UK Inflation Numbers Leave BOE In Nowhere Land

Everyone was interested to see the UK CPI (consumer price index) report after seeing a 2.9% reading last month.

Globally, inflation has picked up over the last couple of years, but in recent months it has stalled. That´s not the case with the UK though, in the last four months we have only seen upward pressure on UK inflation and last month it reached 2.9%, which is above the central bank's target of 2%.

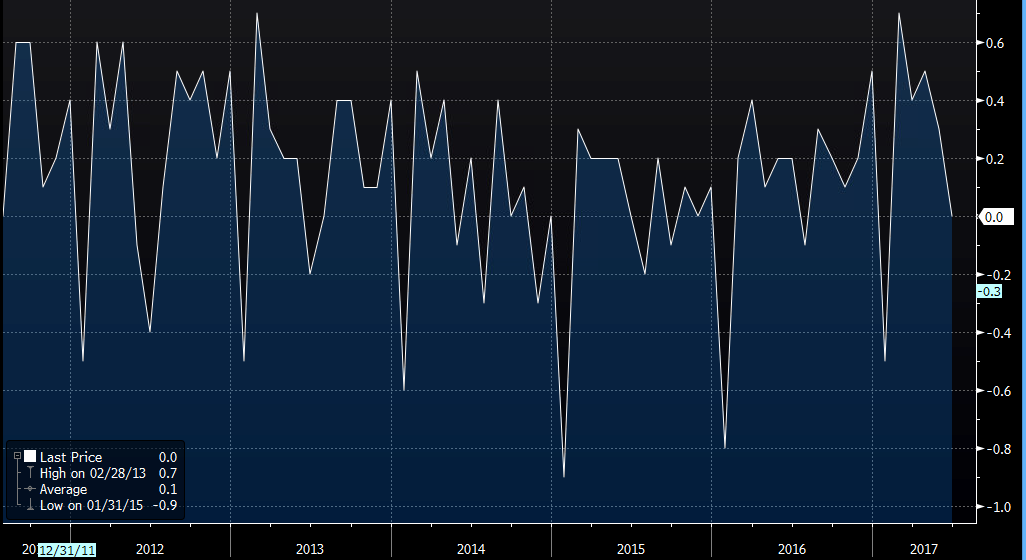

Monthly inflation falls back to flat

The market thought that the BOE (Bank of England) was being forced to turn hawkish and we did hear a few hawkish comments during this time, which have sent the GBP higher. Although, I still think they can hike interest rates or start withdrawing the monetary stimulus because the economy is slowing down pretty fast and UK politics are a mess at the moment.

So, the forex traders were interested to see whether inflation would jump even higher and make things too dangerous or dive back down and offer some slack for the BOE.

Well, CPI (inflation) year/year fell to 2.6% from 2.9%, core CPI fell to 2.4% from 2.6%. These figures show that inflation is easing a bit, which takes some weight off the BOE's shoulders, but both numbers are still well above the 2%.

This means that the BOE won´t be forced to start tightening the monetary policy, especially since the monthly CPI number came out flat. So, no inflation last month then.

That has eased the nerves about hyperinflation. The GBP/USD has dived more than 100 pips lower, although the 1.3000-20 level is a tough level and it might be a good place for a short term buy forex signal.

Regarding the long term sell signal we were talking about a few weeks ago, I think that we need to see more evidence of inflation slipping further back towards or below 2%, where the rest of the global inflation stands. This is because inflation is still high in the UK and this pullback is just a one-off after running higher for 4 months.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account