Forex Signals Brief for July 20th – What to Expect from the BOJ & ECB

Yesterday, FX junkies enjoyed the choppy trading session due to the lack of fundamentals. Despite the lack of fundamentals, Fx Leaders managed to pocket three take profits yesterday. Today we are expecting the release of some top-tier events which are sure to shake the market So far, the market is consolidating as the investors await the fundamentals.

BOJ Monetary Policy

The BOJ (Bank of Japan) is scheduled to release its Policy Rate today, but the time of release is still unknown. BOJ is expected to keep the interest rate unchanged at -0.10%, but we need to monitor the bank’s assessment of economic growth and inflation outlook.

Rookies should know that back in 2013, the BOJ started purchasing a large amount of "asset backed securities", in order to boost inflation to 2%. However, this program failed terribly in its attempt to support the deflationary risks. Additionally, the risk of holding such a large amount of financial assets has increased. Therefore, the BOJ is expected to talk about reducing the stimulus program. Let's wait to see how Karuda moves the market.

ECB Monetary Policy

Just like the BOJ, the European Central Bank (ECB) is expected to release the Minimum Bid Rate at 11:45 (GMT) before the ECB Press Conference at 12:30 (GMT).

Do we think the ECB will hike the rate? I don't think so as it seems too early to do so. The odds of any change in minimum bid rates at this meeting are very low. The main focus will remain on the press conference for guidance about future trends.

I was looking at the growth fundamentals of the Eurozone. The situation isn't as bad as it was before. The ECB is also one of the banks who are competing in the race of Bond Buying Programs. So, we need to look for any time frame that hints to tapering the bond buying program.

US Unemployment Claims & Philly Fed Manufacturing Index

The US claims and Philly Fed may have no influence on the market as they are releasing simultaneously with ECB Press Conference at 12:30 (GMT). Investors' focus will stay on the ECB monetary policy outcomes.

EUR/USD – Pair In Focus Today!

In my previous update, I shared that the EUR/USD is a good sell below $1.1560 to target the $1.1500. That's how it's been trading. It has already traveled to $1.1506.

The bearish moves in EUR/USD are due to the strength of the US dollar. The US building permit figures rose from 1.17M to 1.25M, signifying economic growth.

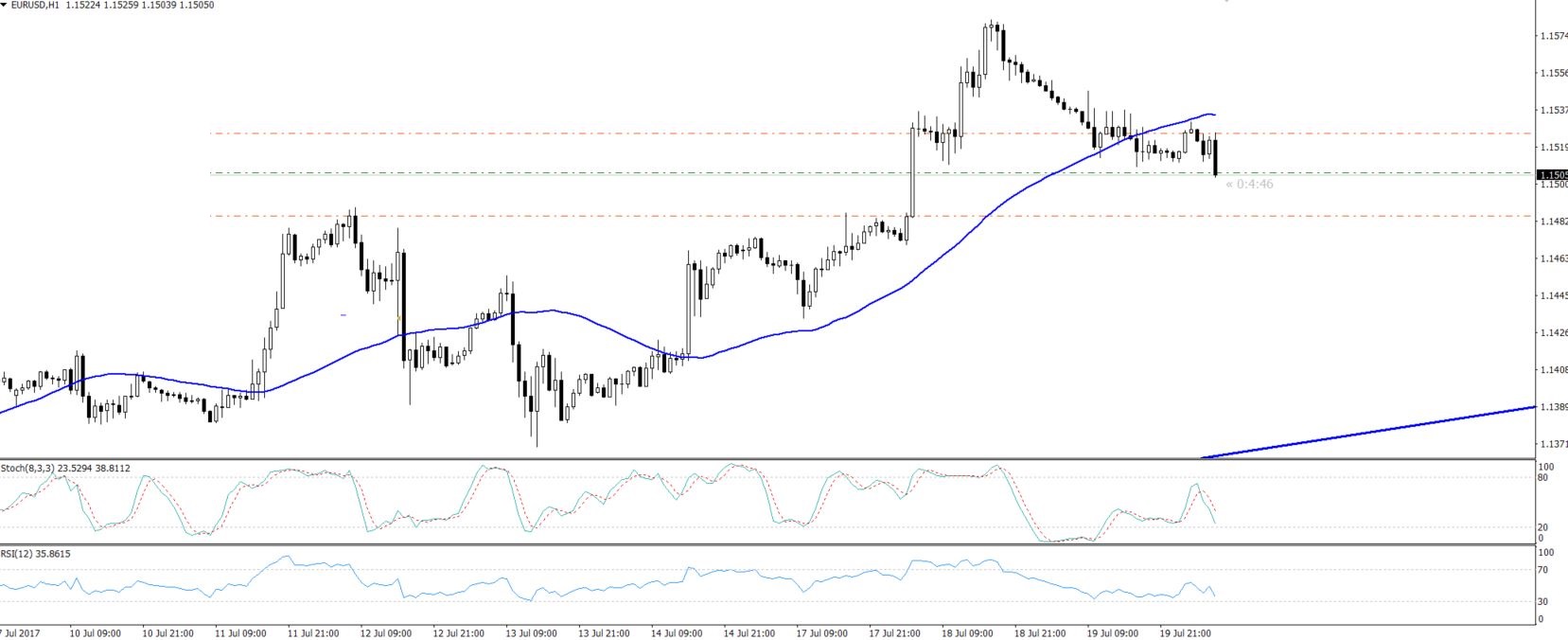

Looking at the chart, the pair is gradually pressing lower for two reasons: first, I think investors are pricing in the ECB's unchanged interest rate. Secondly, the hourly chart is showing a moving average crossover. Refer to our strategy article to get a better understanding of how to profit from a moving average.

