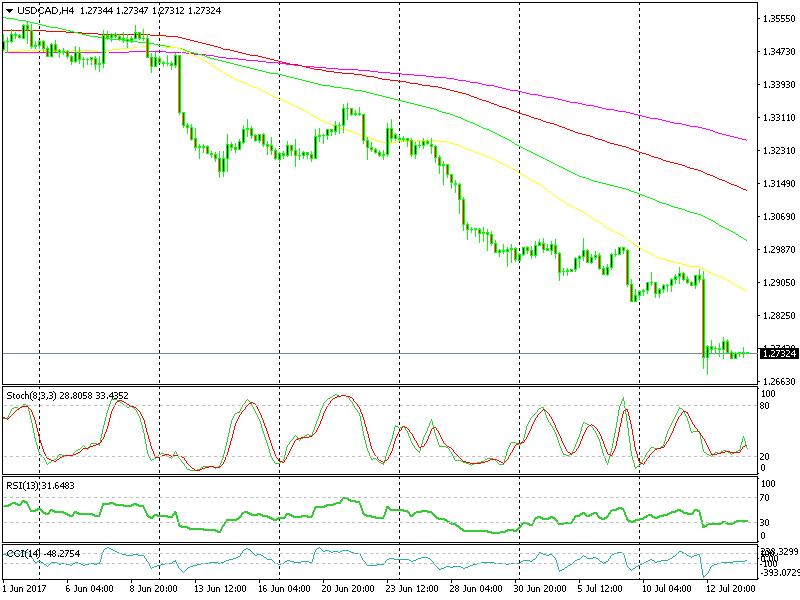

USD/CAD Downtrend – Can You Spot A Trade?

The Canadian Dollar has been one of the weakest currencies during recent years. One of the main reasons for this has been the weakness in oil and energy prices and the Canadian economy which has been stuck in the doldrums for nearly a decade. Though, now we may be seeing some improvement.

Since March this year, the Loonie has started to put up a decent fight. Oil prices haven´t moved/climbed much since March, but the global economy, and the Canadian economy, have improved considerably.

So, the BOC (Bank of Canada) has been forced to shift from dovish to hawkish. They started to tighten the monetary policy and on Wednesday they hiked the interest rates for the first time in a long time.

It's no surprise that the Canadian Dollar has reversed. USD/CAD has lost more than 10 cents since March and it looks like the downtrend will not end anytime soon.

I tried to place an ascending trendline on the H4 forex chart, but the 50 SMA (yellow) is doing a better job, to be honest, so we´re counting on that moving average for resistance.

The 50 SMA is working as a trendline

The 50 SMA is working as a trendline

As you can see, the price failed to break above that moving average at the beginning of the week. It dived about 250 pips soon afterward, but that came after the BOC hiked interest rates.

You´d be surprised how often a big technical level coincides with a major fundamental event. Essentially, forex traders take the price to a technical level and then wait there for the fundamental event to take place.

Regardless, we see that the downtrend is pretty strong and we´re planning to sell this forex pair if we reach the 50 SMA again. The US CPI and retail sales are expected to be released in a few hours, so we´ll keep an eye on those numbers.

If the numbers surprise the market, then we might meet that moving average today, but the move would be too strong to jump in the opposite direction. However, we´ll watch the price action and decide when the time is right.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account