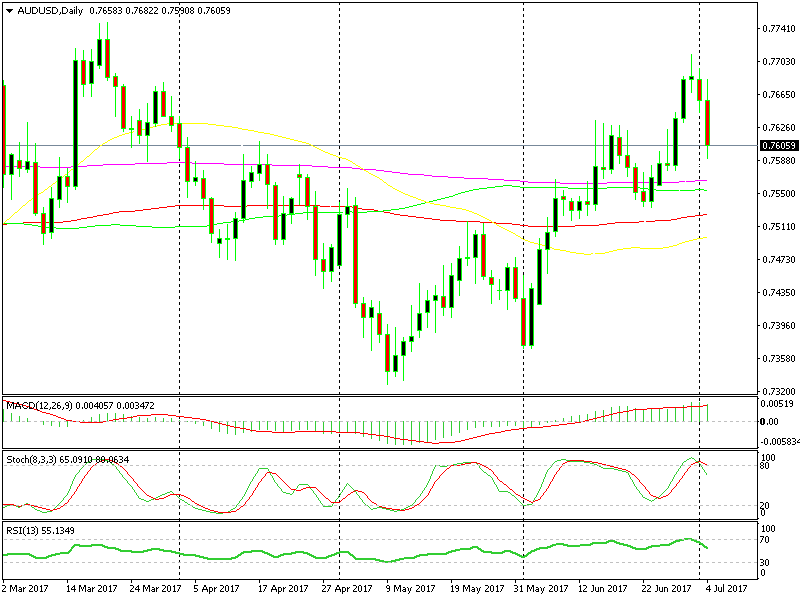

The daily chart didn´t look too favorable for sellers on Friday, but two (trading) days later and this timeframe chart looks like a perfect bearish pattern.

Friday´s candlestick closed as a doji which is a reversing signal, particularly after a trend. The last two daily candlesticks are pretty bearish and the stochastic is headed lower too, after being severely overbought.

We can say the same about the weekly chart and the winning potential here is even bigger. We´re around 80 pips in profit now. But we plan on holding, at least until we´re 200 pips in profit, then we´ll reassess this forex signal.

2 bearish candlestick followed the doji

New Instruments in our Forex Signals Service

We’ve recently incorporated some exciting new financial instruments into our trading signals service -gold and crude oil. We will add more instruments soon, such as CryptoCurrencies, so keep an eye out for analysis on these new instruments.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account