On the hourly chart, a bearish engulfing candle is supporting a selling bias in the pair. For more about Candlesticks, refer to our Fx Leader Candlestick trading strategy article.

EUR/USD – Hourly Chart – Bearish Crossover

EUR/USD – Hourly Chart – Bearish Crossover

EUR/USD Trade Idea

I'm sticking with my old plan of staying in sell until the market tests $1.1500 & $1.1480. Later movements will depend on the ECB.

The long term trend of EUR/USD is bullish. If you are someone who likes to buy the Euro, I would suggest waiting for $1.1440 as it's one of the crucial buying levels.

USD/JPY – Bulls & Bears Fight Mode!

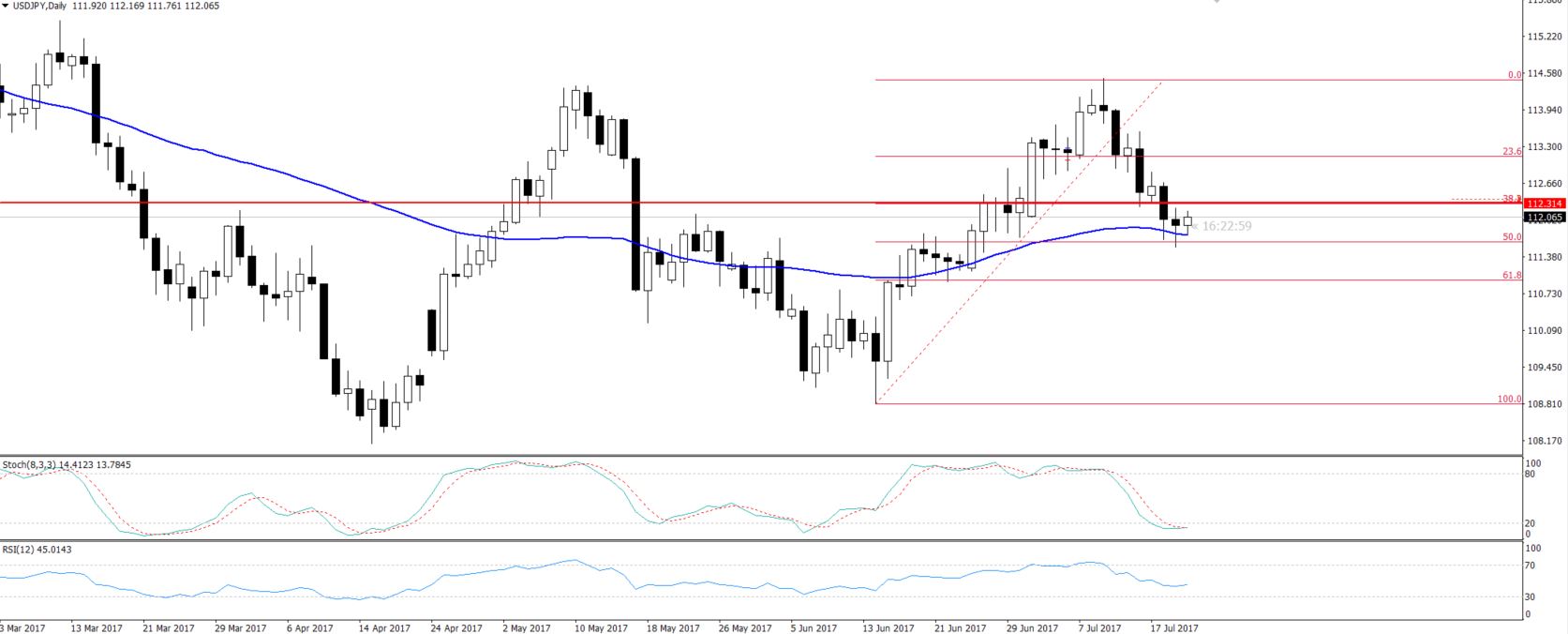

Japanese Yen, the safe haven currency is waiting for the BOJ to give it direction. It's pressing lower but has a strong support at $111.650. While writing this update, the BOJ just released the interest rate decision. NO surprises here!

The BOJ left its benchmark interest rate at -0.1%, this has been consistent since 2016. Because this was expected it hasn't impacted the USD/JPY. However, the Nikkei is showing some gains!

It has completed 50% Fibonacci retracement at $111.630 and the same level is a key entry point in the market. The 50- periods EMA is also supporting the pair at $111.750

USD/JPY – Daily Chart – 50% Retracement

USD/JPY Trade Idea

The long term trade idea is to stay in buying above $111.650 with a target of $113.120. On the other hand, we can target 110.950 below $111.650.

Today, we can expect to see some serious volatility in the market, particularly during the European and US sessions. So, make sure no to place positions without stop losses to avoid risk.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account